Over the last few months, we have been closely watching the monthly loan data in Europe, the UK, Scandinavia and Emerging Markets. It continues to suggest that investment spending will fall in the new year. This short blog looks at this issue and seeks to understand the underlying drivers of this change.

Two key factors that determine business investment spending are:

- The availability of capital; and

- The marginal return that is available on that capital.

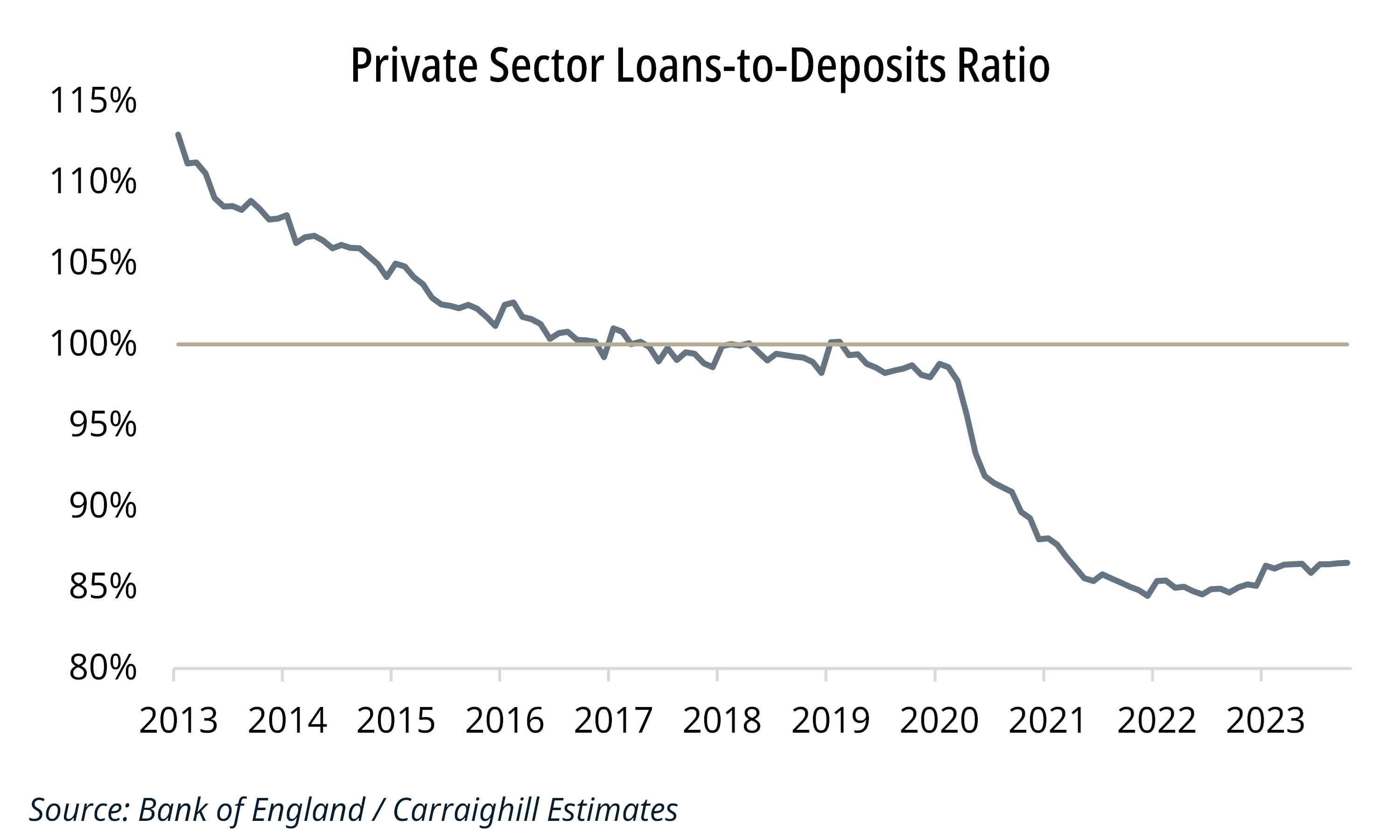

On the former, we know that the loans-to-deposits ratios of most banking systems are now well below 100%. Therefore, all banks can deliver a loan if required.

