The Trade Relationship Between Ireland And The United States, What Are The Actual Facts?

The data here focussed on:

- The current trading relationship between Ireland and the United States and it’s evolution over time.

- We also assess FDI from the US into Ireland.

Ireland’s US exposure: This needs to be subdivided into:

1. Goods trade with the US

a) Exports:

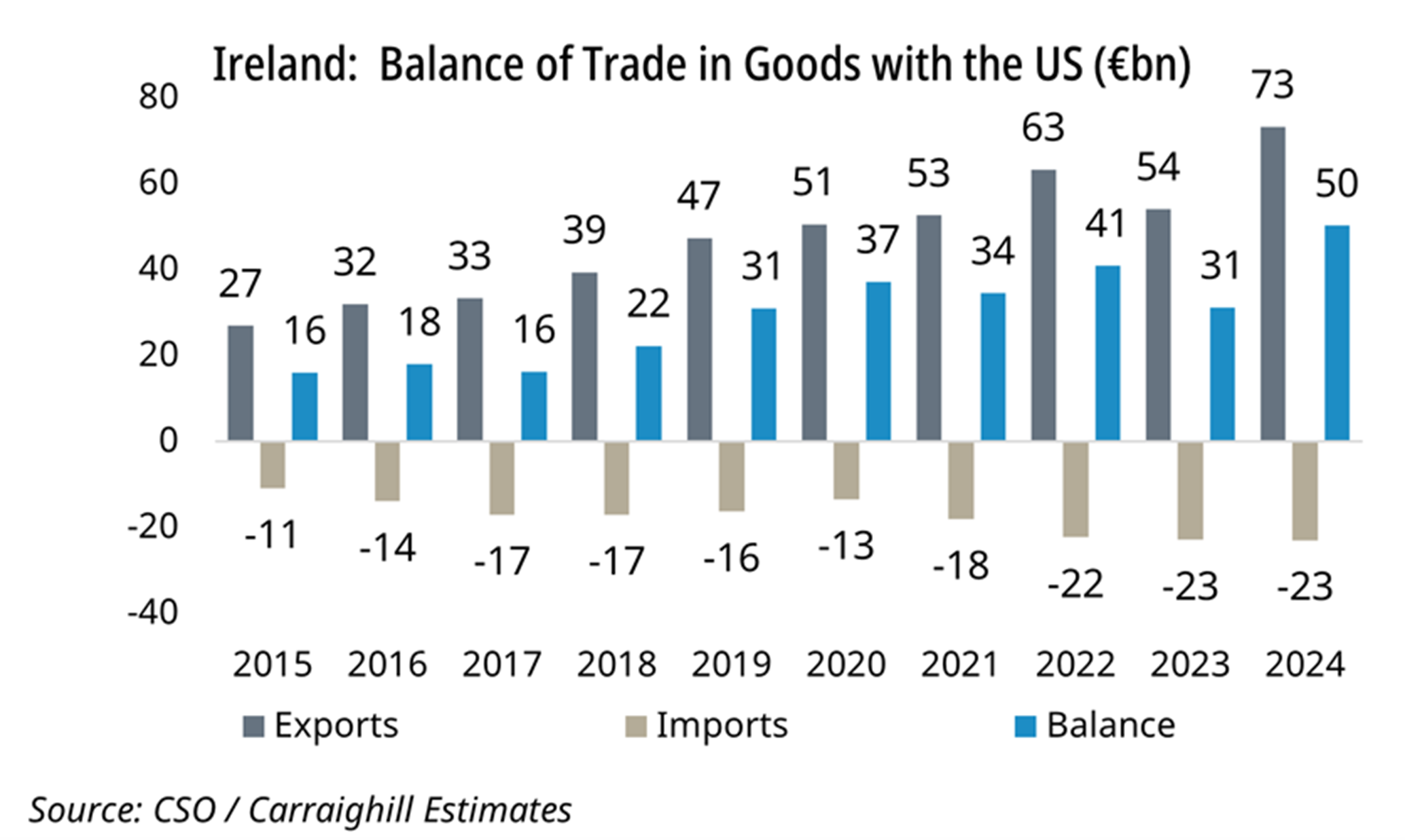

- Ireland exported €73.2bn worth of goods in 2024 to the US. This represented 32.6% of all Irish exports. This is up from €20.8bn in 2014. It is responsible for 40% of the growth in exports over the last decade. The US market has become more important for Ireland.

- The US share of total exports has risen from 22.4% to 32.6%.

