What is the Deposit Beta and Why is it Important for European Banks?

Banks earn interest on their assets (primarily loans), but also pay interest on their liabilities (primarily deposits). As interest rates rise, European banks manage the difference between these two items. This difference is known as the customer spread (banks also make money in other ways, but this is the primary driver of their earnings).

It is worth remembering, that when interest rates fall, the customer spread narrows consistently. Why? Banks cannot pass on negative rates on their current accounts (30-50% of deposits) but need to do so on their loan balances. In this period, customers that have loans benefit significantly from a lower interest bill.

This defined the 2010-2020 decade for the European banks with the customer spread declining consistently over this period.

Using Italy as an example, one can see that the customer spread for Italian banks fell from €45bn in 2013 to €20bn by 2022. This was a horrible time for bank net interest income. Banks, therefore, struggled with revenue and profit growth. The share prices of most European banks fell consistently over this decade.

This era of course also corresponded to one of negative interest rates and quantitative easing.

The latter, which involved the ECB purchasing government and corporate bonds also had an impact on the customer spread. Why? The ECB was purchasing corporate bonds and there was always a buyer for this credit. The rate at which companies could issue bonds fell significantly which further lowered the pricing power of banks with their customers and what they could charge on a new loan (we will return to this topic at another time). The banks lost market share to the bond market.

Because of this excess deposit growth and weak demand for loans, the loans-to-deposits ratio fell consistently in every region. In Italy, it fell from over 130% in 2013 to 80% today. This means that there are excess deposits in the Italian banking system.

So, what happens now as rates rise?

From the chart above you can see that the customer spread of the European banks has started to expand as they charge more to their customers for loans than previously was the case. This is the best case in the cost of new lending, which is well above the rate the banks charge on their existing loans (which will roll off gradually into higher rates). Therefore, the customer spread is rising again (as illustrated in Graph 1).

What is the deposit beta?

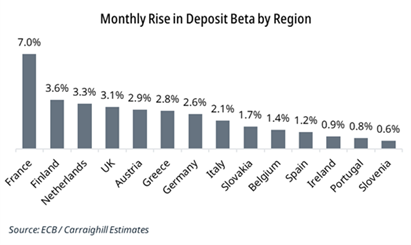

The deposit beta measures the proportion of central bank rate increases passed on to bank deposit holders. A slower rise in this ratio means a greater benefit to banks’ top line revenue (net interest income) as they are only slowly passing on higher rates to their deposit holders. The deposit beta in European banks has been low to date, with many countries still in the low to mid-single-digit range (Portugal, Spain, and Ireland among them).

However, the deposit beta is rising in all regions, as customers demand higher rates on their savings and change their preference toward term accounts. That said, this movement is slow, with customers still maintaining a liquidity preference. They are unwilling to invest or change to term accounts. This may be due to the higher inflation and a preference to spend rather than save (negative for asset management companies) – see graph below.

So which banks have the best structure of their deposit base? The ones most likely to benefit are those with:

- A higher proportion of current accounts within their liability base.

- A low loan to deposits ratio. In this case, the bank already has excess deposits and does not have to compete aggressively.

- A higher proportion of household deposits. Households are less responsive than corporates in terms of demanding more interest on their savings.

The banks that are on the bottom right-hand side of this chart appear well-placed to benefit in this stage of banking net interest spread normalisation. At Carraighill we follow this data monthly and engage very actively with the banks to try and understand how this ratio is evolving.

One last point, the deposit beta in the US has been much higher than in Europe. Why? This may relate to the presence of money market funds in the US, with such a market not really present in Europe. This is a topic for another day.

Carraighill’s work involves deep concentration on data to understand the environment within which banks, asset management, payment and REITs operate in Europe and select emerging markets. We also do bottom-up fundamental work on close to 50 companies across these sectors. If you would like to speak to us on the topics raised in this piece, you can contact us here.