How we are thinking about European Banks

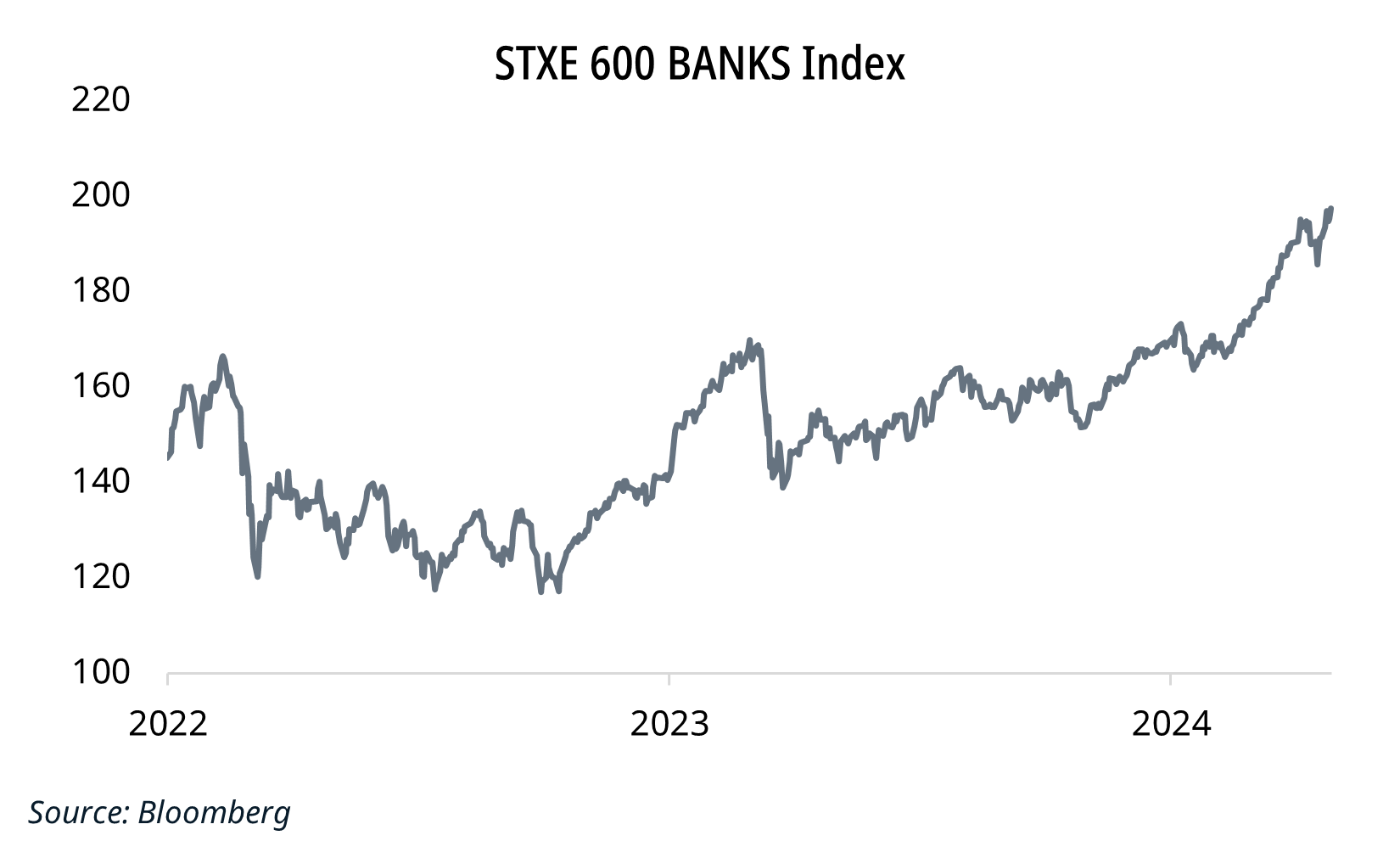

Since the last post we wrote on European Banks (August 2022), the SX7E European Banks index is up c.55% and recently reached a six year high. It is among the best preforming sectors in Europe this year.

The original post, which coincided with the first interest rate hike by the ECB in 11 years, asked the question: is now the right time to invest in European Banks? At that time we expected rising rates to result in higher incremental net interest income for many banks in the region. This has transpired.

Given that the European Central Bank sent a strong signal that it would consider cutting interest rates at its next meeting in June , we may be entering a new stage in this cycle. As a result, we believe this is an opportune time to assess the factors we need to watch going forward.

1. Fiscal deficits

Fiscal policy has always been a focus area of our work, however, the related risks to banks have been muted in recent periods as central banks across developed markets have stepped in to fund governments through quantitative easing (QE). This, alongside the need to stimulate the economy in the aftermath of the GFC and Covid pandemic, allowed unconstrained government spending and consequently expanding government deficits.

Deficits don’t matter – until they do, and in the absence of QE much of Carraighill’s recent work has been focused on government funding requirements. Who will step in to buy government debt, and at what rate? For us, a key area of concern is the potential impact these issues may have on banks’ balance sheets due to banks competing with governments for deposits. This in turn could impact deposit costs in a falling rate environment.

The Eurozone is not an optimal currency area and economies vary widely across the 20 countries which make it up. This is well understood and the negative impacts of this have been relatively contained since the Eurozone sovereign debt crisis. Since then, the ECB has established policy tools to address the risk of bond market fragmentation.

The environment which helped contain these issues may now be shifting and as a result, we prefer to focus on banks in countries where government funding needs are low. Of course, fiscal deficits will also impact the rate curve, and this has been an increased area of focus for us in recent months.

2. Cost of Risk (companies/households default probability)

European Banks have generally done a good job cleaning up their balance sheets since the 2008 crisis and up to now, the cost of risk (provisions) is muted and asset quality trends remain robust. However, higher interest rates may increase the likelihood of non-performing loans for some banks.

This is something we monitor and forecast closely across all the companies we cover. We favour banks with the following characteristics:

- Higher household exposure (mortgages in particular).

- Banks that operate in regions with high household and corporate interest coverage ratios.

- Banks which have large overlays. These may present extremely low LLPs in 2024.

3. Growth

Loan growth remains challenging in most regions. This is evident in the monthly data we track, as well as in our conversations with management. The data points to excess liquidity, rate curve expectations and tax as the main causes of struggling loan growth. We believe it is also related to government spending in a full employment economy. History tells us such.

So, what does this mean moving forward? We assume a largely static balance sheet in most European banks.

That said, European banks P/Es are not high, and therefore we need to ask how important loan growth is for European bank share price performance?

4. Capital return:

With low loan growth, the ability of banks to differentiate themselves to investors will be increasingly dependent on the size of their distributions. This factor remains a key focus for us, and the opportunity for banks to buy back stock (below book) remains elevated.

Conclusion:

While the SX7E European Banks index is up c.55%, some banks (UniCredit, Sabadell, AIB) have significantly outperformed. Others (Société Générale, Lloyds) lag behind.

The sector remains “cheap”, but we are now being more selective in the geographies and companies we want to invest in. We favour banks that operate in regions with low fiscal deficits and government debt, as well as those with large potential capital returns.

At Carraighill, we are monitoring all of the above factors (across 40+ companies) using both top down and bottom-up analysis to help our clients.

If you would like to access more information and in-depth analysis on these topics, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to stock investment ideas across the banks, payments, fintech, asset management, and real estate sectors for Europe, the UK, Scandinavia and select emerging markets. If you would like to speak to a partner or analyst on the topics raised in this piece, please contact eoin@carraighill.com.