Mexico: Recovery Risks & A Repeat of The Taper Tantrum?

Mexico is the 10th largest country in the world by population and 15th by GDP. Yet, it is ranked 64th on a GDP per capita basis. Although it is still emerging as a country, key drivers of this lag include high levels of income inequality, crime, corruption, and a volatile macroeconomic environment over the past decade.

If consumers are to demand more cars, houses, and other discretionary goods, then wages and wealth will have to rise for all (not the few). Ultimately, the resolution of this issue will determine the health of its banking system (evidenced through higher loan demand, higher profits, and a stable currency).

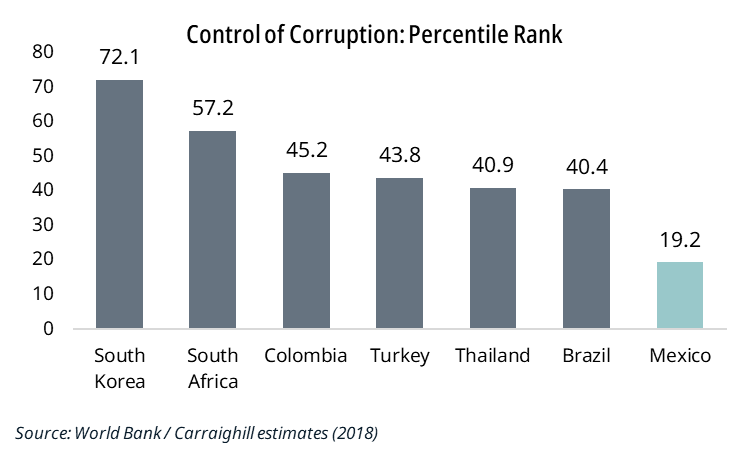

Note: Higher value indicates a greater control of corruption.

As a starting point, we note that Mexico has clear attractions:

1. Location: It is proximate to the US, the largest global economy which remains its primary trading partner.

2. Demographics: Mexico also has a very young and fast-growing population (over 150m people by 2050f). Of these, close to one-third will be aged under 25 years old, and the working-age share of total will rise from 61% currently to 65% at that time. Moreover, with relatively cheap wages, the country continues to transition from primary industries (12.4% of employed in agriculture) to one based on industrial production and services.

3. Attractive investment destination: FDI remains strong and is a key influencer of growth. The US has the greatest absolute and relative share, with Europe also now investing heavily in this economy. The stock of FDI has risen from $336bn to $568bn over the last decade.

4. A relatively stable external financial position: The Mexican crisis in 1994 is now a distant memory for most observers, but it induced significant losses for investors. The current situation is much more supportive for the following reasons:

- The country has run a low current account deficit (2020 being the exception with a small surplus) which is more than offset by capital inflows. In the early 1990s, the deficit was c.5% of GDP.

- The central bank is now independent (since 1994) and prudent in managing inflationary pressures. Import prices are much more stable.

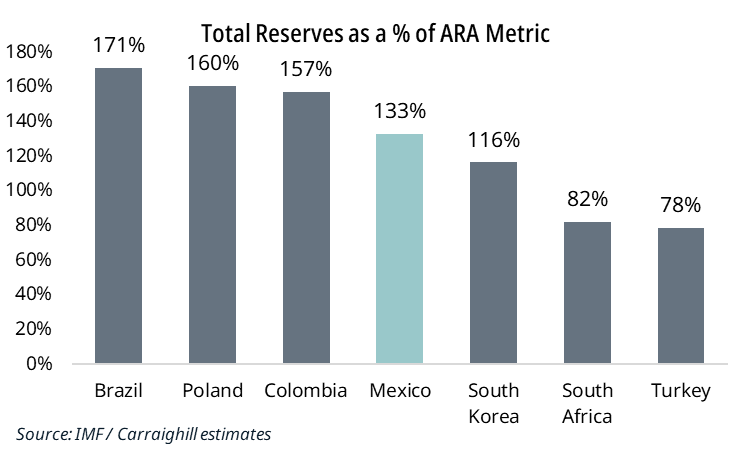

- Central bank FX reserves are adequate to support the currency, economy, and financial markets (reserves equate to over five months of imports currently vs. less than one month in 1994).

- Banco de Mexico also embraces the flexible exchange rate, avoiding FX intervention to maintain a peg to the dollar (which was the case in the early 1990s).

