UK housing and builders:

Understanding House prices and input cost inflation and how accurate and timely data informs decision making.

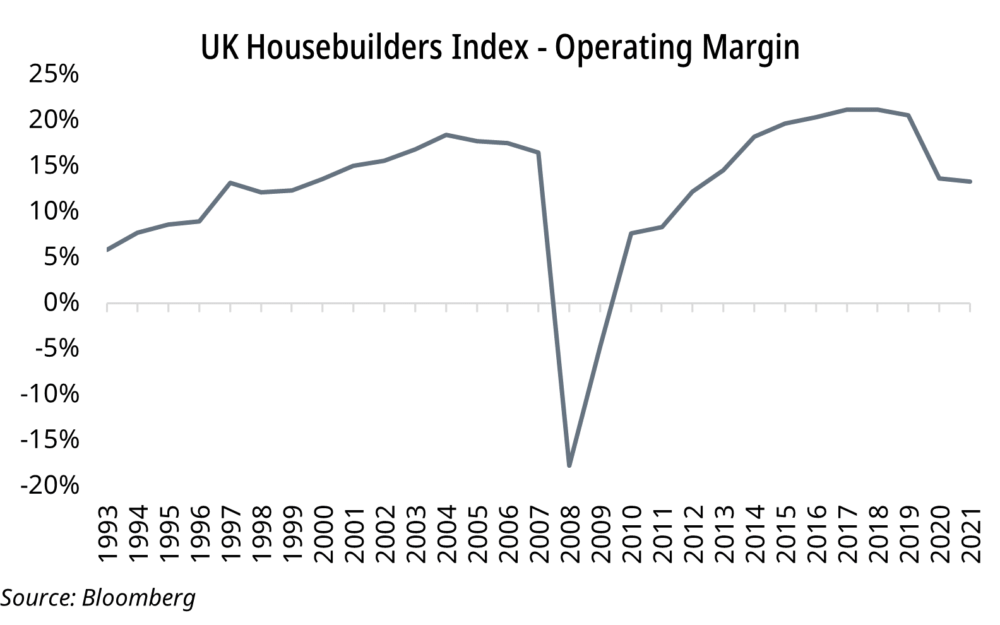

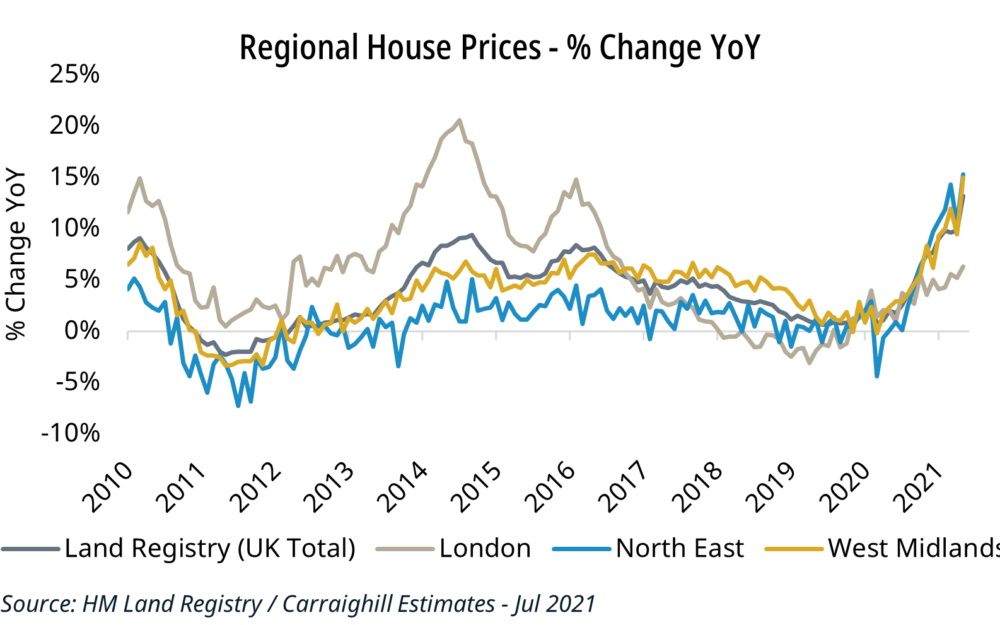

There have been two periods of excess relative and absolute share price return for the UK homebuilders (>+20% on average p.a.). These were the 2004-2007 and the 2013-2016 eras.