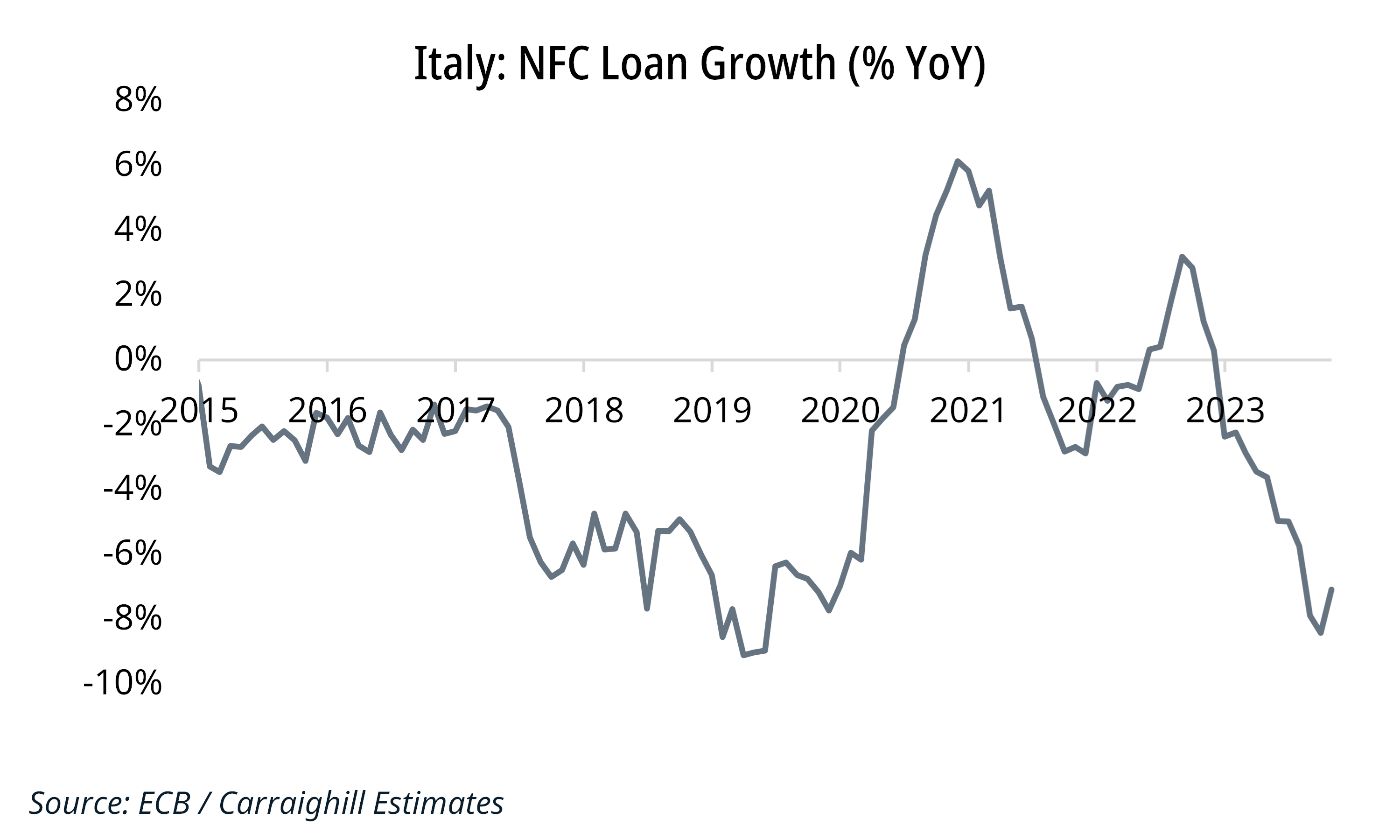

On the latter issue, it is concerning that we have seen a collapse in non-financial corporate (NFC) loan growth over the last year. This is not unique to any region but is evident across many geographies. For example:

