European Asset Managers Stay out of Europe. Are They Wrong?

In May 2021, Carraighill published “The Flow,” a new report which tracks some key data points that influence the share price performance of global asset management (AM) companies, with a particular focus on Europe. This piece includes excerpts from the report and examines how European asset managers are abandoning investing in Europe in favour of higher returns in US equities and other equity markets abroad.

Key points:

- European asset managers are growing AUM.

- There is a nascent structural move towards equity ownership by European asset managers.

- Allocation into European assets is being abandoned for higher returns in the US and elsewhere abroad.

- These trends are evident at the system level and in individual asset management firms.

- Strong household deposit growth, passive investing, and central bank QE continue to support a higher allocation to equities.

European Asset Managers are growing AUM

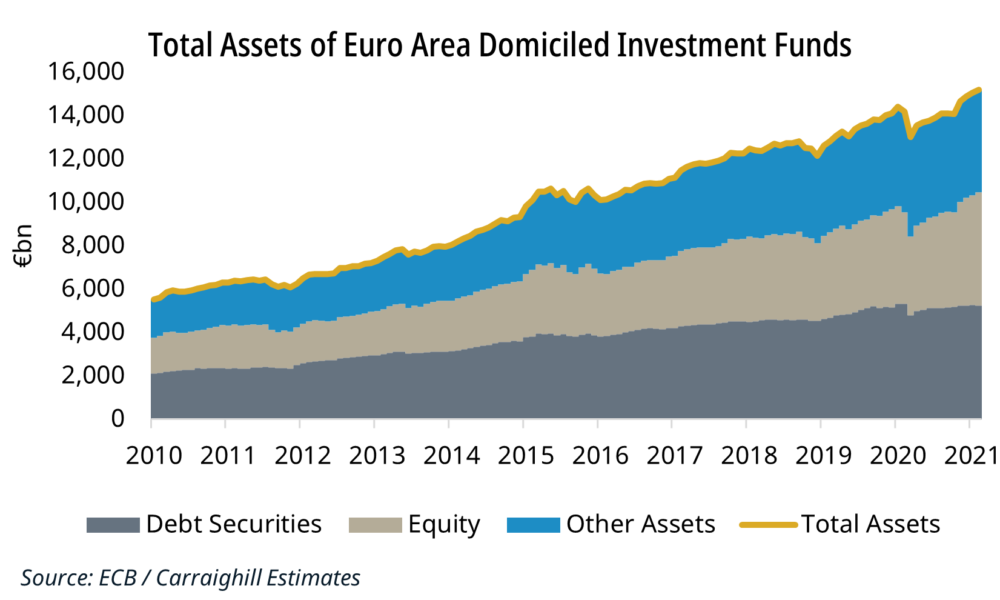

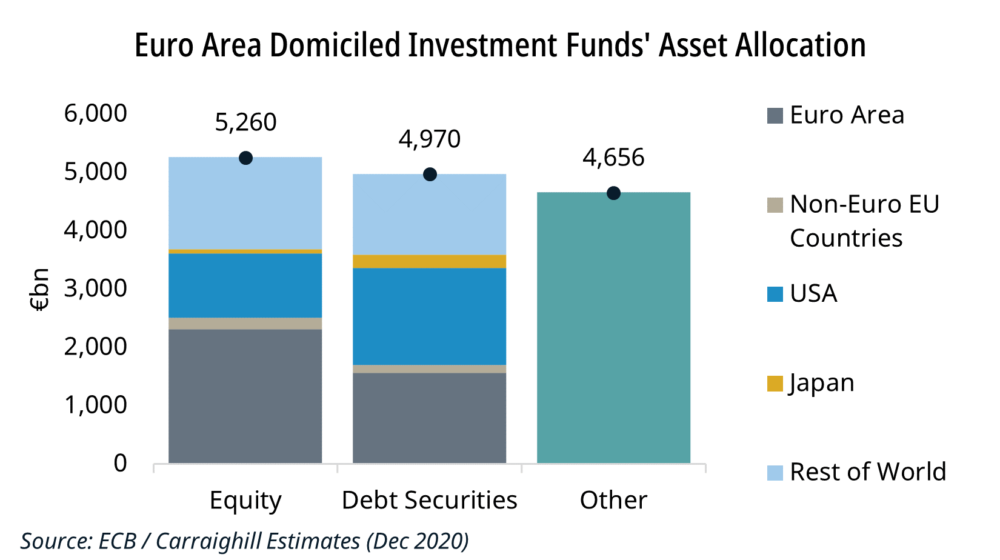

European asset managers held assets of €15.2 trillion in February 2021. This level has been growing consistently over the past decade. It was just €5.5 trillion in 2010. Assets under management (AUM) are approximately:

- One third equities

- One third debt securities

- One third other assets

There has been a gradual change in preference for equities over debt securities. In 2015, 37% of assets were debt securities, and 30% were equities. In 2020, this had changed to 35% and 33%, respectively. “Other assets” includes €2.5 trillion of investment fund and MMF shares/ units. This represents indirect ownership of more equity and debt securities.

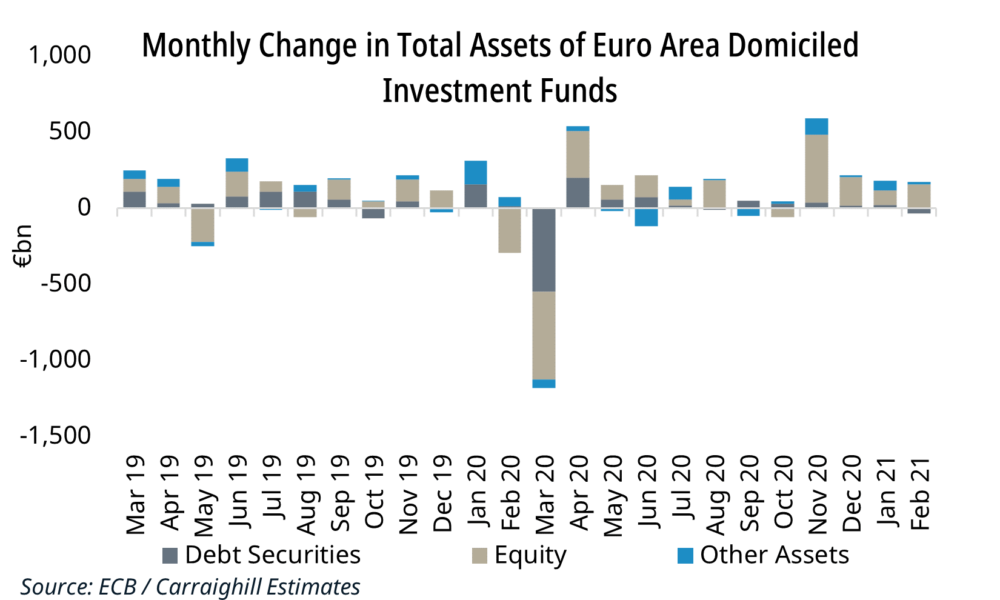

AUM increased by €145bn in February 2021 (+1.0% MoM), a mix of €82bn in new inflows and €63bn in revaluations. If current trends persist, 2021 will represent the most significant inflow into Euro Area funds since 2015. Interestingly, the drivers are both domestic and from outside the Euro area – suggesting a pick up in external money flowing into Europe.

Why move towards equities?