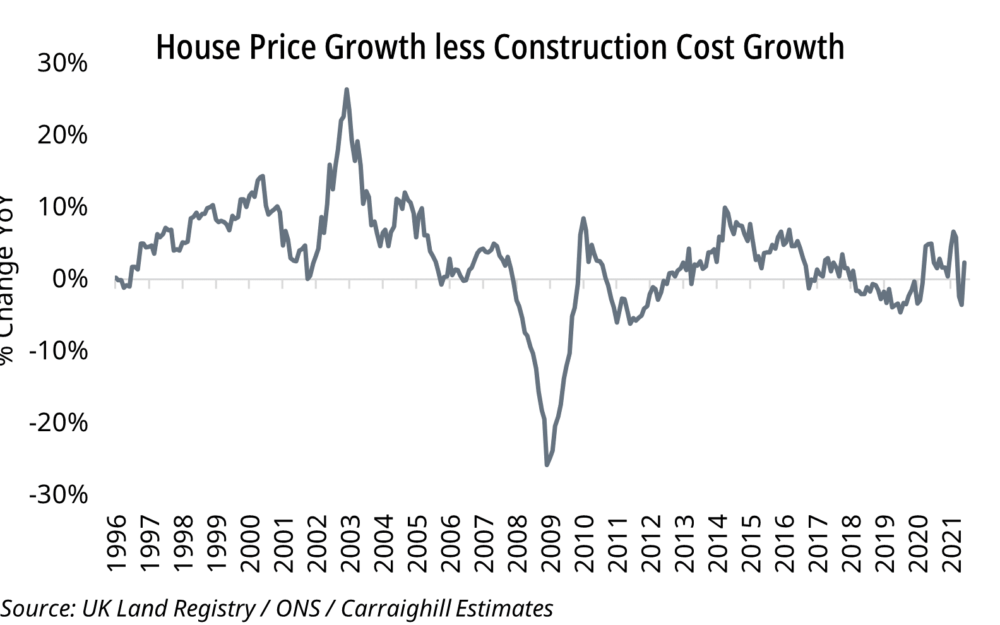

Common characteristics of both include strong house price growth, rising completions, and a positive differential between asset price growth compared to cost growth (which allowed housebuilder operating margins to expand). Following COVID-19 and the lockdown, completions are clearly rising in the UK. This condition is therefore fulfilled. So, where are we on house prices and input cost inflation as these will ultimately influence the company operating margin?

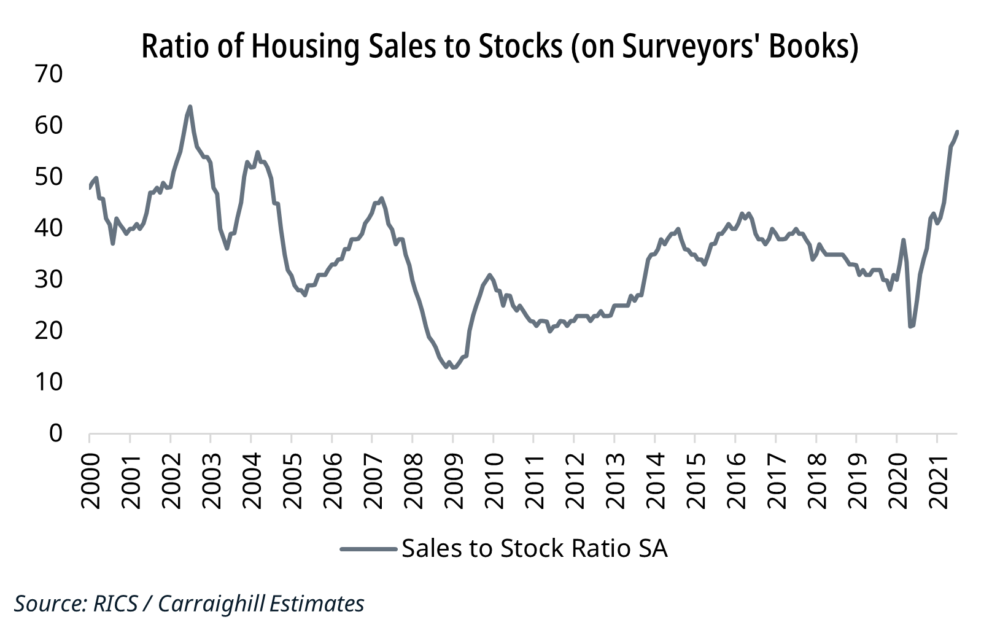

New House Price Drivers: We have previously reviewed the longer-term structural drivers of house prices in the UK (demographics, employment mix, land bank availability, mortgage rates, available workers, and government supports). However, several other drivers have emerged as key influences since the COVID-19 pandemic. These are driving the ratio of UK housing sales-to-stock to levels last seen in the early 2000s (this means builders can’t keep stock on their books as it is selling so rapidly):