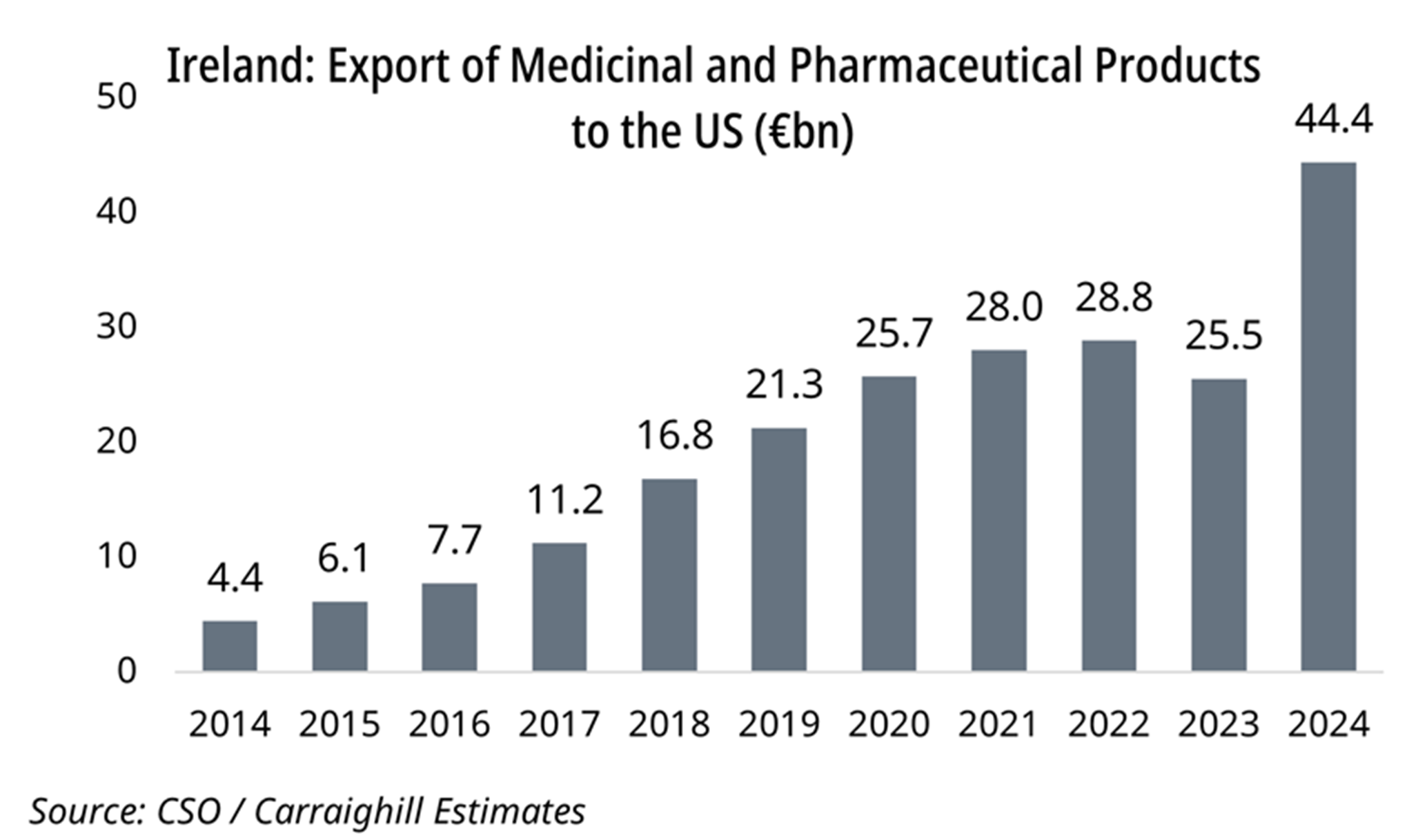

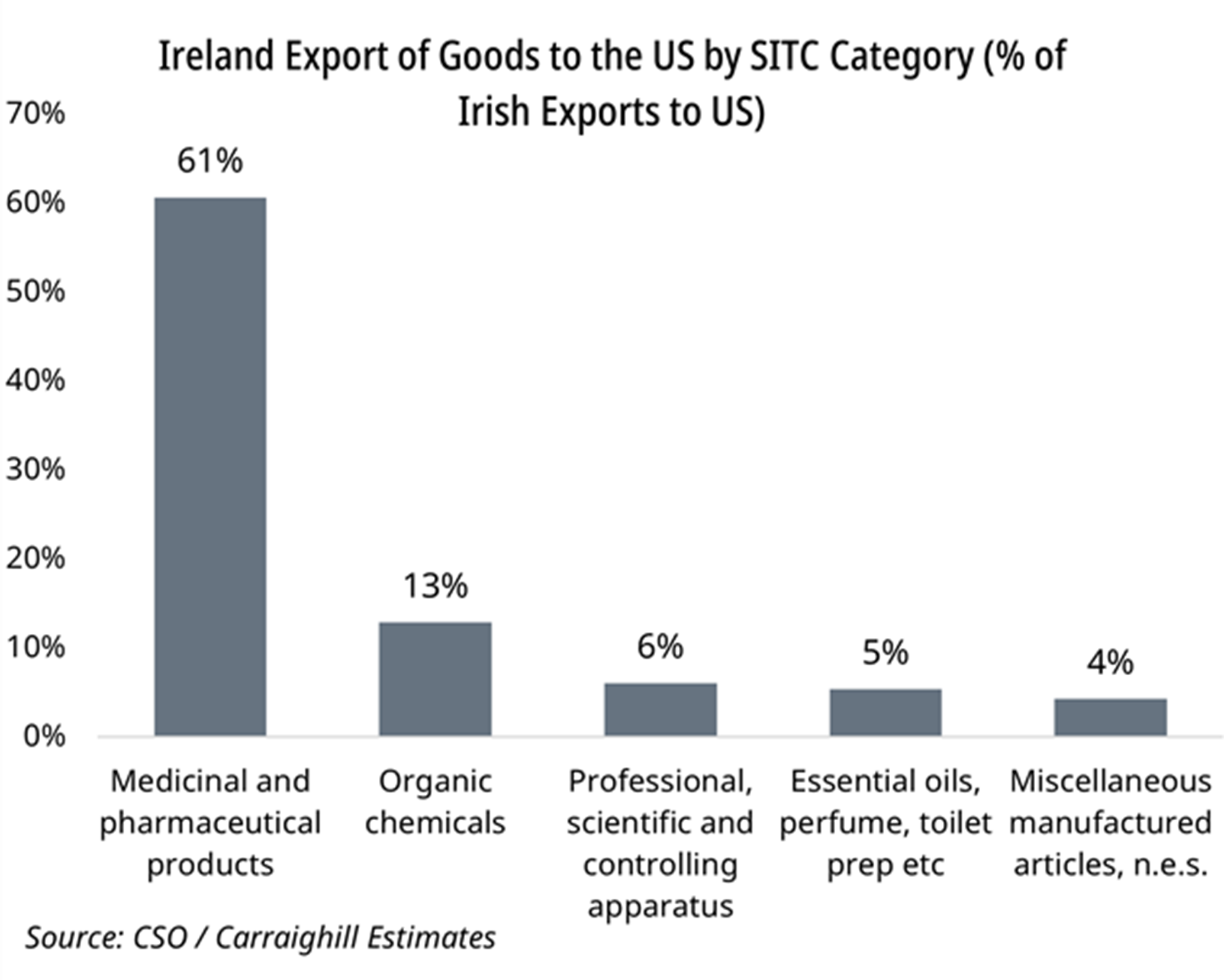

- The main export is medicinal and pharmaceutical products (€44.4bn, 61% of Irish exports to the US). This is up from only €4.4bn in 2014, showing strong growth over the period.

- This mainly consists of patented/branded drugs and active pharmaceutical ingredients to be included in finished drugs.

- This was followed in importance by two related categories: the export of organic chemicals (€9.4bn); and professional, scientific and controlling apparatus (€4.4bn).