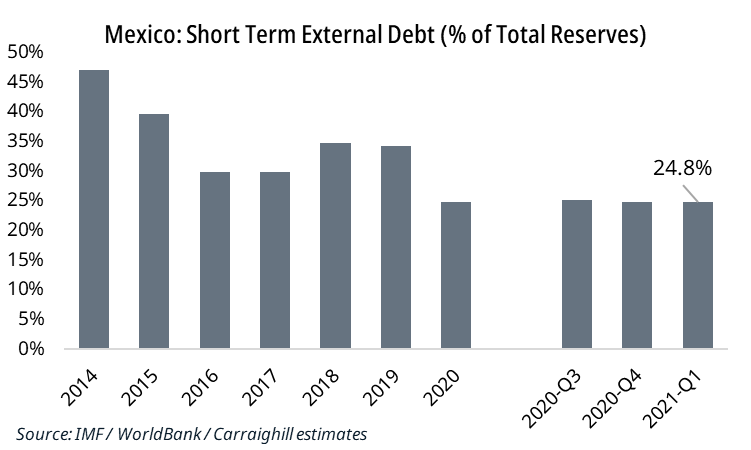

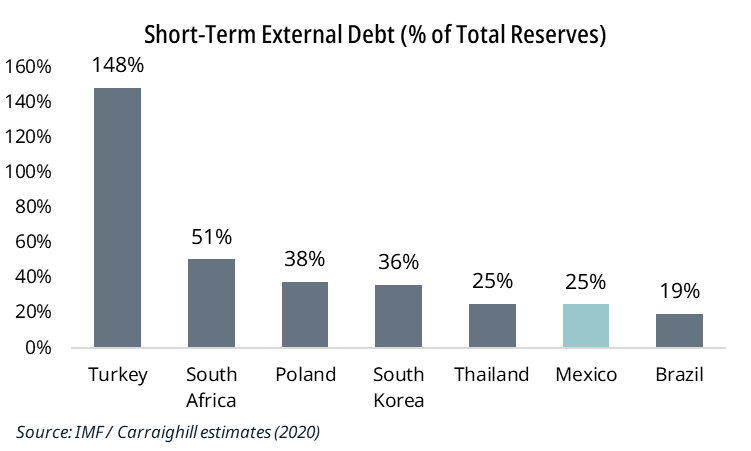

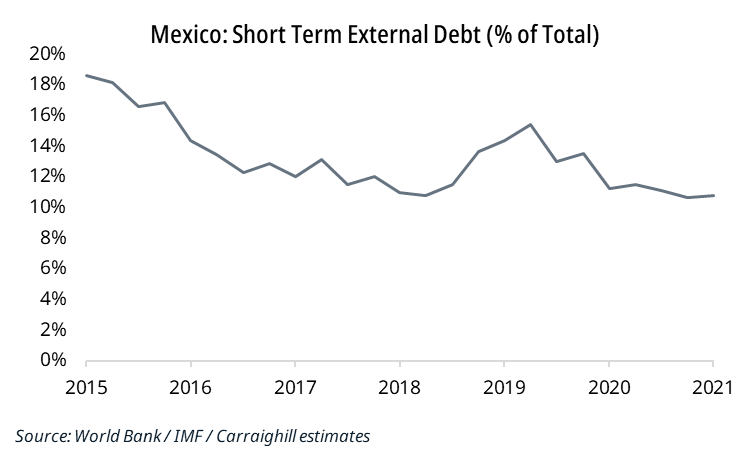

- The country has lowered its reliance on short-term external debt. Its share of total is now c.10% falling from over 20% in 2014 (28% in 1994). As a result, the liability structure is now lengthening.

Note: IMF’s Assessment of Reserve Adequacy (ARA) metric weights external debt, money supply, and imports relative to reserves. A higher value indicates greater reserve adequacy.

So what are the key risks in the near term?