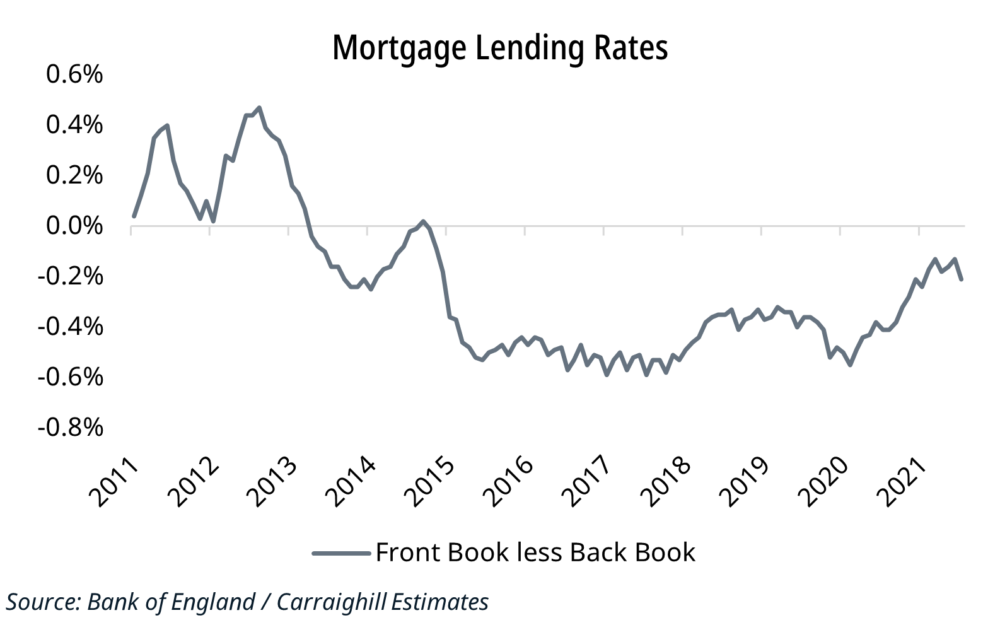

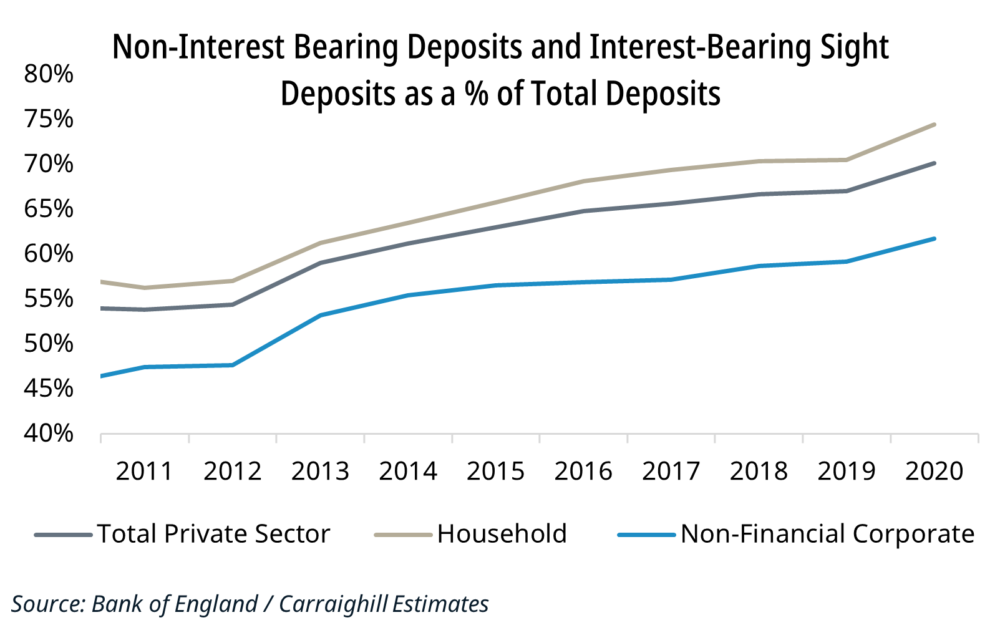

1. The collapse in the loans-to-deposits ratio in the UK banking system: The UK loans-to-deposits ratio fell into 2021, given the rise in deposit volumes (primarily due to higher savings by households and SMEs). In total, household deposits in the UK banking system are up £215bn from end 2019 levels (+16%). To put it in context, this 18-month rise is a larger increase than the prior five years.

