UK Banks: Net Interest Income

A Lens Into How Carraighill Analyses UK Banks Net Interest Income And Top–Line Drivers

Our recent “The Carraighill Two Bank AnalysisTM Framework” blog post outlined our unique approach to forecasting individual bank income. We also try to do this on a system basis. This helps us better comprehend the environment in which a company operates. This short piece outlines this approach for the UK banks’ net interest income.

Multi-pronged approach: Carraighill distils data from multiple sources as we form a rounded view of the UK banks’ net interest income. This includes collecting data from the Bank of England that distils hundreds of thousands of data points that we use and analyse to identify the most important ones. We also monitor and analyse the banks’ fundamentals via quarterly earnings results, bank management meetings, and via our dialogue with our clients (many of whom are experts in this area). Carraighill also conducts in-depth research into the UK property market, which further helps our understanding of the UK banks as mortgages represent the largest component of their loan book.

Key drivers of UK banks’ net interest income:

Broadly speaking, the key drivers for a banks net interest income (NII) are its:

1. Loan volume and rates

There are £2 trillion private sector loans in the UK Banking System, of which mortgages represent £1.37tn (68%). Therefore, the UK property market is inextricably linked to the UK banks and vice versa. Consumer loans and corporates represent a smaller piece of the pie but are still important to the incremental growth of the UK banks’ net interest income as the interest rate charged on these loans tends to be higher than for a mortgage. Recent trends in each loan book include:

- Mortgages

-

- Mortgage volumes have boomed in the UK since COVID-19, with the stock of loans up >5% YoY. This has been aided by national house price inflation of close to 10%. Whilst house prices have been helped in 2020/ early 2021 from the stamp duty holiday (now ended), we believe that structurally the UK is undersupplied with housing, and this dynamic will take years and not months to resolve itself. First-time buyers are driving the market with existing bank customers more reluctant to remortgage during the past 18 months (likely due to restrictions during the pandemic).

- Front book mortgage rates initially spiked upwards in 2020 as banks withdrew from higher LTV mortgage lending. The rate on a 90% LTV mortgage rose to as high as 3.7%. Since the start of 2021 this has reversed as competition intensifies in the UK mortgage market. A new loan now has a rate of 2.47% in August 2021. This is rapidly falling each month. This bodes well for borrower repayment capacity but is incrementally less attractive for banks (although if volume remains strong, it is a positive for the UK banks’ net interest income outlook).

- Consumer (credit card and personal loans)

The interest received on credit card balances and consumer loans has fallen significantly for the UK banks in the past 18 months. This is due to a lower stock and weaker pricing. However, this has now stabilized, and bank management indicate that growth should resume as we enter Q4 2021 (which is traditionally a strong quarter due to Christmas spending, etc.).

- Corporates and SMEs

Large corporates in the UK are awash with liquidity, and hence the stock of loans to large businesses is falling. In contrast, the pace of credit to SMEs rose rapidly in 2020 (helped by government backed loans), but this is now tapering as the economy reopens. Credit standards to this segment have also tightened recently. Overall, from a UK banks’ net interest income perspective, this loan category is the lowest contributor to the top-line. In addition, large corporates in the UK have access to a deep pool of financing in the bond market, which effectively competes against the banks.