- Europe: The periphery is now mired in deeply negative territory. The most recent data suggests that Italy saw a large fall of 7.1% YoY in October. It was also negative in Ireland (-7.1%), the Netherlands (-5.5%), Portugal (-4.4%), and Spain (-5.6%). Even the core has struggled in this regard with Germany moving from +10.5% growth in January to -0.3% in October.

- Scandinavia: For example, Sweden has also seen a slowdown in NFC lending with the latest data showing a fall from growth in the mid-teens to just 2.8% YoY in October.

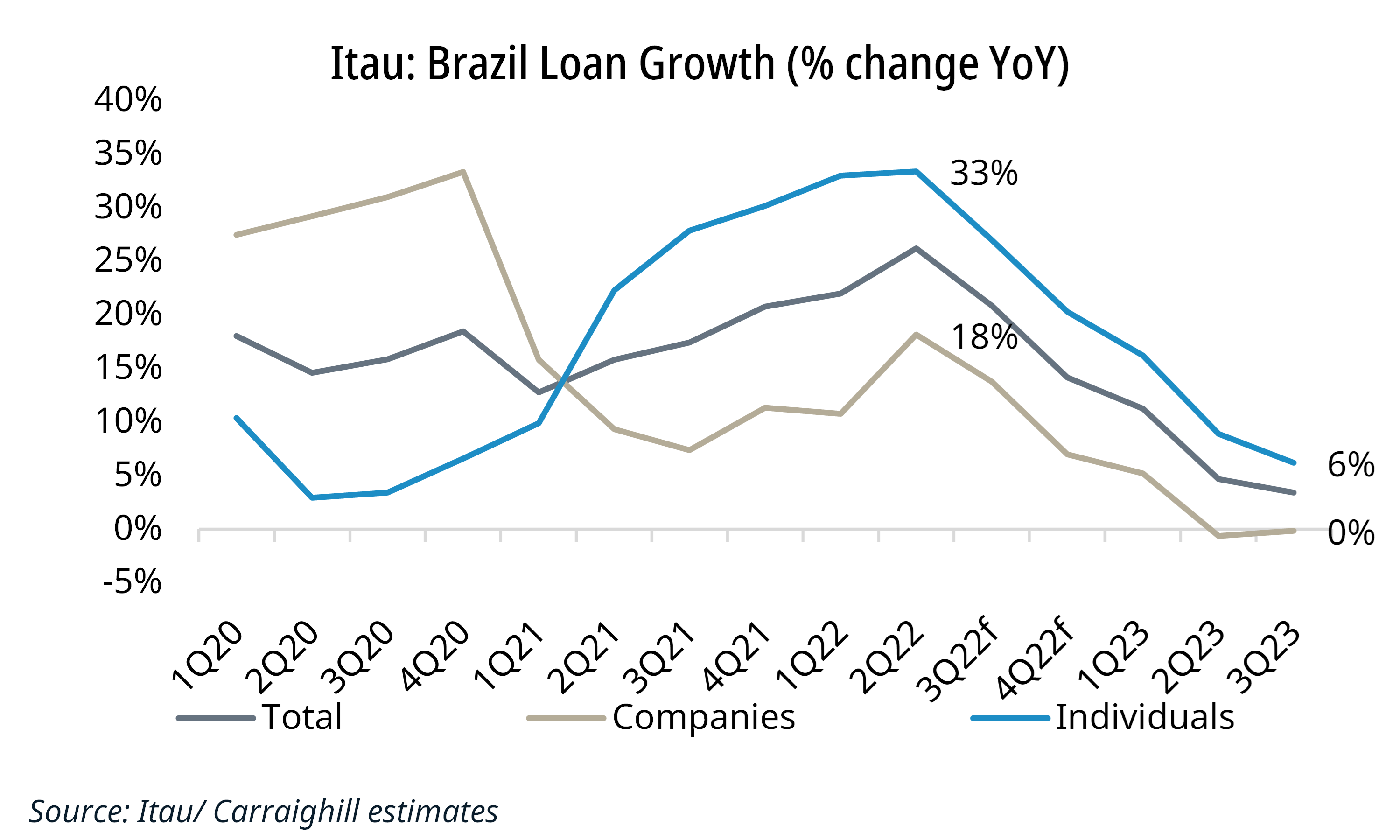

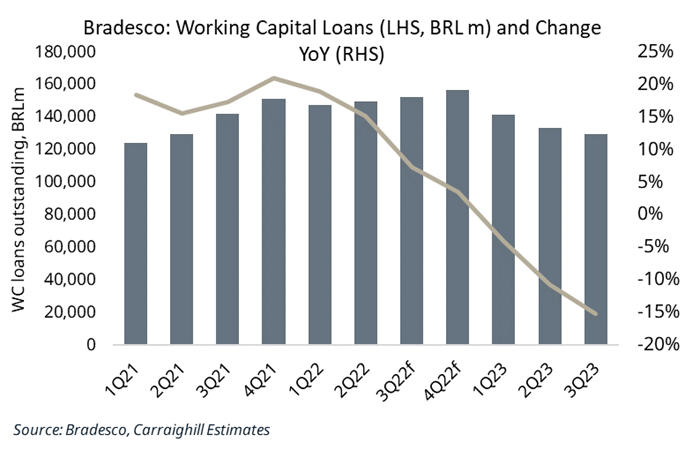

- Emerging Markets: As part of our ongoing coverage of the Brazilian banking sector, we noted the steep fall in NFC loan growth in Brazil. Itaú reported 0% loan growth for this segment in Q3 2023. Another point of concern is the decline in working capital loans as published by Bradesco. This suggests that businesses are already not investing. Growth in working capital is a signal that an economy is investing.

