UK Banks’ Pricing Power Returning, but QT and Balance Sheet Size is a Concern

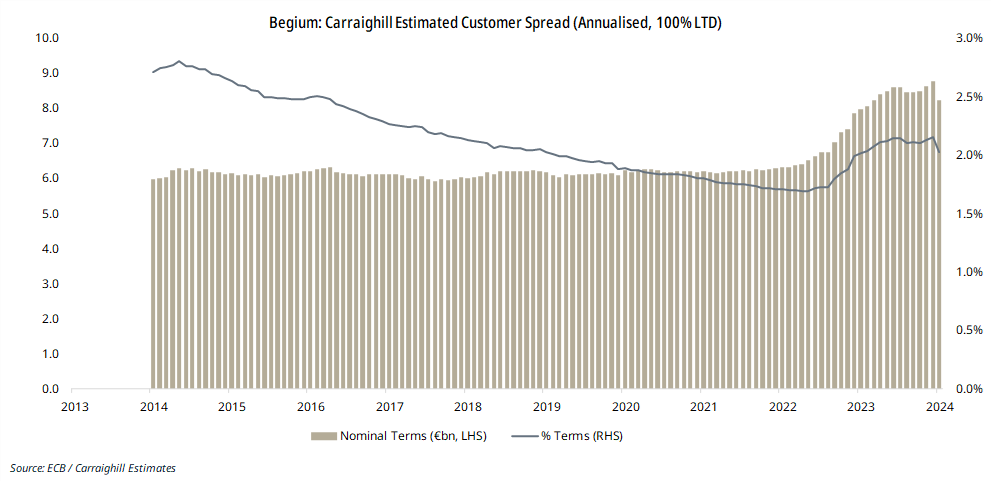

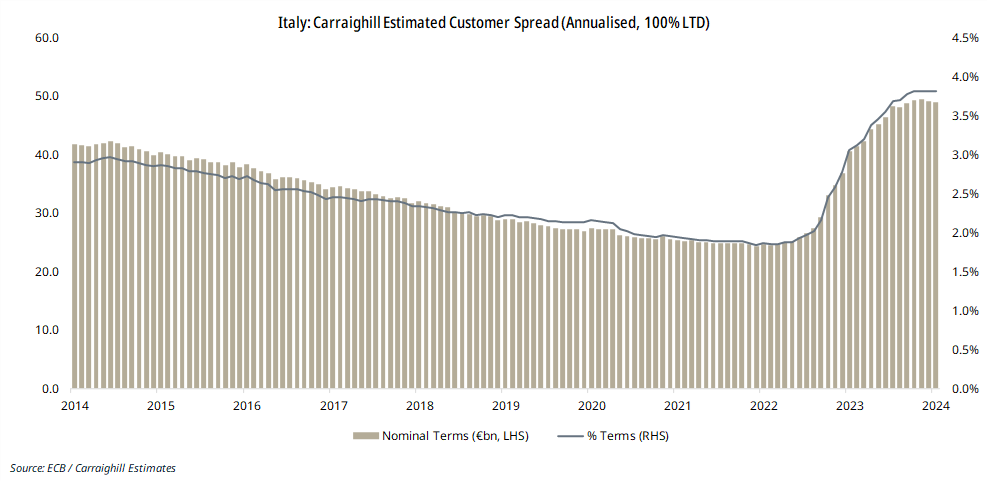

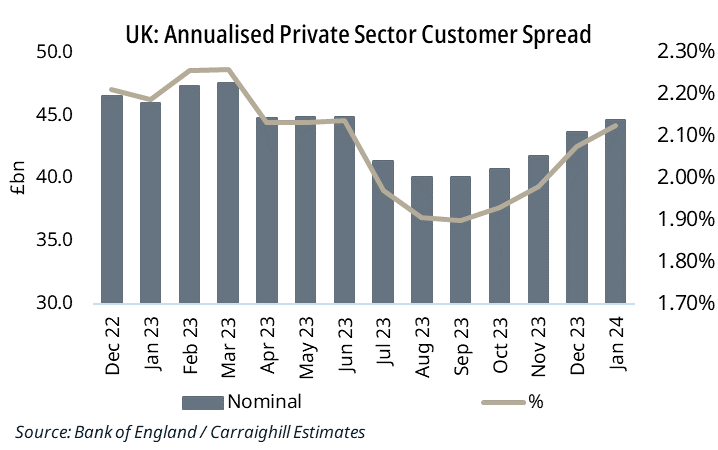

In recent months, the data we follow in the UK has indicated a return of the domestic banks’ pricing power. Whereas the customer spread (loan income less deposit expense) now appears to have peaked throughout the Eurozone, it has begun to grow in the UK.