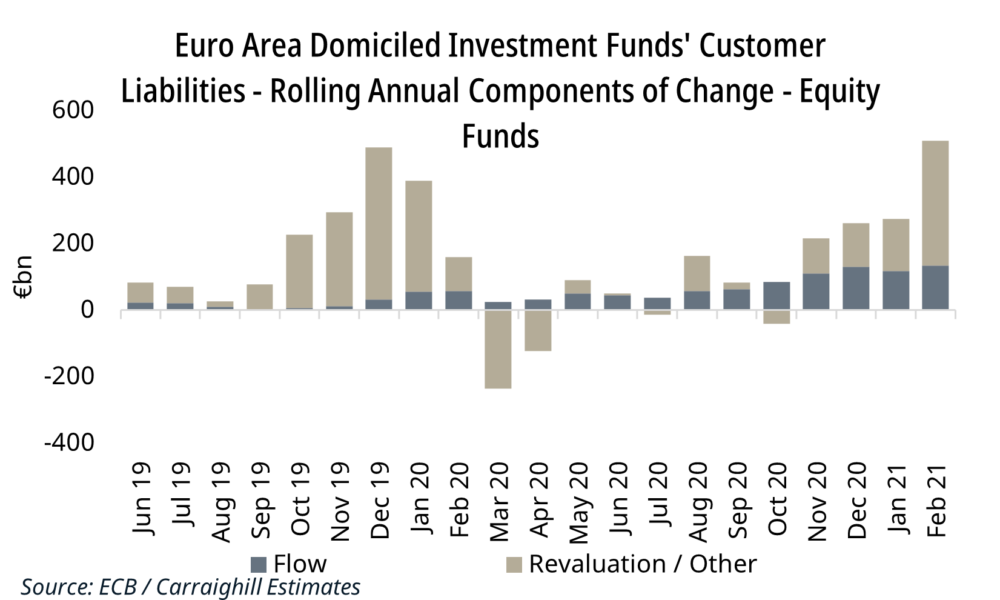

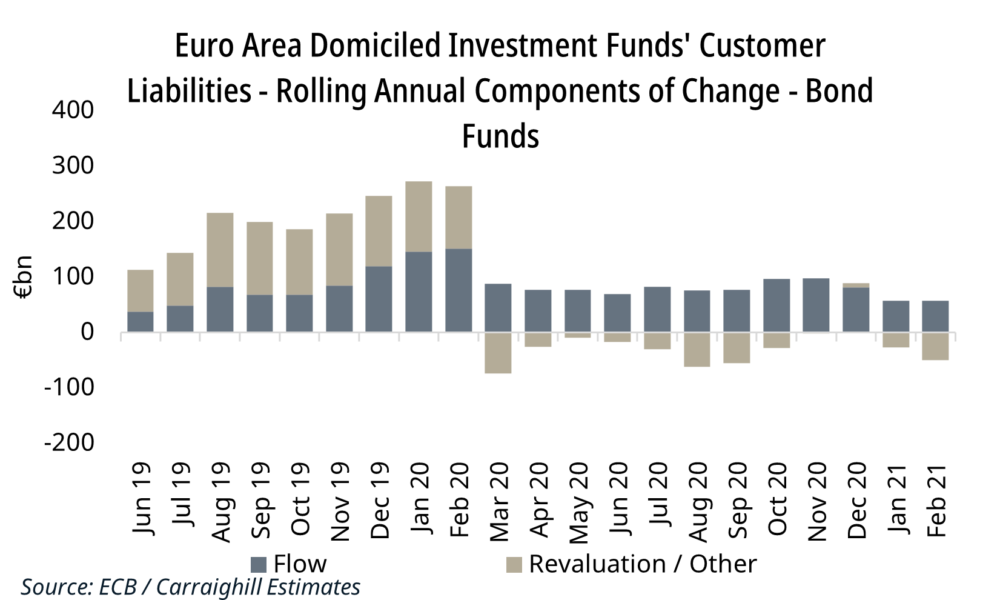

European asset managers increase their AUM in two ways:

- Growing customer accounts (flow)

- Growing asset values (revaluation)