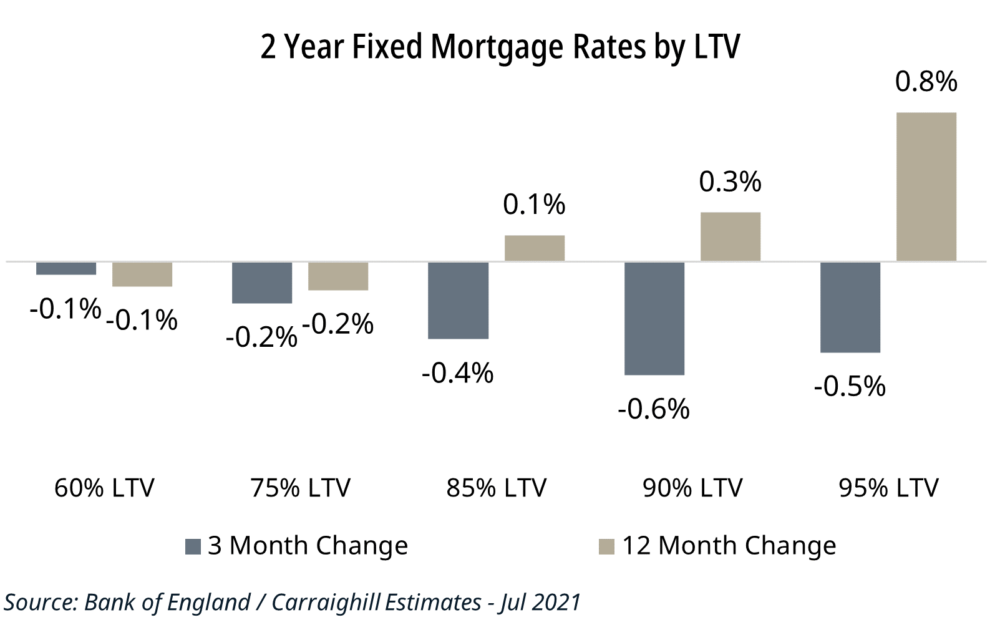

This liquidity surge is likely to have implications for front book mortgage loan rates. The difference between the new mortgage rate and the existing back book rate had narrowed to -0.2% after COVID-19 as banks became more risk-averse. This should now reverse and migrate towards the pre-COVID-19 level of -0.6%. This is also aided by the UK Mortgage Guarantee Scheme, which has put pressure on higher LTV front book rates.

In addition, it is worth noting that a greater proportion of these deposits are now receiving zero or limited interest (c.70%). This increases the urge to buy property.

2. Working from home: As people increasingly migrate to a changed environment of working from home, this should lead to a greater demand for housing in the suburbs and country locations. We have previously noted that each day working from home lowers the London office occupancy rate by 5.8% (weighted for employment mix effects). This increases the demand for suitable housing elsewhere. The political establishment in the UK is also likely to welcome this development as London house prices were clearly unaffordable for many pre-COVID. Recent house price changes, with more rapid rises evident in areas outside the capital, appear to support this view.