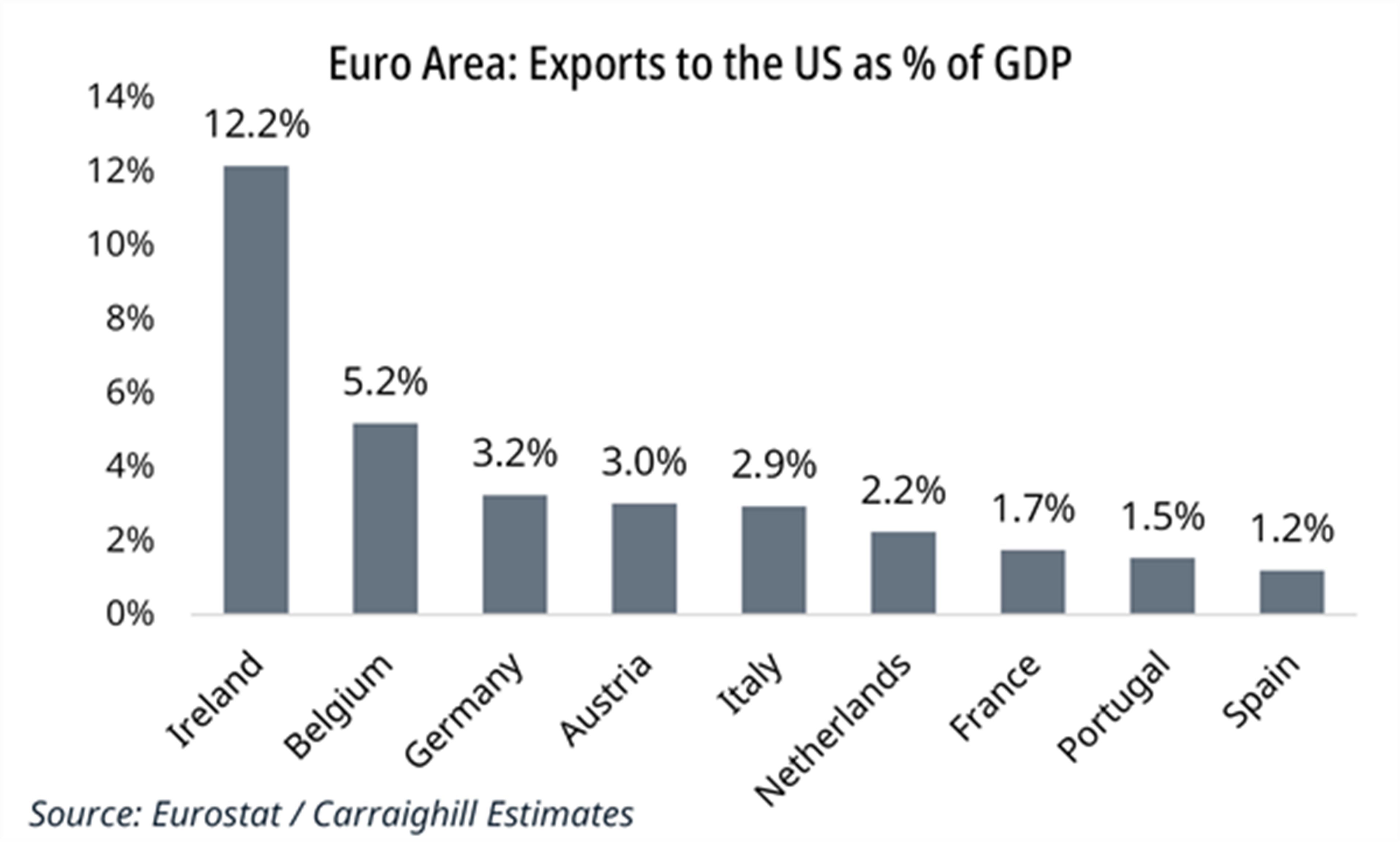

- In a pan European context, Ireland is the most exposed country to US exports (12% of GDP). Belgium is second highest at 5%.

b) Imports:

- Ireland imported €23bn worth of goods from the US in 2024. The main component was “other transport equipment”, valued at €7.5bn.

- This division includes planes and likely corresponds to Ryanair’s purchase of Boeing aircraft.

- Ireland is a European hub for aircraft leasing and these firms may also purchase planes from the US. This is the single biggest line item by a wide margin.

c) Trade Balance:

Ireland therefore ran a trade surplus in goods with the US of €50bn in 2024 (9.6% of GDP). This is up from €16bn in 2015. The main areas of imbalance were:

i. Medicinal and pharmaceutical products wherein Ireland runs a surplus with the US of €40bn (7.7% of GDP).

ii. The next large area was related, with a surplus in organic chemicals of €9.0bn (1.7% of GDP).