For any bank, the customer spread is a key driver of net interest income. Across the Eurozone, spreads have grown considerably since the ECB began raising interest rates in July 2022. By contrast, the UK, which entered its rate cycle earlier (December 2019), had, until recently, experienced a gradual decline in its customer spread. This can be explained by several factors pertaining to deposit remuneration:

- Competition: The UK’s retail banking system is subject to intense competition. While the 5 major players; Lloyds, Barclays, Santander, NatWest and HSBC together account for over 50% of the market, hundreds of smaller banks, credit unions, and in recent years, ‘neobanks’ (e.g. Revolut and Monzo) compete with the large players. This limits UK banks’ pricing power on both sides of the balance sheet (loan and deposit rates) and creates intense competition for deposits (the loans-to-deposit ratio is c. 87%). This is in stark contrast to banking systems in countries such as Belgium and Ireland, where a small number of players dominate the market.

- Tax-wrapper accounts: Households in the UK have access to tax-free saving products such as ISAs (Independent Saving Accounts). This puts pressure on retail banks to offer superior remuneration on term accounts to compete with these products.

- Political pressure: In June 2023, UK banks came under pressure to pay higher interest rates to savers, with the treasury committee describing the available rates on instant-access deposits as “measly”. Following this, the UK government began to directly compete with the domestic banks, with the state-backed NS&I offering savers 6.2% on 1-year savings.

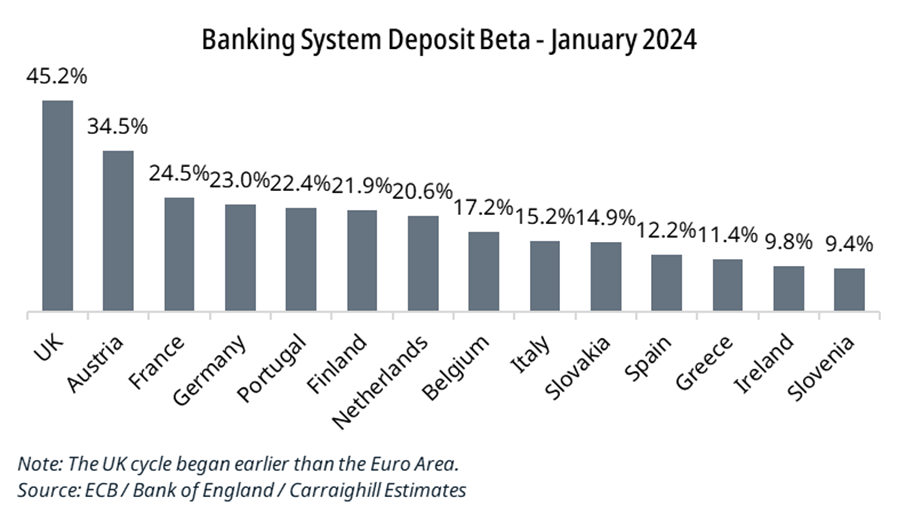

The result of these deposit pressures has been a substantial pass-through of interest rate hikes to deposit holders. The deposit beta (measuring the proportion of the increase in the interest rate that is passed through to depositors) is now c. 45% in the UK. In other words, for every 100bps increase in the BoE bank rate since December 2019, deposit remuneration has grown by c. 45bps. This is significantly higher than even the largest deposit beta observable in the Eurozone (Austria at 34.5%). Other key Eurozone geographies such as Italy (15.2%), the Netherlands (20.6%) and Germany (23%) exhibit far lower betas than the UK.

So what has changed?

Back in December 2023, the data started to show a return in UK banks’ pricing power, as indicated by modest growth in the customer spread. We have continued to observe this trend in recent months, and in the most recent (January 2024) data, we estimate a customer spread of 2.12%. This is still a narrower spread than that in most Eurozone countries and, more interestingly, is well below the pre-pandemic average of 2.4%-2.5%. This would indicate that there is still some way to go in terms of regaining lost pricing power, and therefore NII. Furthermore, if UK base rates should fall sharply, the high deposit beta leaves plenty of room to lower remuneration, providing a further potential tailwind to NII as loans will be slower to reprice.

