UK House Prices: Why they have not fallen and the factors that influence the direction from here

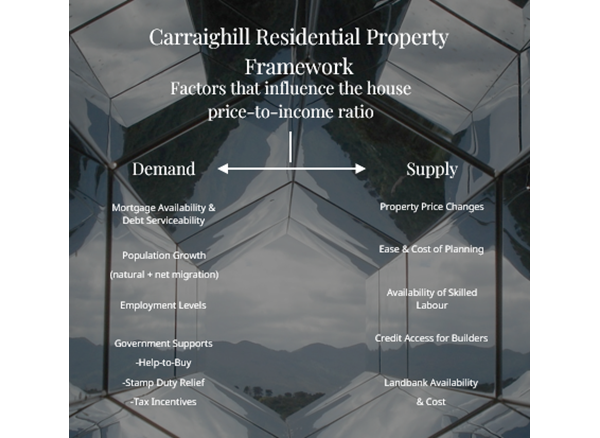

Many people had expected UK house prices to decline as interest rates rose. However, we always try to understand the multitude of factors that influence the demand and supply side of the equation to arrive at a balanced assessment of the outlook for house prices rather than focus on one variable. The evolution of this asset class is important for:

- Household confidence (which influences spending in an economy);

- UK banks interest income (66% of total loan income is now derived from mortgages); and

- It underpins bank mortgage collateral.

All UK banks have increased the share of mortgages in their loan book in recent years, given the weak growth evidenced in the SME/ corporate sector (in part influenced by excessively loose fiscal policy – but we will leave that thought process for another day).

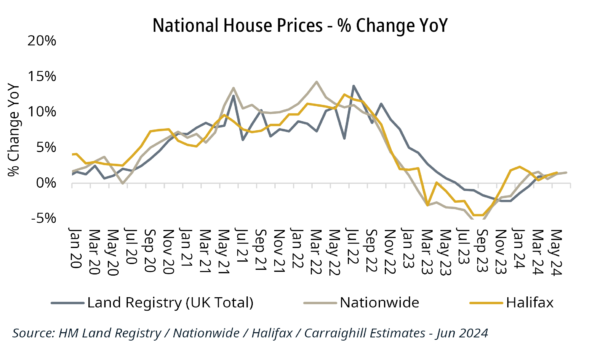

At Carraighill, we follow this data monthly, trying to be aware of inflection points. So, what is the data currently telling us about UK housing?

Demand side: The key factors that influence demand include:

1. Population and employment growth (positive):

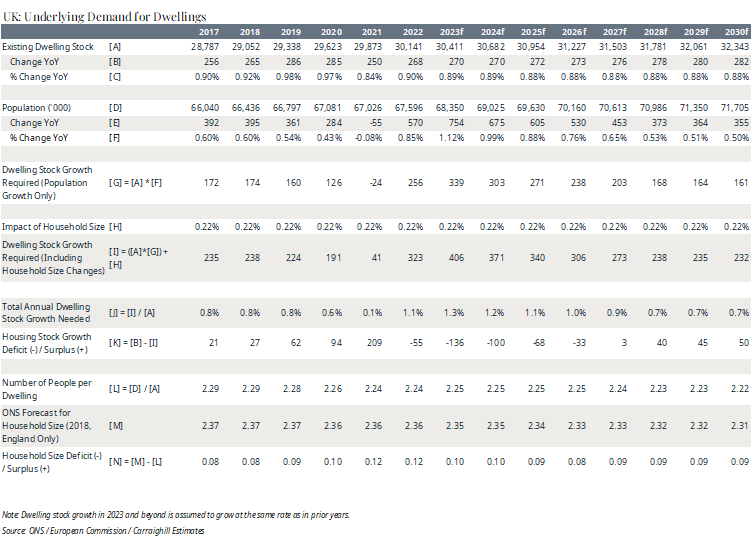

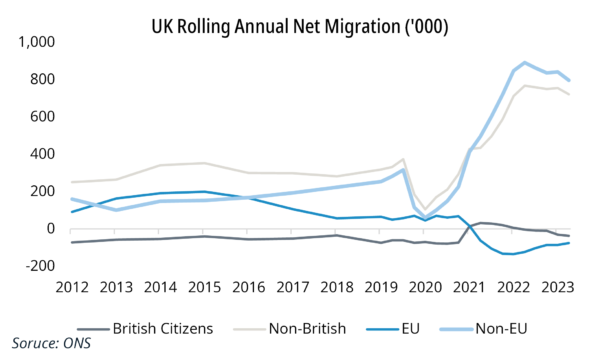

UK population growth averaged 0.5% in the years leading up to the pandemic. In 2021, it fell 0.08%. However, in 2023-2026f it should rise by c. 1% per annum. This is primarily due to the high levels of net migration, as outlined in the table below. Net migration has risen from an average of 200-300k to 400- 500k since 2021. This has become a major political issue. It is also increasing rental pricing.

2. Employment (positive):

The unemployment rate is currently estimated to be 4.4%, close to record lows.