2. Trade in Services:

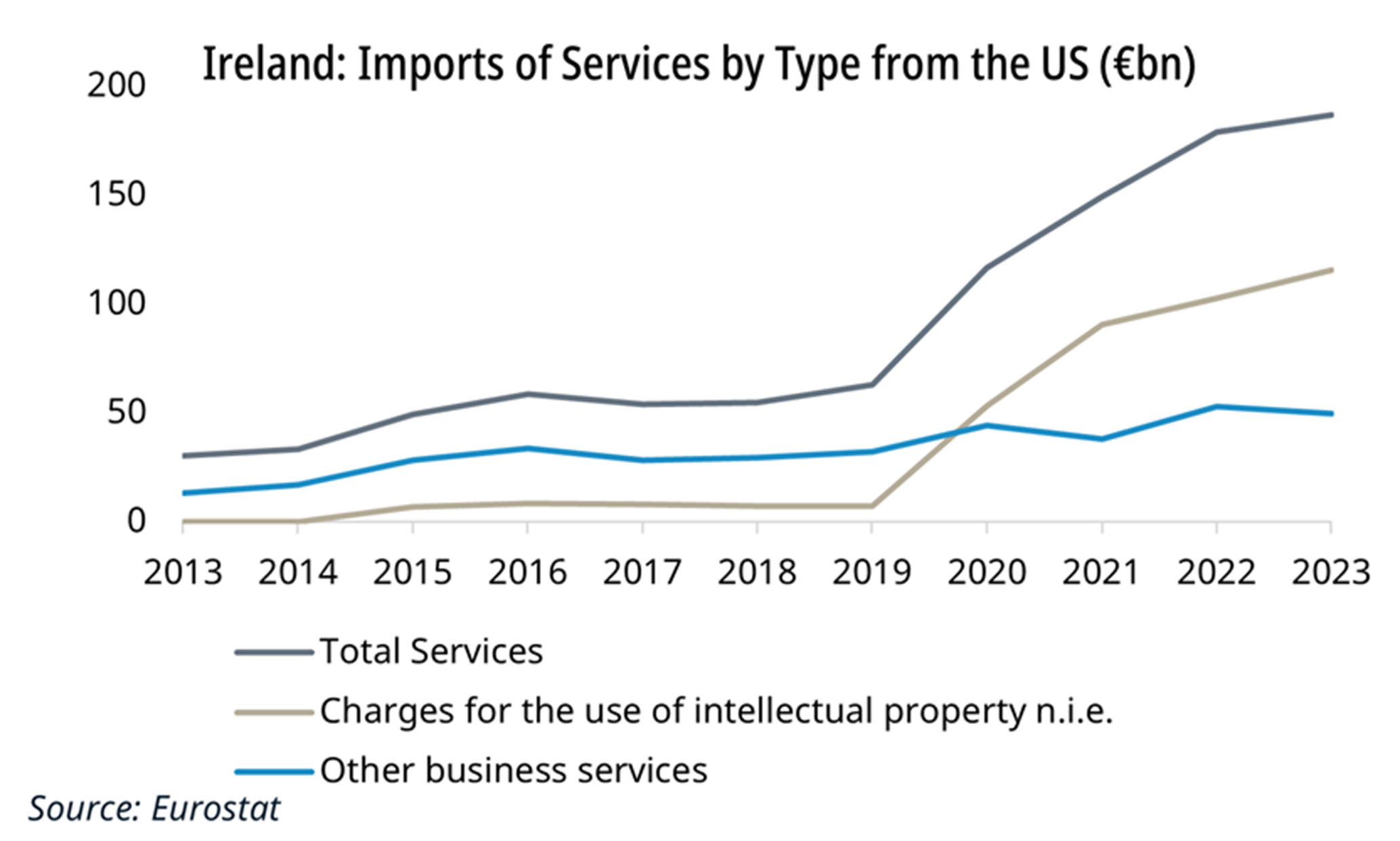

- Ireland imports more services from the US (€187bn) than any other country by a wide margin (36.6% of Ireland’s GDP).

- This was 48% of all services imported in 2023.

- Services imports from the US have increased over the past decade, up from €30bn in 2013.