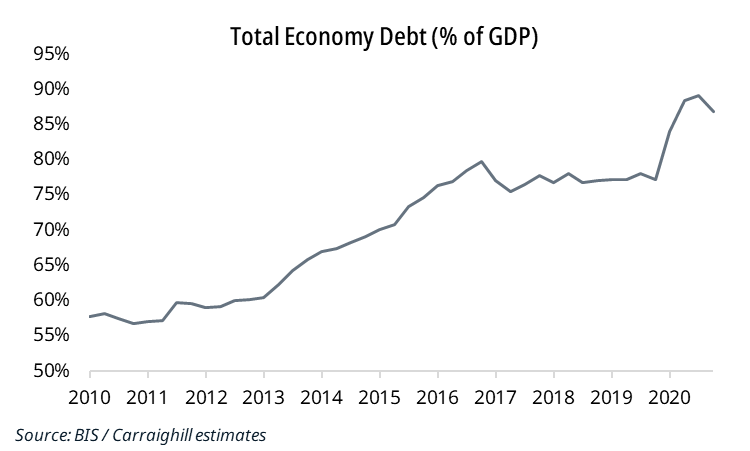

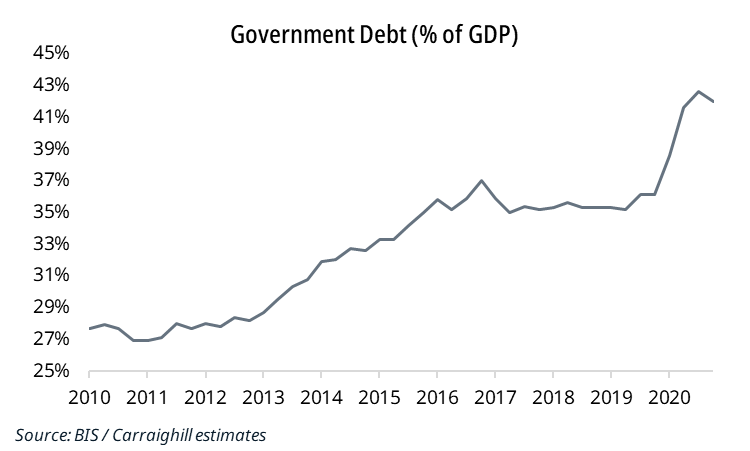

1. Political uncertainty: The rule of law in Mexico has deteriorated during President AMLO’s six-year term. He has also largely failed on his commitment to tackle corruption. When ranked next to other EM countries, Mexico remains last on this metric. Along with other external risk factors (US trade relations), this domestic political instability has placed downward pressure on the peso. The current government’s fiscal consolidation policies also suggest that the rebound in investment is slow. Unlike most other countries, Mexico opted against the wide-ranging stimulus, electing austerity measures in 2020 to reduce debt. We note that total economy debt (private plus government) totals 90% of GDP.

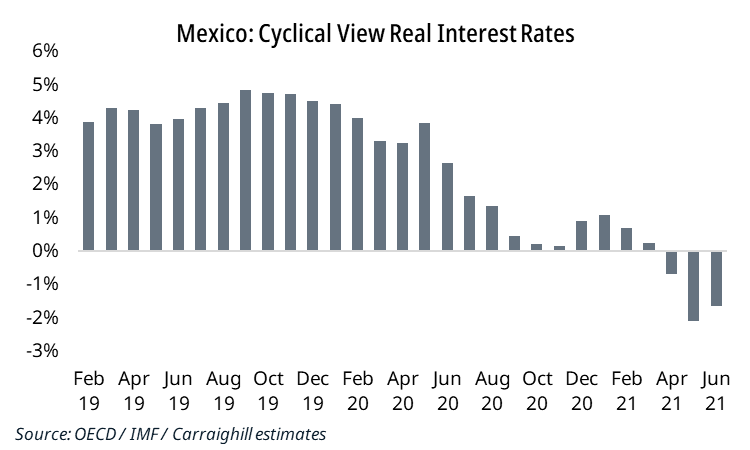

2. Maintaining an independent Central Bank: Like the rest of the world, Mexico is currently experiencing high inflation above 4.5% nominal interest rate. The real interest rate is therefore negative. Despite the Banco de Mexico supporting the Fed’s view that current price pressures are transitory (we also believe this – see blog), it has nonetheless raised rates two times this year so far. Further hikes are likely until December. The forward market is also pricing in further tightening, with the current governor, Alejandro Diaz de Leon, remaining relatively hawkish (the 3 years forward rate is now close to 7%). Perhaps the greatest near-term risk is his term expiry in December 2021. His successor, former finance minister Arturo Herrera is President AMLO’s ally. This may result in a more dovish policy period for the central bank as the president pushes for a greater focus on growth rather than inflation. This is a significant risk factor.

3. A repeat of the 2013 taper tantrum: Despite a fundamentally strong economy, the prospects of repeating the sluggish growth of the mid-2010s remain. The 2013 taper tantrum, falling commodity prices, and slowing Chinese economy resulted in sharp devaluations of many currencies at that time. This risk remains today, as the Fed is currently discussing tapering and China weakening. We note that most EM crises occur during periods of global monetary tightening. But there are significant differences to 2013:

- Mexico’s FX liabilities are much lower than in the early 2010s, which suggests some protection from an adverse macro environment.

- FDI accounts for much of external liabilities today (50%), while the more volatile portfolio investment holds a lower share, suggesting a stickier foreign investor base.

- It was only when the central bank engaged in a tightening cycle in 2016 that domestic bank equities recovered, and the peso stopped falling. Today, Mexico is already raising rates, which should lower the risk of damage to financial markets and the currency.

Mexico’s economy is set to rebound in the coming years following the slowdown in 2019 and the COVID-19 pandemic in 2020. Structural demographic trends should also support growth over the long term. Its banking system remains highly profitable. Still, we are attuned to political risks regarding President AMLO and the incumbent governor of Banco de Mexico.

The country is better positioned than most emerging markets to maintain and grow its global influence, but these political risks (crime, corruption, and authoritarianism) may interfere with the country taking the next step. Ultimately, we believe the core issue of raising GDP per capita in USD will have to be resolved longer term if the economy is to reach its full potential.

If you would like to access the reports mentioned in this article, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.