Turkey: Building up to be one of the Greatest Emerging Market Crises of All Time?

Turkey: Building up to be one of the Greatest Emerging Market Crises of All Time?

Since our previous blog on Turkey, President Erdogan fired central bank governor Naci Agbal. We noted their differing views on monetary policy and the likely tensions that would arise.

Interest rate cuts are now expected by the end of the year. Given the lack of an independent Central Bank, the new governor Sahap Kavcioglu continues to battle a weakening currency and rising food prices. The short-term outlook remains bleak.

The following problems remain:

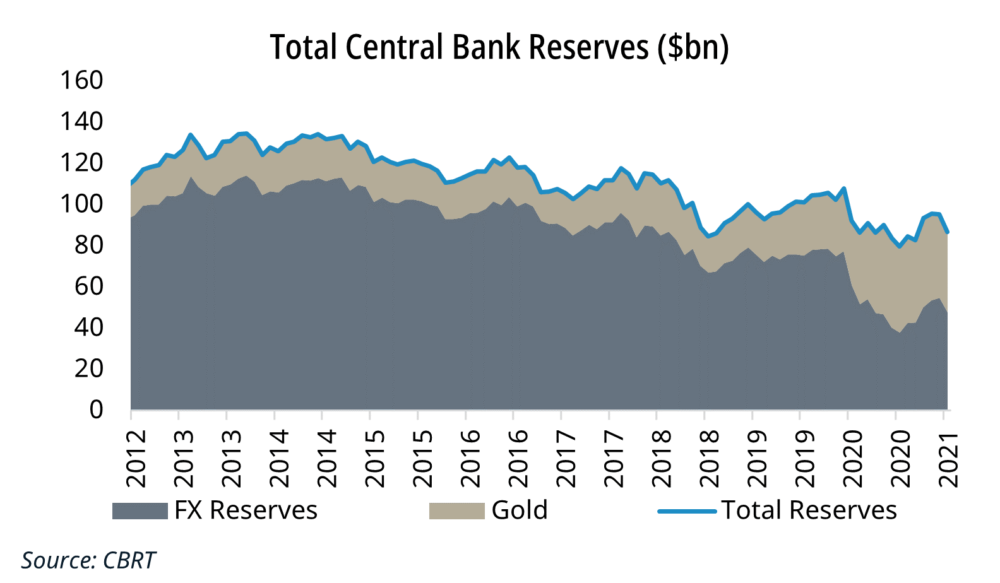

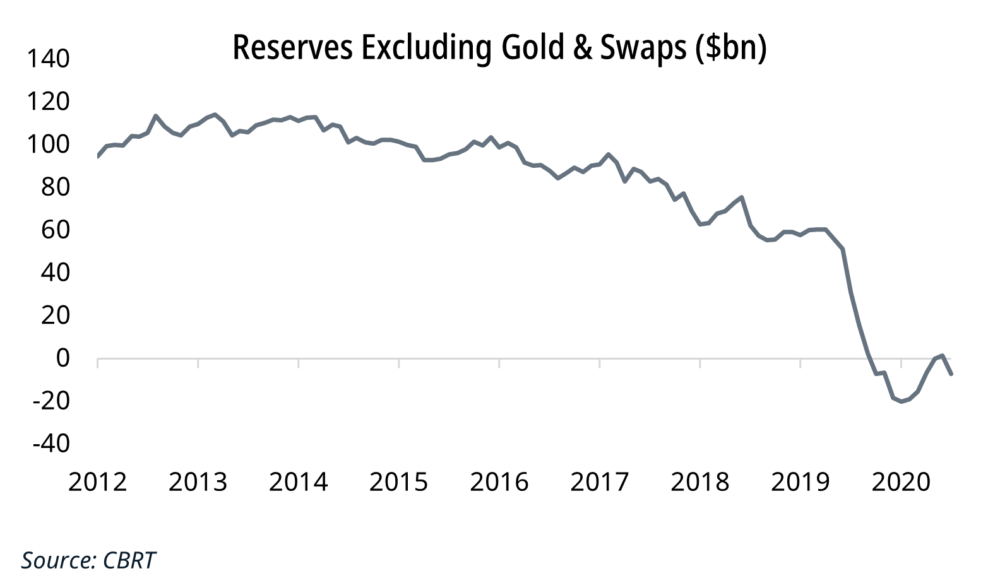

- FX reserves are wholly inadequate as the central bank continues to rely on swaps with domestic banks. We define this as a Ponzi scheme that can persist for a period but ultimately is constrained by the need to have more and more US$ in the scheme. This accelerates the movement by the domestic population towards holding their liabilities as anything other than the domestic currency.

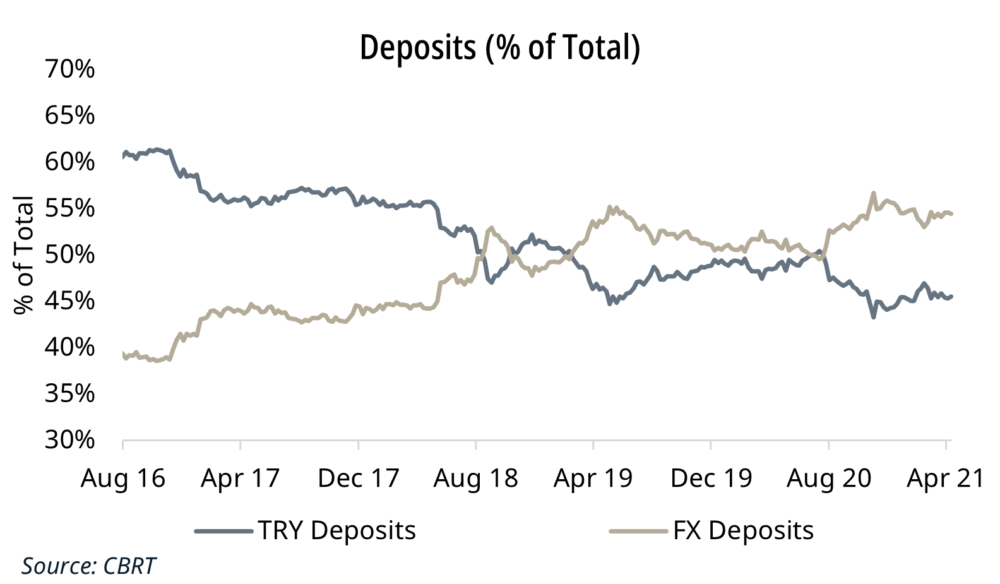

- Dollarisation risk persists, with over 50% deposits now denominated in a foreign currency. Gold purchases by citizens were also large in 2020.