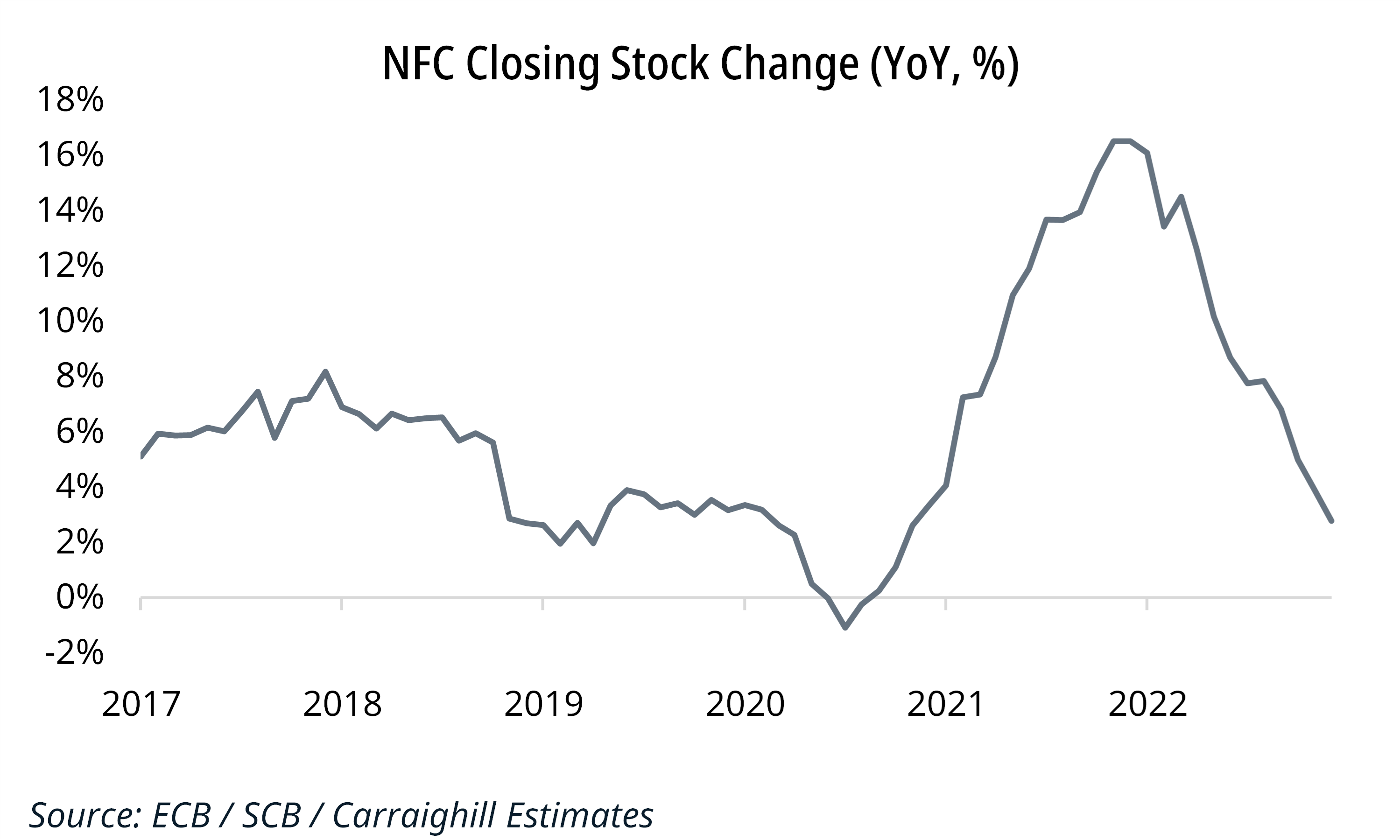

Why is this fall in NFC lending happening? The decline suggests that corporates cannot see a return on investment on new loans above the front book lending rate of c. 5-6% across most geographies. Hence, they are deciding to pay back their debt rather than invest.