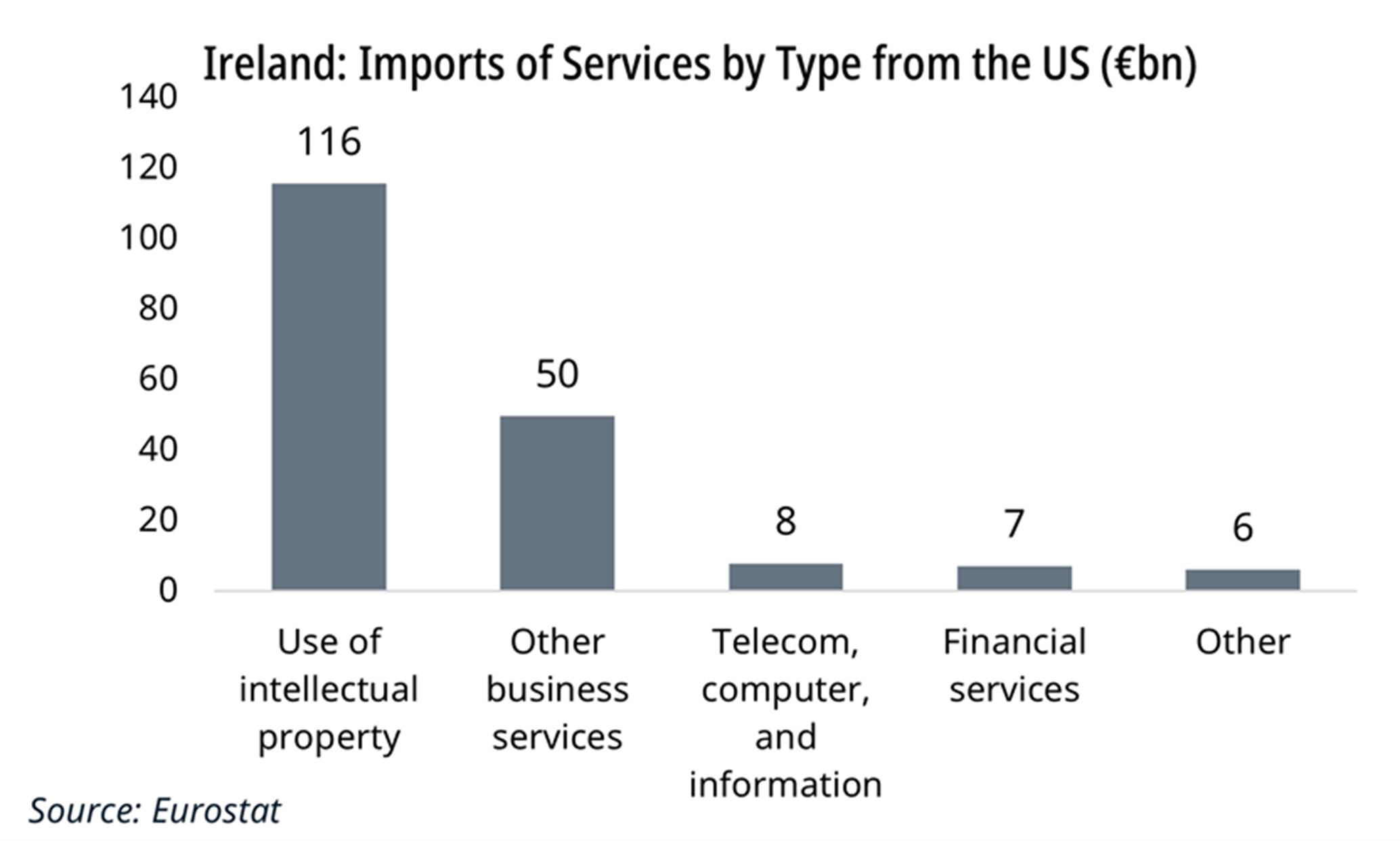

- The main import by type is charges for the use of intellectual property €116bn (62% of total) and “other business services” at €50bn (27% of total).

- “Other business services” includes the import of R&D, which is where the trade accounts record US multinationals transferring IP into Ireland.

- Ireland exported €53bn of services to the US in 2023, up from just €11bn in 2013. These are also charges related to intellectual property and business services. Travel-related services are small by comparison (€2bn).

- On a net basis, Ireland ran a services trade deficit of €134bn or 26.2% of its GDP.

Note: Ireland runs large services surpluses with the rest of the world because of the presence of US technology companies exporting tech services.

Balance of trade in both goods and services: Overall, Ireland runs a trade deficit in goods and services with the US of €84bn. Before the pandemic, Ireland ran a surplus with the US. This has deteriorated over the subsequent years, driven by a large increase in the import of US services into Ireland.

