Payments Companies: Household Consumption and the Move Away from Cash

A payments company facilitates a transaction between two parties – for example, between a customer and a shop. The payments industry is generally characterized by a recurring revenue stream and a high level of operating leverage once the IT infrastructure is established. This translates into high levels of free cash flow. Incremental capex requirements are modest and given the high predictability of revenue, companies can bear reasonable levels of debt – although this differs based on company specific capital allocation preferences. Revenue growth is fuelled by two trends:

- Growth in consumer spending; and

- The secular shift from paper to digital forms of payment.

For our clients, we follow both these drivers in our monthly report – The Signal.

Who wins the payments game?

Payments companies can distinguish themselves based on:

- Price: A large component of payment processing and merchant acquiring costs are fixed and hence payment companies benefit from increasing operating leverage as the user base expands. This allows for better value pricing relative to competitors. Hence scale wins. This is a large barrier to entry for new entrants.

- Service: Large payments companies generally have a full service offering which help both the merchants and issuers. In addition, there are niche players who focus solely on parts of the payment’s ecosystem such as payment processors or point of sale terminal providers. A strong relationship with the retailer or firm that processes payments is important.

- Technology: The technology used differs by provider and largely can be differentiated into more tech savvy players such as Adyen which has one core platform and Stripe which levers off its developer friendly APIs. These companies have gained a foothold with e-commerce companies due to their ability to transact globally and their superior authorisation and conversion rates. There are also traditional bank payment companies which are either still part of incumbent banking groups or separately spun out. These tend to have older systems that have been parsed together from historic acquisitions (for example Nexi in Italy). The emergence of new technology is a risk that may scupper older (and incumbent) players prior core competence. Square is an example of this.

There is likely to be a number “winners” serving different cohorts of customers from large e-commerce players to small SMEs. However, distribution and scale will remain the key operating drivers. Hence consolidation in the sector will remain an important tool to gain scale.