But, there’s a catch…

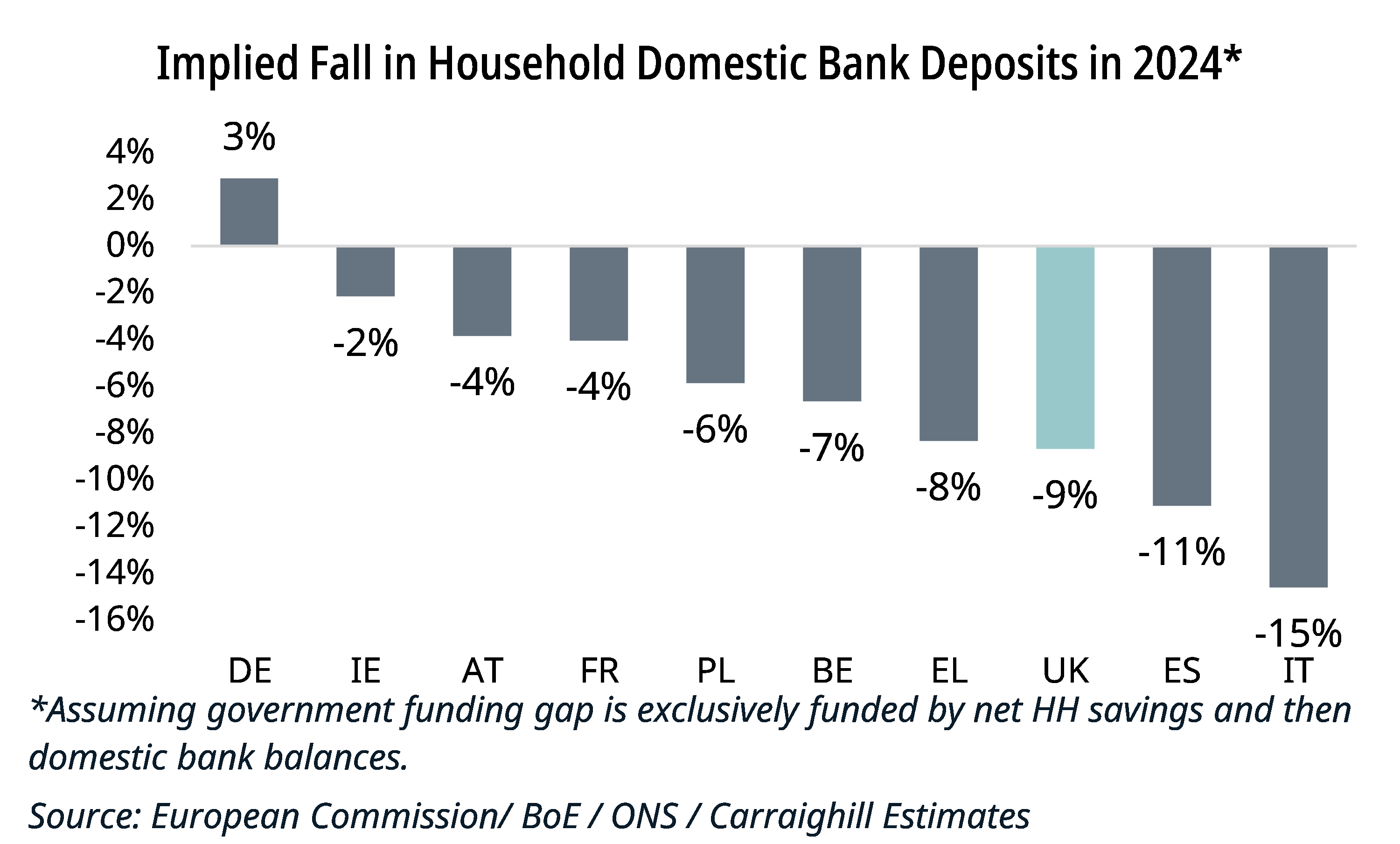

Much of Carraighill’s recent work has been focused on the impact of government funding requirements due to QT and fiscal deficits. A key area of concern is the potential impact on banks’ balance sheets. Our research on this topic is ongoing, but from our estimates, given the UK government funding requirement of c. 6.5% of GDP, and assuming this is exclusively funded by households (through government bond purchases), the implied fall in household domestic bank deposits in 2024 would be c. 9%. Clearly, a hit to banks’ balance sheets of this size, and the ensuing scramble for deposits, could undo any gains to pricing power that the banks might otherwise enjoy in 2024.

We are working to increase our understanding of this topic, not just concerning the UK’s banking system, but across all geographies and sectors within our coverage.

We speak with the management teams of companies including Lloyds and NatWest on these issues on an ongoing basis as we seek to match what management teams tell us with our understanding of the system drivers.

If you would like to access more information and in-depth analysis on these topics, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to stock investment ideas across the banks, payments, fintech, asset management, and real estate sectors for Europe, the UK, Scandinavia and select emerging markets. If you would like to speak to a partner or analyst on the topics raised in this piece, please contact eoin@carraighill.com.