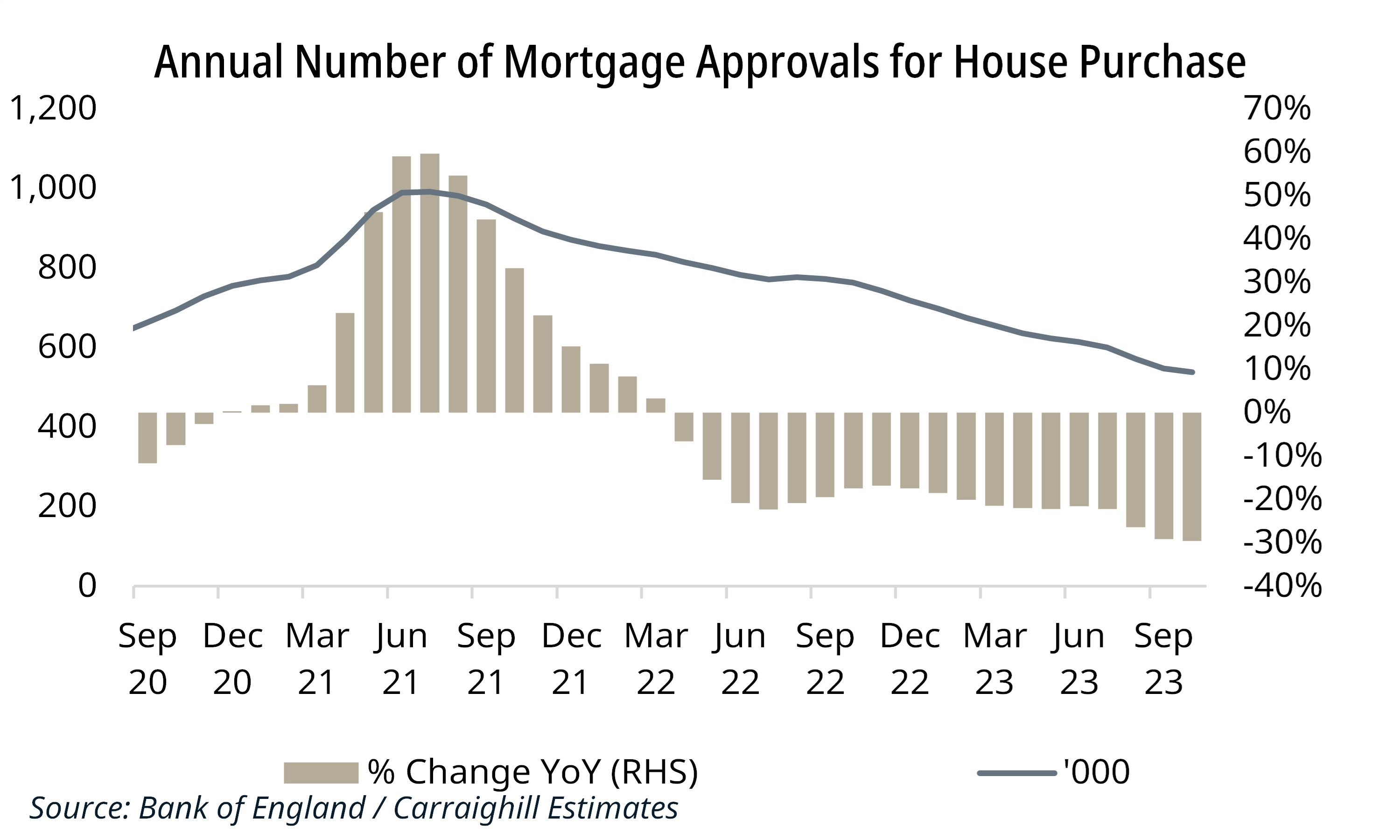

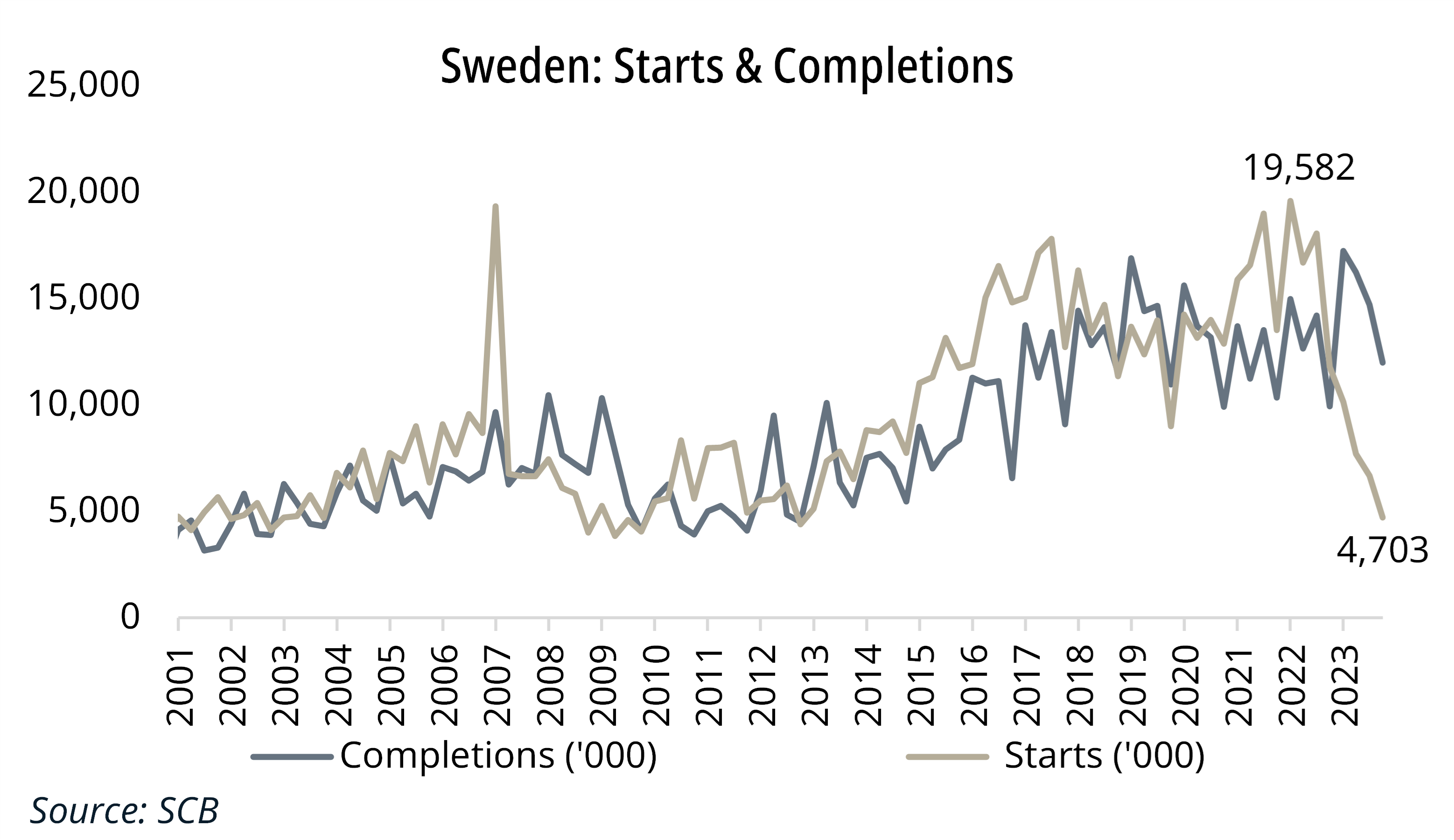

Is housing investment showing a similar trend? The answer to this is yes. Looking at Sweden, we can see that there has been a fall in new housing starts from close to 20 thousand at the start of the year to below 5 thousand in the most recent data. This is the lowest this figure has been since the Financial Crisis in 2008/2009. A similar trend is evident in the UK with the decline in new mortgage issuance.

Clearly, if this trend continues given that housing represents a significant proportion of investment spending, it reinforces the worrying picture for the trajectory of investment in the coming year.