2. Funding base (primarily deposits)

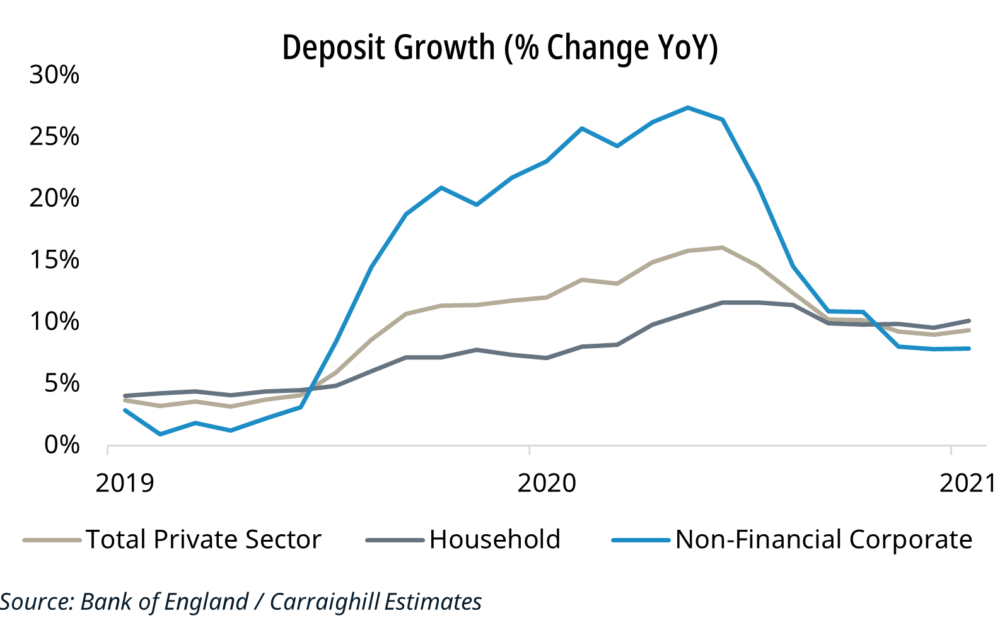

Both UK households and businesses have recorded record levels of deposit growth since the pandemic. This is not surprising given the restrictions in place. Household deposits have risen 10% YoY, and businesses have risen 8% to August 2021 (they reached a record growth of 26% in 2020). Banks have been unable to sufficiently lend out this excess liquidity, resulting in the bank’s loans-to-deposits ratio plummeting to 85% from close to 100% pre-COVID 19. This liquidity has ended up parked at the central bank earning a paltry 0.1%, or it has been invested into government securities or interest rate swaps (see securities portfolio below).

3. Securities portfolio

This section focuses on the securities business drivers to the UK banks’ net interest income. The key reason why banks hold a securities portfolio is to limit the immediate impact of interest rate swings on their earnings. This can be a technically challenging aspect to understand for non-bank experts, but in essence, banks invest part of their excess liquidity (which earns close to zero) into UK government bonds and UK interest rate swaps (swaps are usually the more significant component). The key determinants of securities business income are:

- Size of the Portfolio: This is primarily influenced by the growth of free balances/low-interest earnings deposits and bank equity-less non-interest earning assets.

- Rates: The difference between the 5-year rolling average level of interest rates or swap rates (generally 3-5 years) and the current rate.

- Timing: Individual banks may choose to engage or not engage in hedges depending on the prevailing interest rate level at that time. This brings some level of unpredictability to any analysis.

Swap earnings represent >20% of some of the largest bank’s earnings in the UK, such as Lloyds. The UK swap rate is at its highest point since 2018 (as the market anticipates higher UK interest rates in the future). The steeper curve bodes well for the UK banks‘ net interest income outlook and is one of the primary reasons we are encouraged for the outlook of the UK banks’ net interest income.

4. Other drivers (for example, insurance)

Several other variables can impact the UK banks’ top-line, such as their insurance subsidiaries or any investment banking activity. These are both topics in themselves and are not explicitly covered in this post.

Conclusion: The top-line story for the UK banks has remained positive in 2021, and the latest BoE data continues to show improved UK banks’ net interest income. Concerns on lower front book mortgage pricing have been more than offset by higher swap income. In fact, the front book swap rate is now above the 5-year average back book rate. This is the first time this has occurred since 2018/19.

Applying our experience and expertise to a diverse range of data sets allows Carraighill to form actionable insight, which ultimately helps our clients make better investment decisions. We hope this provides a sliver of insight into how we approach understanding one important aspect of a bank’s earnings.

If you would like to access our work, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.