3. US FDI into Ireland:

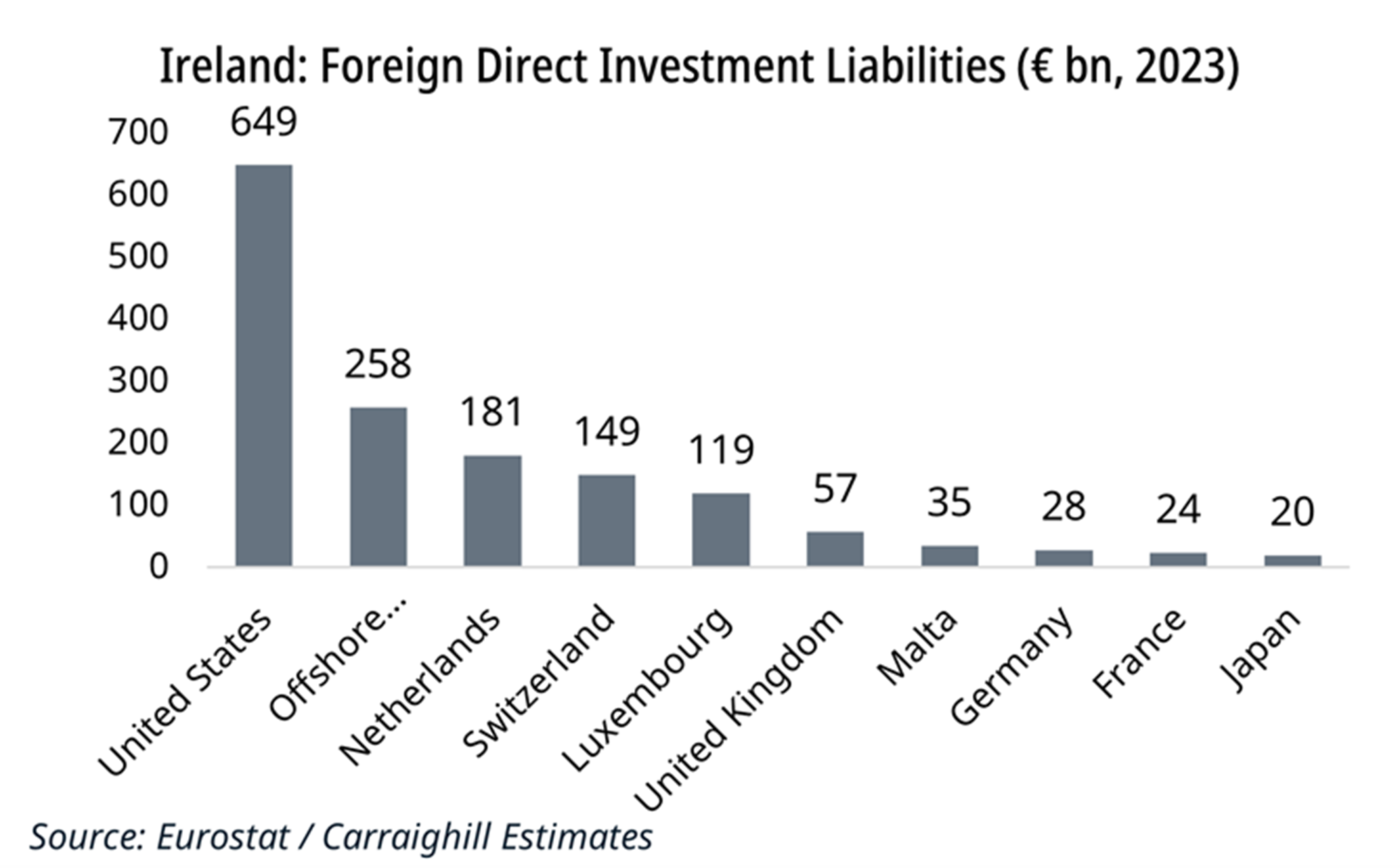

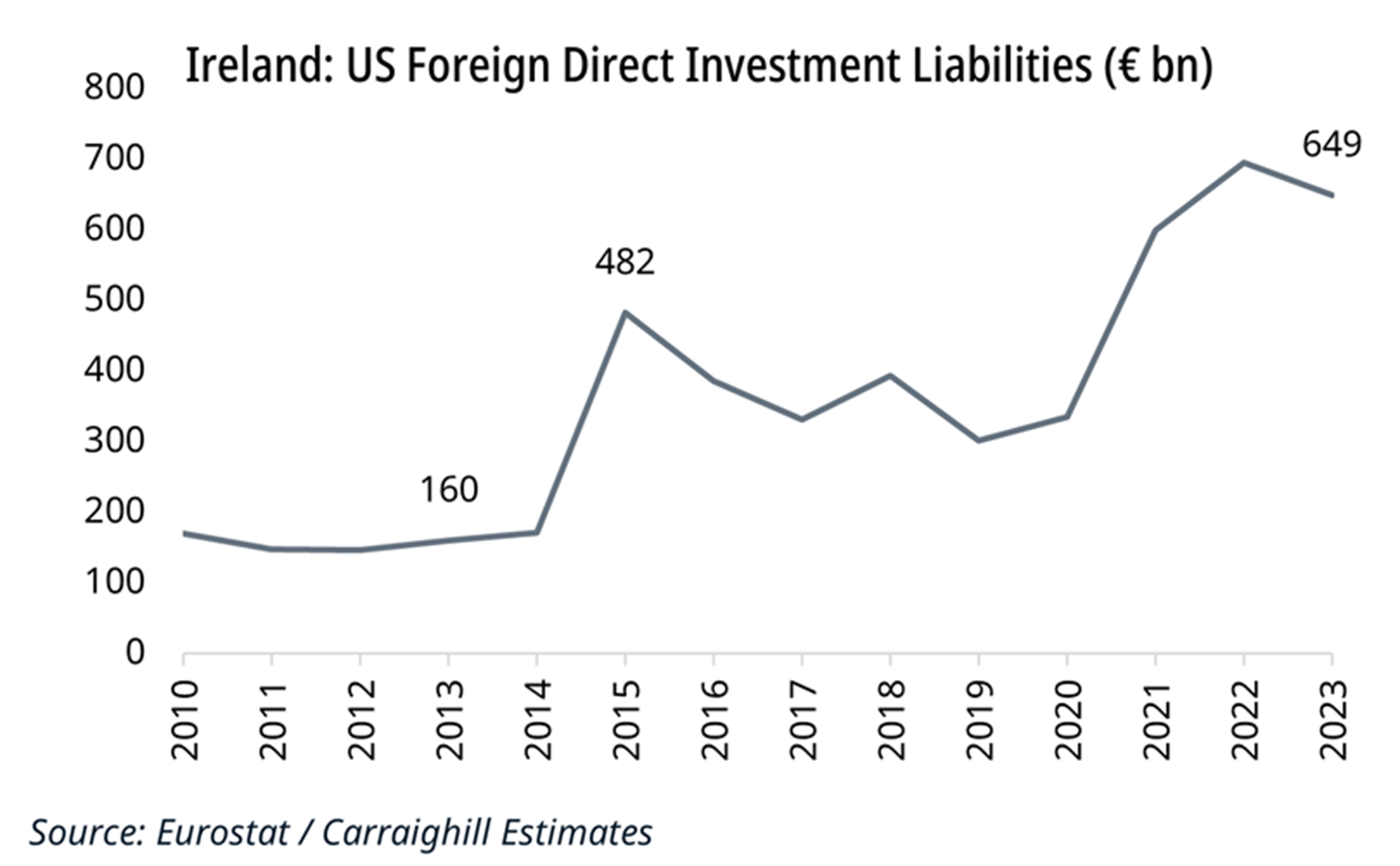

- The US is the largest holder of FDI in Ireland by a wide margin. At the end of 2023, it had a stock value of €649bn (This is high, 38% of total).

- This has grown significantly over time, up from €160bn in 2013 when it was 24% of total FDI.

- By category, we note that the direct investment position in Ireland (net) from the US was split into services (€347bn) and manufacturing (€167bn).

- Within services, information and communication was the highest at €144bn, followed by financial services excluding insurance and pension funding (€123bn).

Conclusion:

Ireland has been a significant beneficiary of trade with the United States and uncertainty around tariffs could make companies rethink/ pause further investment into Ireland, awaiting clarity.