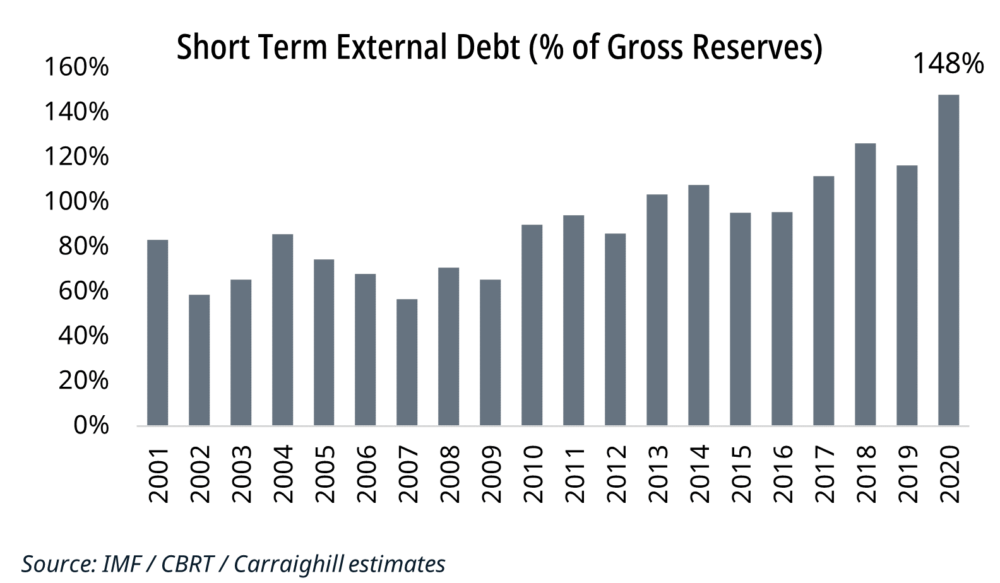

- The external liability structure continues to shorten. Foreign debt is rising, particularly for state banks. Short-term external debt was 148% of total reserves at end 2020.

- Attracting foreign capital will get more problematic if real TRY rates remain negative (PPP theory suggests the actual inflation rate is closer to 30%).

- Higher rates may instigate a significant NPL cycle in the banks; and

- External political risks linger due to heightened tensions between Turkey and the US.

The next step in our analysis was to compare the structural flaws in the Turkish economy to other major emerging market crises.

Most emerging market crises follow a series of steps:

- High current account and government deficits (2-5% of GDP).

- Rising external debt (usually +30% of GDP) and capital outflows that result in currency depreciation.

- Central Banks often intervene in FX markets to support the exchange rate (to keep some quasi peg).

- The result is usually wasted reserves and negative investor sentiment causing further outflows/ currency depreciation. (Short-term external debt as a % of reserves rises to over 100%).

- Inflation then soars due to rising import costsand a government that seeks to print local currency through rising fiscal deficits to ease the pain on its domestic population. At this point, two options can occur. Central Banks increase interest rates to recover lost reserves and reduce price growth, or Central Banks engage in aggressive fiscal/ monetary expansion (loan growth) although productivity is weak. We believe that Turkey is now doing the latter.

- Recession ensues in the former. Hyperinflation is the most likely outcome in the latter.

How Turkey compares to these crises (year prior)

Current Account Deficit: A negative trade balance without sufficient capital inflows leads can depreciate the local currency and/or drain reserves. The CA deficit in Turkey reached c.6% of GDP in 2020. It is likely to remain high in 2021. Comparison to other crises (prior year): Only Thailand in 1996 had a higher level.

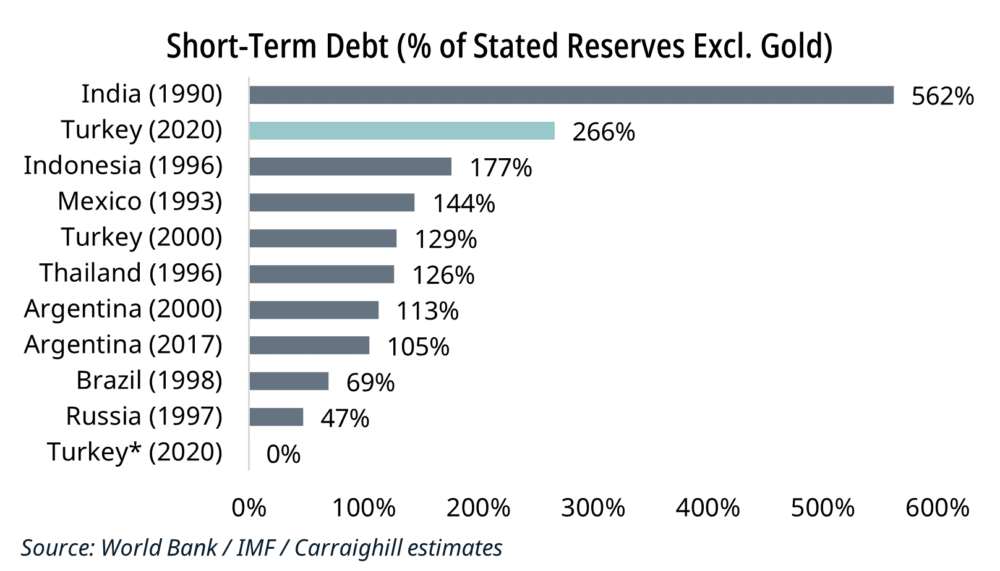

Short-Term External Debt % of Reserves (excluding gold): This figure was 266% at end 2020. If swaps are deducted, it is negative. This implies no cover for ST debt maturities in Turkey. Comparison to other crises (prior year): Turkey is in a precarious position as only India (562%) exceeded its current stated number, ex. gold (266%) prior to its crisis in 1991. No other country has used swaps ex. Thailand in 1996. If we exclude swaps, Turkey has no cover.