Household Income and Spending Drivers

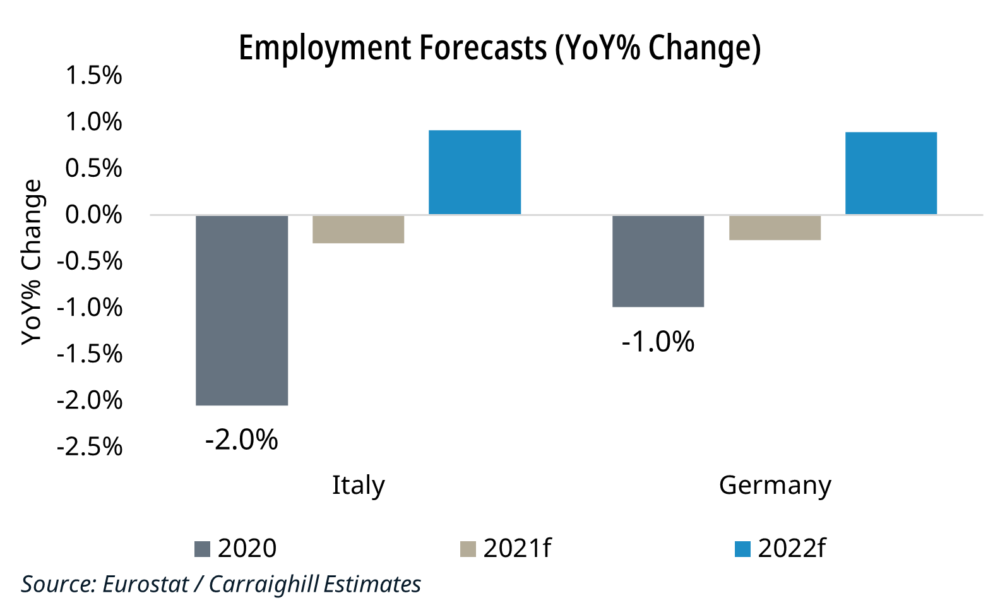

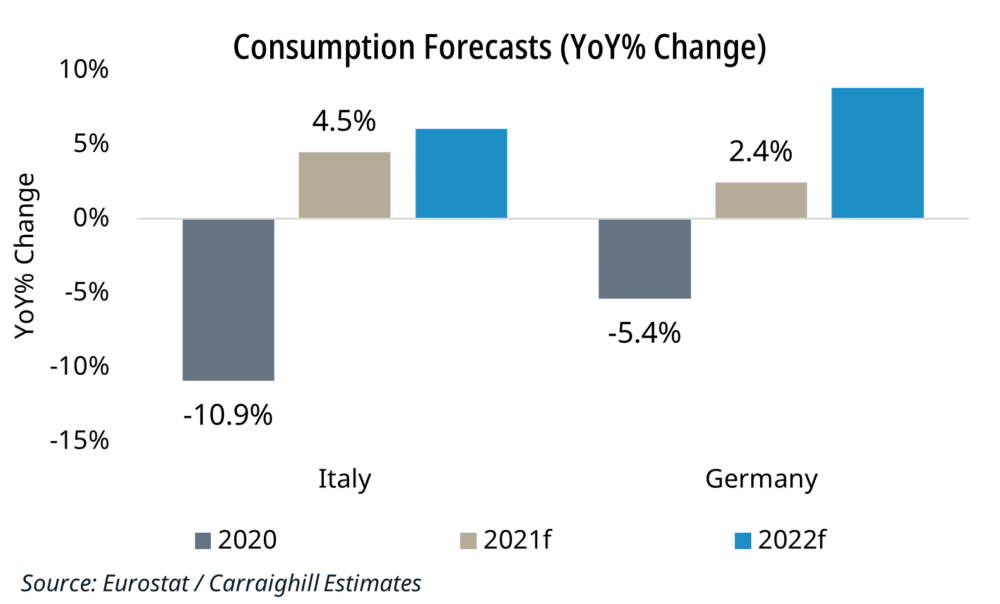

Ultimately the growth and mix of employment and wages in an economy influences the level of consumption. This translates into customer transactions which benefits payment companies (assuming the payment was by card/ online as opposed to cash or cheque).

This graphic explains how Carraighill logically works down from employment and wages to retail sales and how specific companies/ sectors are influenced along the way.

The Link Between Household Income Flow & Company Revenue Drivers

Carraighill’s unique approach is based on the application of clear analytical principles to complex financial systems. We distil actionable insight and ideas from this process which allows us to generate alpha for our clients. Household cash flow is one of the key top-down drivers for payments companies. The below table is a sample of key household data in select European countries. The ideal dynamic for a payment company is:

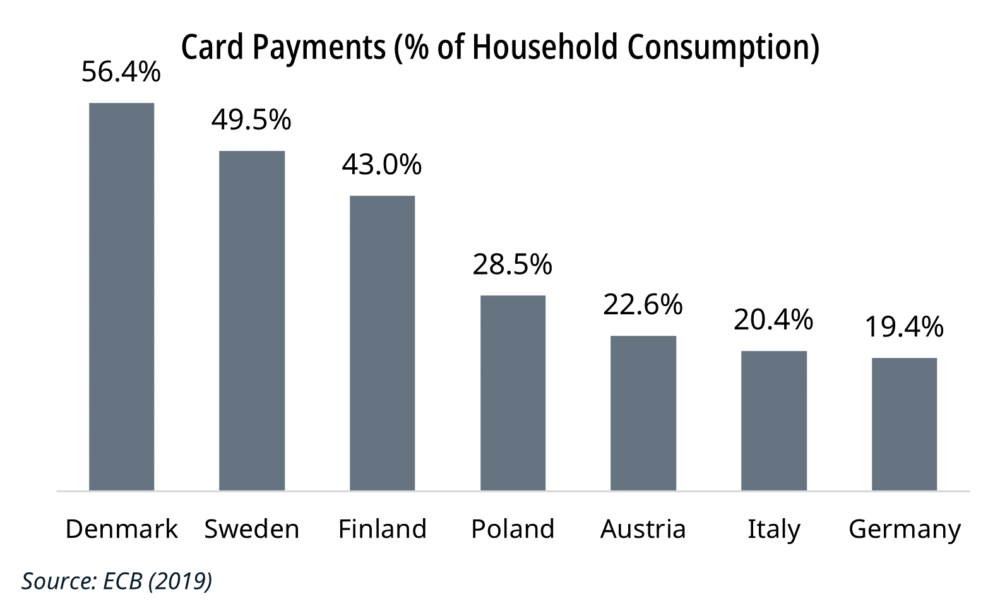

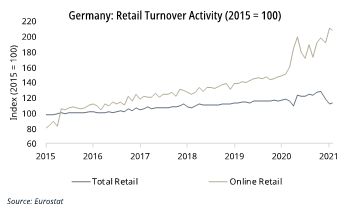

- A young growing population: The younger generation are more inclined to use cards, digital wallets, and shop online versus the older generation. The move away from cash is driven by this demographic. The Nordics for example have a significantly higher online penetration than many older European peers (e.g. Germany).

- Growth in wages and employment: Higher wages, full employment and moderate inflation increase the propensity of consumers to spend. This is influenced by the industrial structure of an economy. For example, household income growth in Italy is low given its older industrial base. In contrast, Ireland is a leader in Europe given its large IT sector. Payment companies benefit from more frequent, growing, and higher value customer spending habits as they take a cut off the merchant transaction value.

Consumption and savings: Consumer spending habits differ by country due to various factors such as demographics, culture, the level of wealth and the willingness to take on additional leverage based on the outlook for your income. For example, Germans are known for their relatively higher savings rate. Hence consumption as a percentage of gross disposable income in Germany is lower than fellow European peers in Italy and Austria.

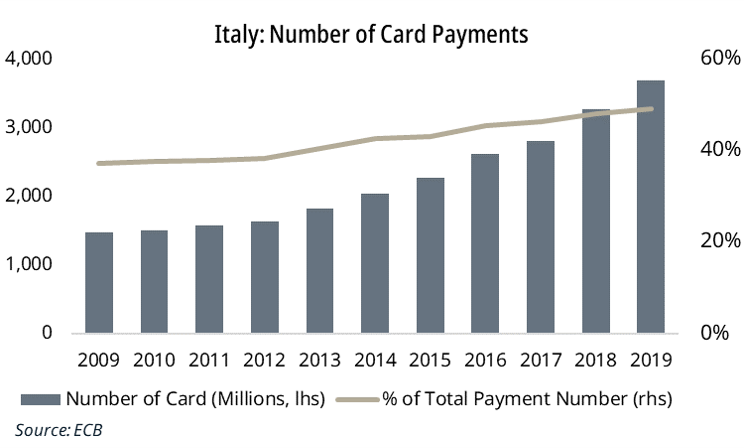

Payment Data – The Move Away from Cash

Carraighill tracks an extensive array of data points that influence how we think about payments in a country including:

- Total payments split by credit transfer, card and Others.

- Value and number of transactions.

- Number of cards per population.

- Number of ATMs in a country.

- Point of sale (POS) terminals (think of the machine you tap your bank card against).

- Consumption trends.

For example, Italian household consumption is struggling to grow due to a lack of productivity growth. The population is also now falling, and the median age is high (47). People are therefore more likely to save than spend. However, the value of card payments as a share of household consumption is also low. This presents an opportunity as digital transactions are still underpenetrated. Most importantly, the government has introduced several measures that incentivise the move away from cash.

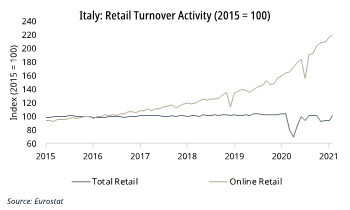

The Migration Online

Carraighill has developed a proprietary estimate of the monthly online penetration level in local currency for the output of the retail and wholesale sectors across major European countries. This data helps us to appreciate:

1. The extent and pace of the migration online in total and in core product areas.

2. The size of the market opportunity for internet-based distribution.

3. The topline pressure on existing instore retail and the implications for high street and shopping centre rents.

Our data set extends over a decade, and it is monthly, with a small 1–2-month timing lag. This should help us monitor cyclical troughs and peaks. This is important for payment companies such as Adyen who primarily serve large global enterprises such as eBay that benefit from e-commerce.

Conclusion

The future for payments companies is bright and ever evolving. Carraighill offers extensive data driven investment recommendations into the sector which is exclusively available to our clients.

If you would like to access the reports mentioned in this article, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.