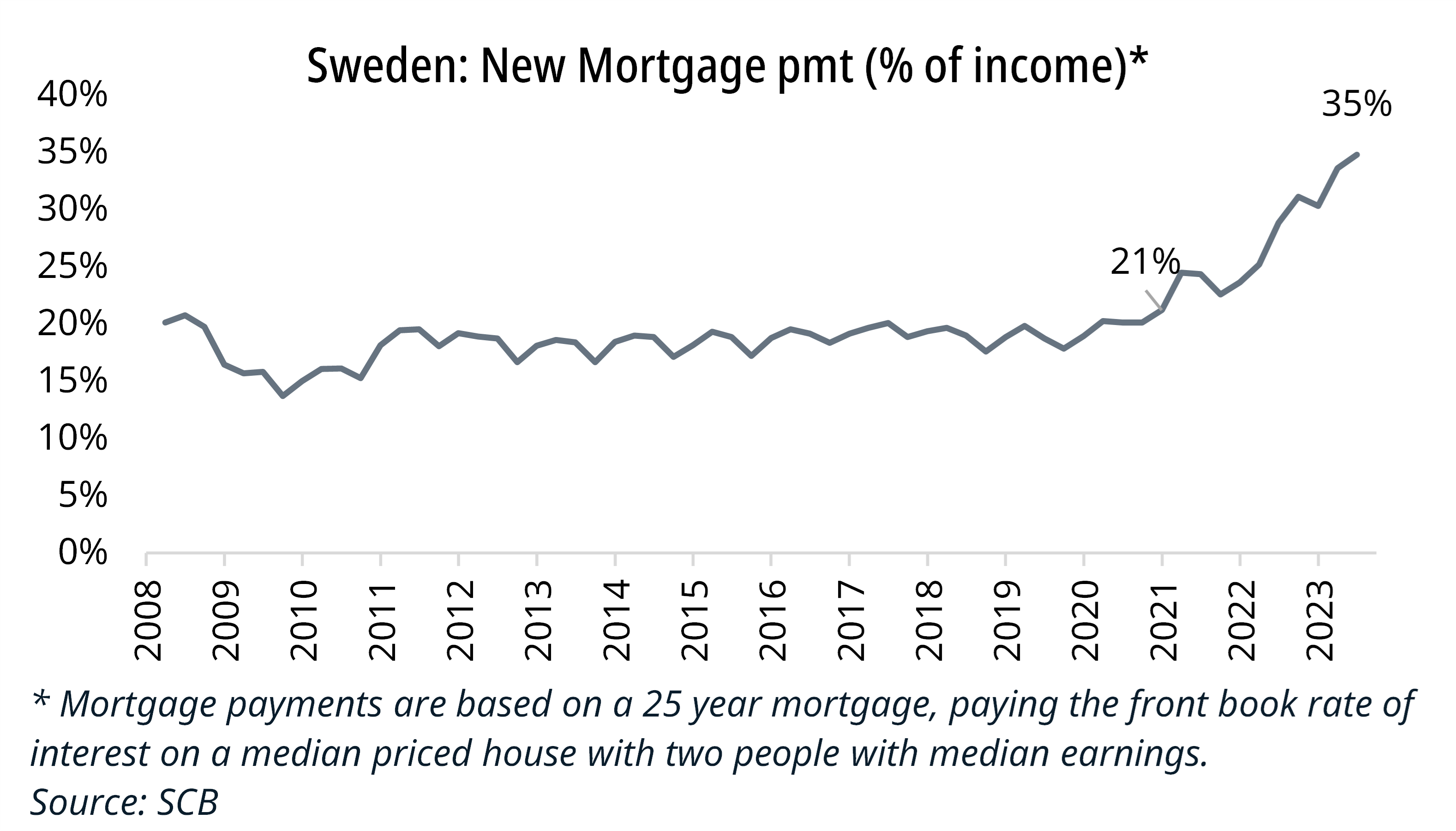

The key reason is that higher rates are working as demand has fallen. In Sweden, for example, a couple earning the median salary and purchasing a median-priced house would be paying 35% of their income on a mortgage payment. This has risen from 21% at the start of the rate-increasing cycle. While the narrative on rates is now changing, demand for housing should remain weak for some time. Basic tenets of economics say that while demand remains low, so will supply. This will continue to be the case.

What does this mean for the outlook for the economy in these countries? Investment, as measured by Gross Fixed Capital Formation, represents a significant proportion of GDP (in Sweden, 27% in 2022). Within this, NFC investment accounts for roughly 50% of total, the single largest sector.

A significant fall in NFC loan growth is clearly a drag on NFC investment, which in turn puts downward pressure on real GDP. Residential property is another significant chunk with dwellings making up 20% of investment in Sweden last year. Ergo, a reduction in the number of units built driven by a combination of weak demand and low starts has obvious implications for the economy.

Taking all of this into consideration, we believe that investment spending will fall sharply into the second half of 2024 with significant repercussions on real GDP and the overall health of the economies we cover.

We continually seek to incorporate some of these data trends and their implications into the specific stocks that we cover in our fundamental stock research at Carraighill. We will test these theses with management of the individual banks, asset management, payment, and property companies that we cover.

If you would like to access more information and in-depth analysis on these topics, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to stock investment ideas across the banks, payments, fintech, asset management, and real estate sectors for Europe, UK, Scandinavia and select emerging markets. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.