In terms of potential implications:

- Ireland has close to 5% of persons employed in what, we at Carraighill, describe as vulnerable European industries (autos and pharma). Growth here may now be more constrained as we look forward (particularly pharma).

- The growth in FDI liabilities has also helped power the professional services sector in Ireland. The key issue is if this growth reverses/ stalls this may limit further growth in this sector. There are reasons to suggest that it may not, as many of the tax advantages persist and Ireland is still the main European head office location for many multinationals.

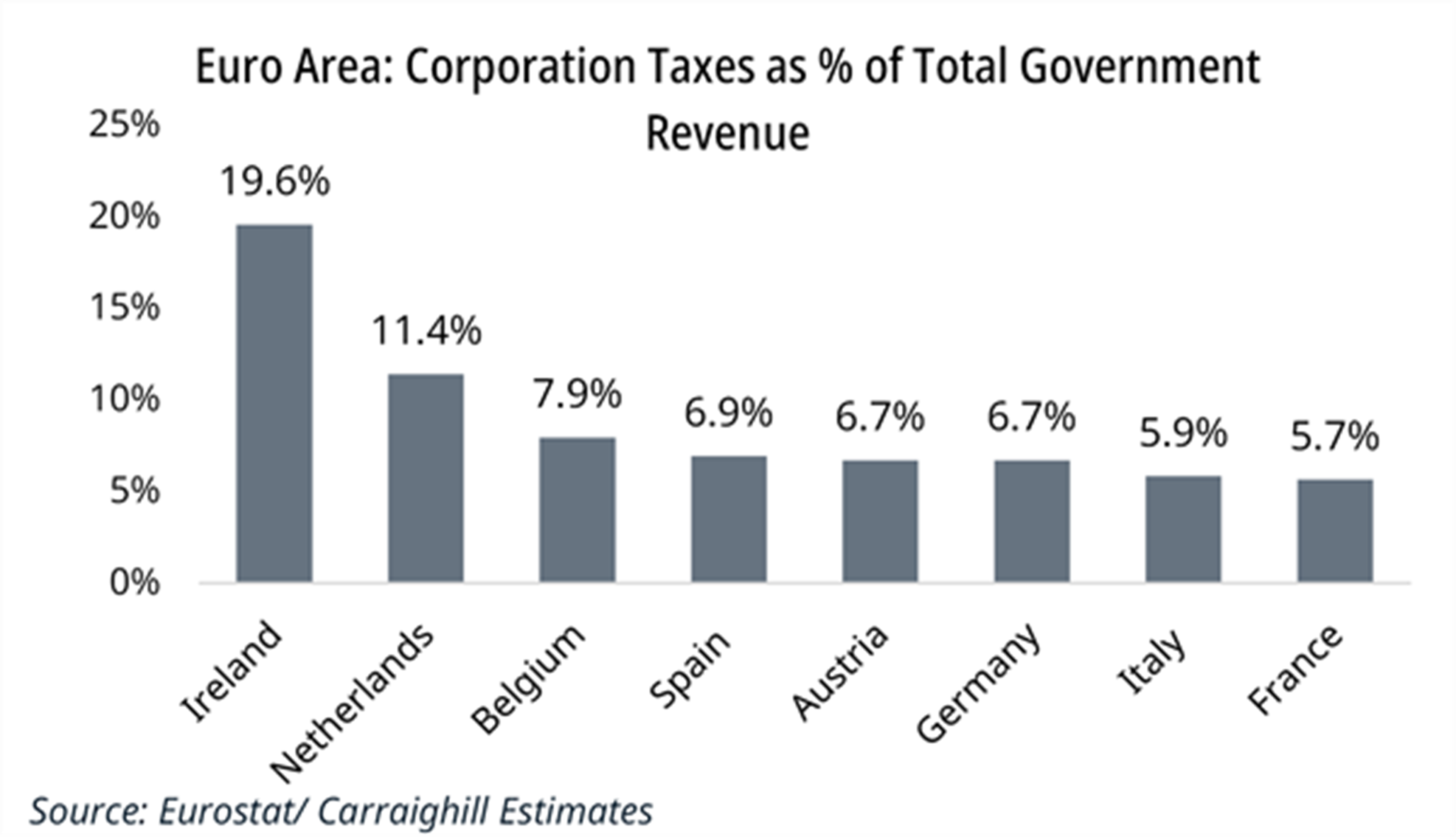

- Corporate profits in Ireland as a share of GDP has risen sharply, and is likely correlated with the growth in FDI liabilities. This is a much-highlighted vulnerability for Ireland.

If you would like to access more information and in-depth analysis on these topics, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to stock investment ideas across the banks, payments, fintech, asset management, and real estate sectors for Europe, the UK, Scandinavia and select emerging markets (Brazil, Mexico). If you would like to speak to a partner or analyst on the topics raised in this piece, please contact eoin@carraighill.com.