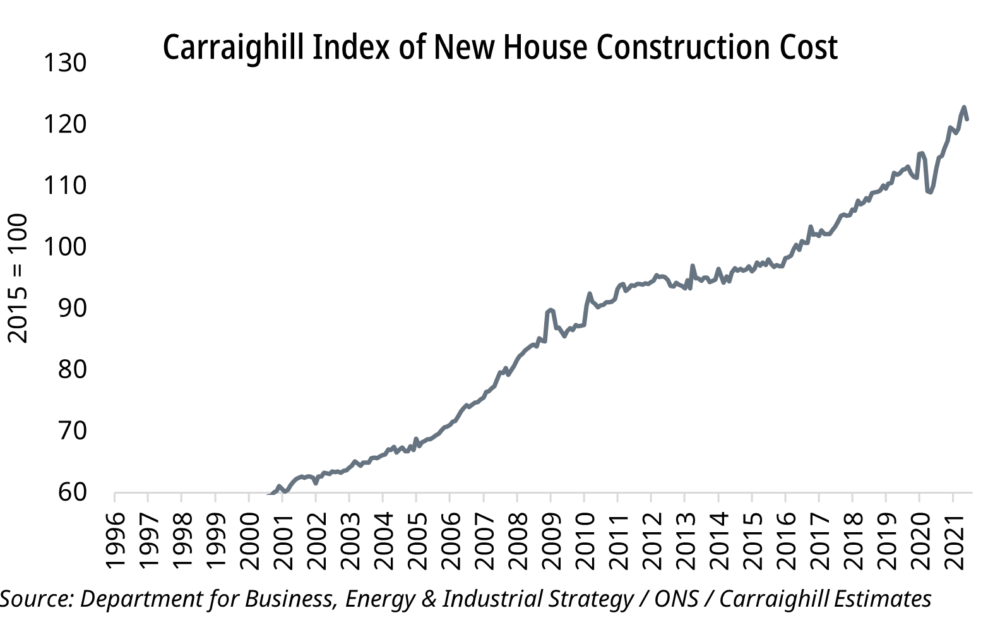

Cost inflation: However, from a housebuilder return perspective, there is little value in higher house prices if this is eroded through higher input costs. The building of a house comprises several raw materials, which correspond to c. 40% of the total build cost ex-land. The balance is 60% labour. In terms of building materials, the significant items include:

• Windows, doors, and wood items: 26.7% of total.

• Brickwork and concrete: 23.2% of total; and

• Slates, tiles, and other coverings: 9.6% of total.

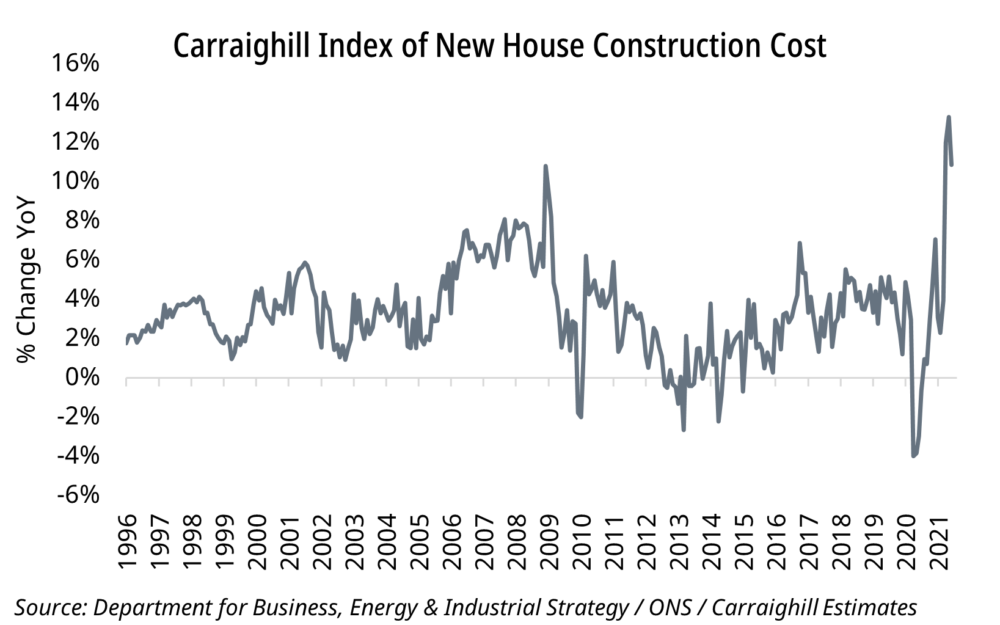

The UK Department for Business, Energy & Industrial Strategy publishes a monthly index of construction building materials (CMPI). This index is only available back to 2016. It is therefore of limited historical use. We in Carraighill have replicated it back to 2000. It correlates closely with the CMPI index.

It shows the consistent rise in the cost of a new build over time. It also details the acceleration post COVID. We highlight that the current level of annual input cost inflation is higher than any time in history and greater than before the GFC in 2008. This is clearly a worry. However, positively, the pace of rise is now slowing. If this decline persists, this negative challenge for housebuilders should erode gradually over time.

How do we use this data in Carraighill? The outlook for the UK housebuilders profit stream is dependent on many data factors beyond what is covered in this short piece. However, the two mentioned here are vital. The regular and easy availability of this insightful data:

- Facilitates detailed conversations with UK housebuilder company management teams; and

- Helps us to better understand the outlook for an individual companies’ earnings over the short, medium, and long term (independent of company management).