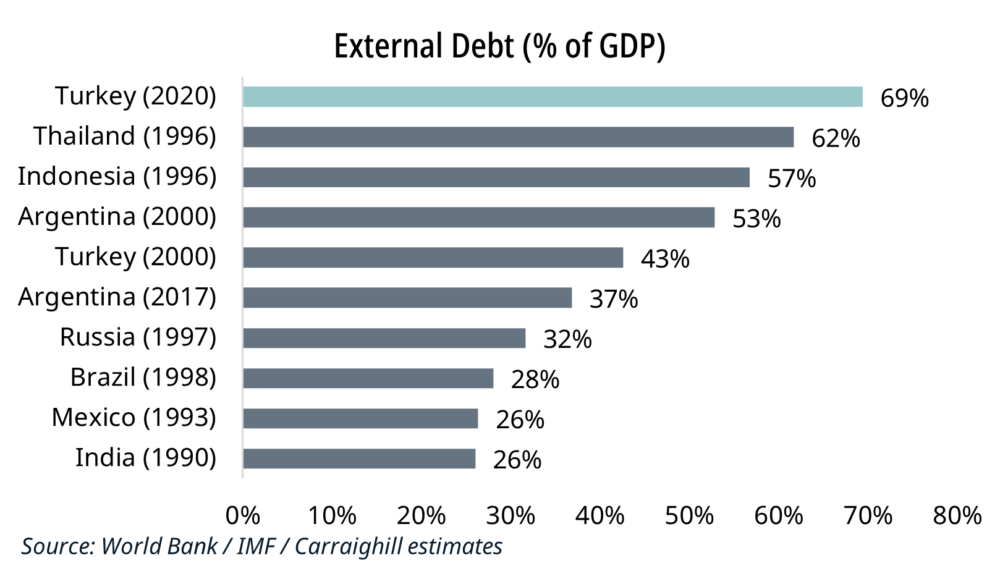

External Debt as a Share of GDP: This figure is now 69%. Comparison to other crises (prior year): Thailand’s foreign debt was 62% before its crisis. Turkey now exceeds this level. The short-term component is 31% of total (Thailand in 1996 was 42%).

* Represents reserves excluding FX swaps with domestic banks.