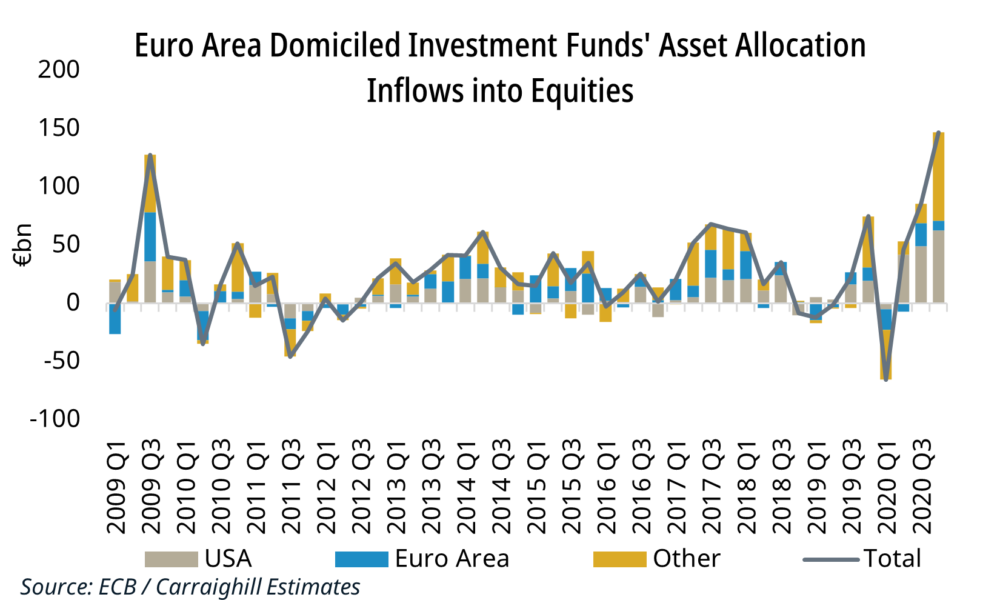

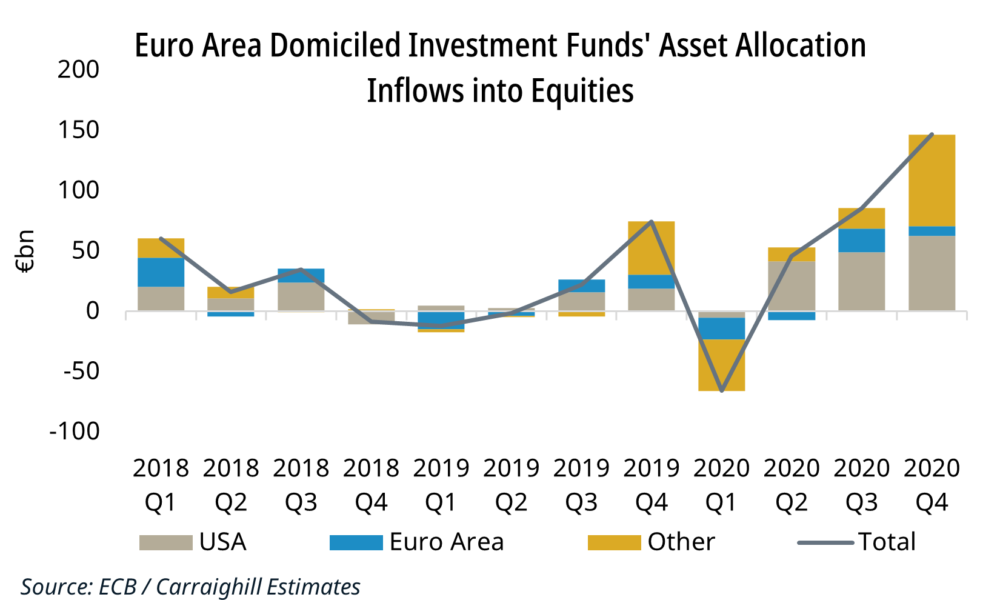

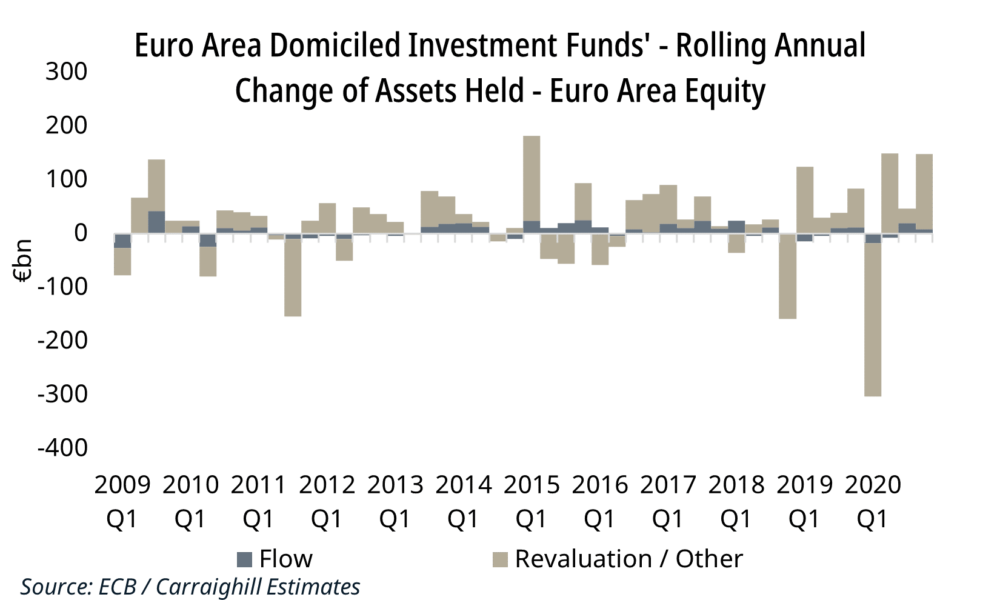

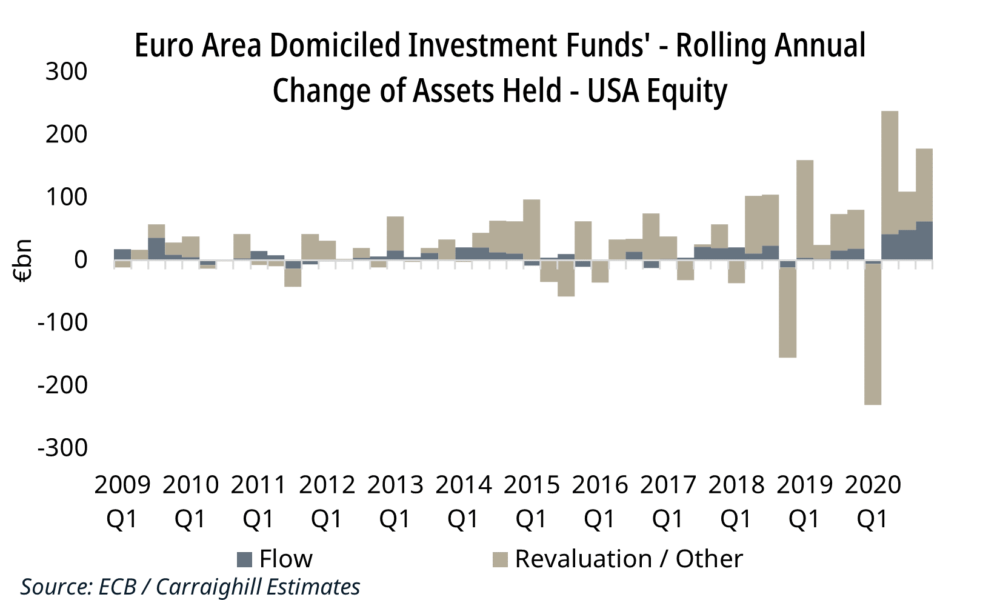

The charts below illustrate the mix of flow and revaluation for equity funds and bond funds. Over the past two years, it is clear that growth in equity funds has primarily come from revaluation, whereas bond funds are a mix of flow and revaluation. This outperformance has attracted new flows