3. Wage growth (positive):

The average employee compensation rose 8.7% in 2023. It is expected to rise 3.6% and 2.6% in 2024 and 2025 respectively. This is positive.

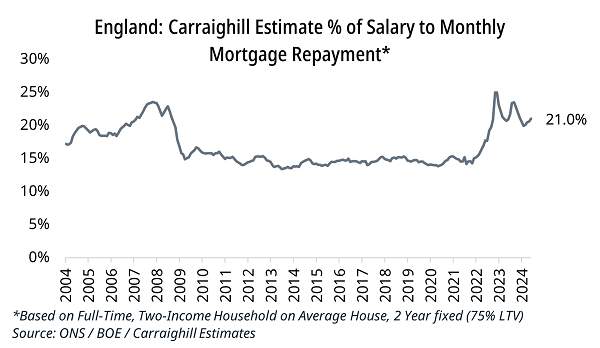

4. Mortgage rates and affordability (negative):

Mortgage rates have risen dramatically, negatively impacting the affordability of housing. For example, a couple earning an average gross salary must now commit 21.0% of their joint income to payments on an average-price home (75% LTV, 25-year mortgage). This was around 15% through most of the 2010s.

Supply Side: The key factors that influence supply include:

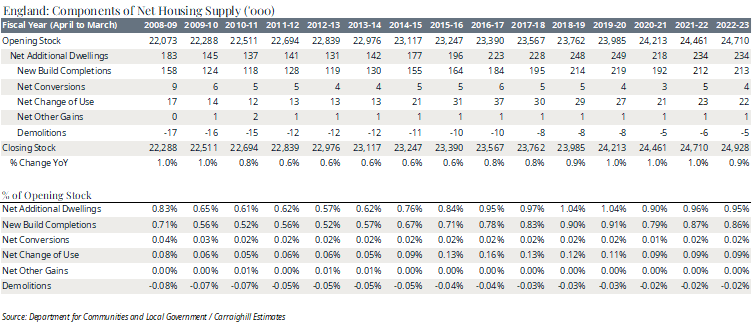

1. Lack of new builds (negative):

The UK government has consistently aimed to provide roughly 300,000 new homes per year, but has failed to meet this target, with only 234,000 net additional dwellings completed in 2020/21. The ten-year average of 193,000 is far short of the target. We note that housing construction output is down 14.2% YoY (well below the pre-pandemic trend).

2. Banking supply of credit (negative):

Banks have tightened lending standards as rates have risen. However, as the loans-to-deposits ratio in the UK is close to 80%, there is an ample supply of credit available.

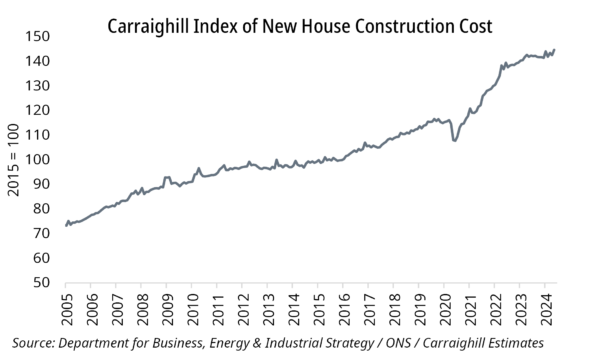

3. Increased cost of house construction (negative):

At Carraighill, we created a proprietary index tracking the evolution of house construction costs. This helps to explain why house prices have not fallen in many regions, as the replacement cost is up c. 40% from 2021.

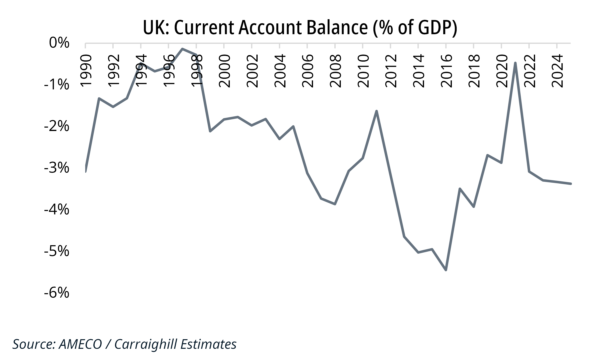

4. A “shock” risk (negative):

A country that runs a consistent current account deficit, which is being used to fund consumption rather than investment, is always more vulnerable to “shock risks”. The UK has run a current account deficit for some time, so we must always be aware that a weakening in global liquidity flows could, at some point, impact domestic funding needs (as happened with the Kwasi Kwarteng budget in 2022).

Conclusion: The demand side remains strong, but there are a significant number of factors limiting supply. With rising construction costs underpinning asset values, the outlook for housing is certainly not negative.

If you would like to access more information and in-depth analysis on these topics, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to stock investment ideas across the banks, payments, fintech, asset management, and real estate sectors for Europe, the UK, Scandinavia and select emerging markets (Brazil, Mexico). If you would like to speak to a partner or analyst on the topics raised in this piece, please contact eoin@carraighill.com.