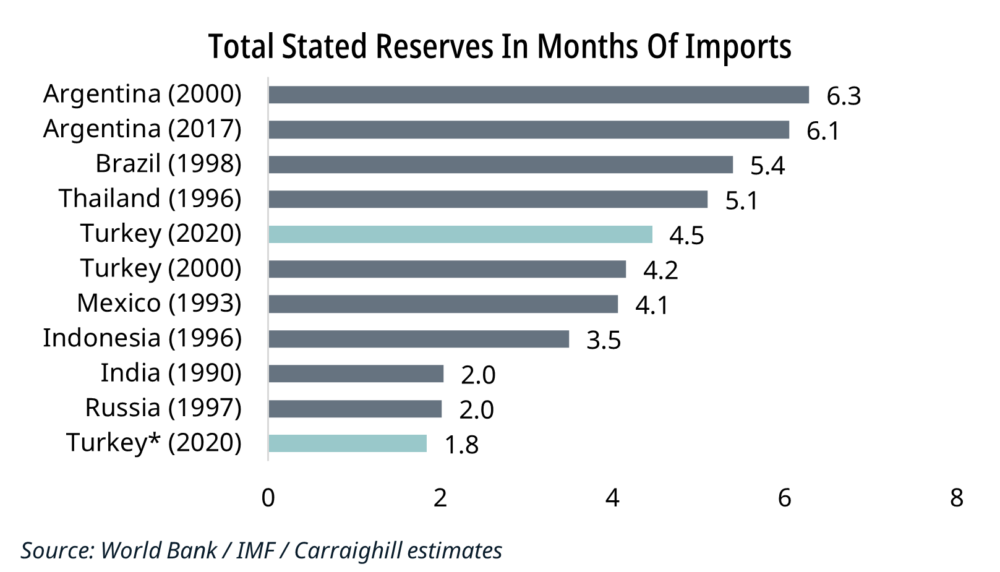

Total Reserves in Months of Imports: In 2020, Turkey’s reserves were adequate to cover 4.5 months of imports. If we exclude swaps, it is 1.8 months. Comparison to other crises (prior year): India and Russia (2 months) had the lowest ratios prior to their crisis years. Again, the position of Turkey appears record breaking (ex. swaps).

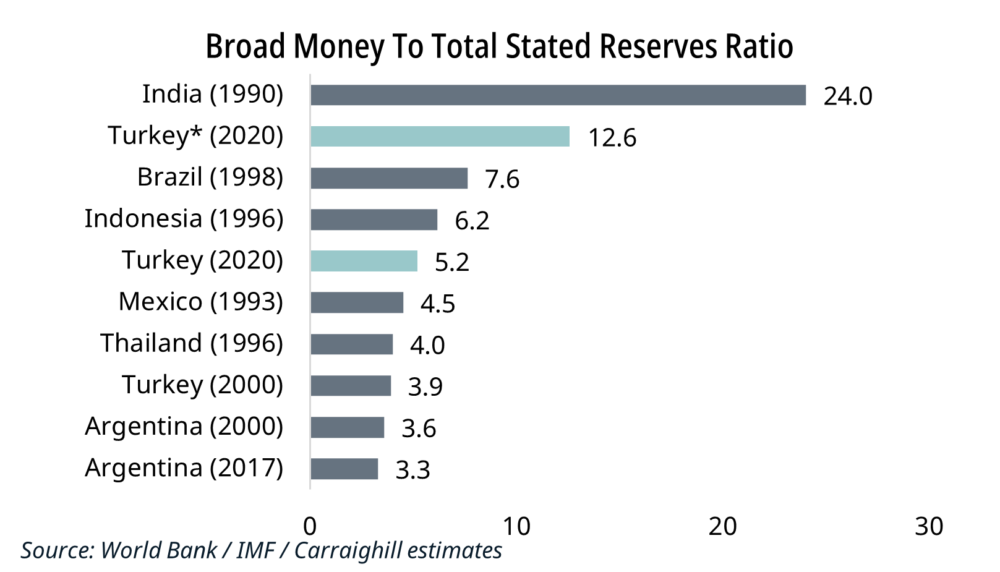

Broad Money to Reserves Ratio: A high value for this indicator highlights the lack of reserves to support the ample money supply. This figure increased from 4.2 in 2019 to 5.2 in 2020 and is likely to rise further. Monetary growth remains high in Turkey. Ex. swaps it is 12.4. Comparison to other crises (prior year): Prior to its 1991 crisis, the ratio in India reached 24, but this remains the outlier. Brazil and Indonesia ratios were both high single digits.

Conclusion: Turkey remains in an extremely weak position compared to other emerging market crises since 1990. The current policy is likely to result in further currency devaluation, reserve depletion, and high inflation. The level of Central Bank reserves is unprecedently low relative to external debt. Swaps mask the true value (a ‘Ponzi’ with the domestic banks). The internal bank liability and external debt structure are now shortening. Deposit dollarisation trends persist.

This impending crash has the capacity to be one of the greatest emerging market crises in history (Turkey is the 19th largest global economy).

While globalisation likely peaked in the 2010s, the contagion effects of a crisis may remain. Further emerging market equity growth may be at risk to worsening crises in Argentina and Turkey.

To discuss this work and the investment implications, please contact admin@carraighill.com