into equity funds at the expense of bonds and other funds. Hedge funds have seen outflows in 2019 and 2020.

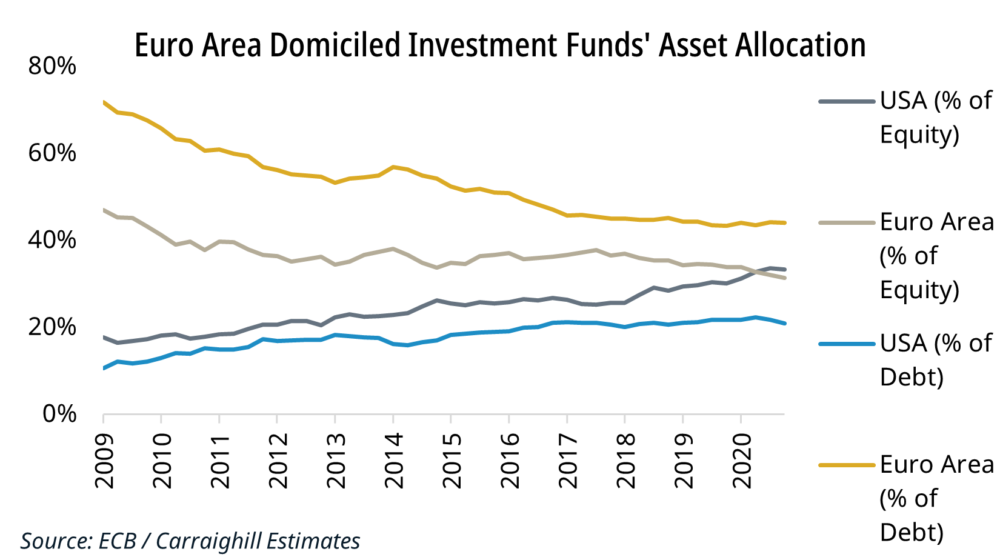

Why abandon Europe?

The past decade has seen a structural shift by European asset managers away from Euro Area assets. This is true for equities and debt securities. US markets have seen their shares of total increase, along with an increased allocation to other countries. This trend shows no sign of stopping. Q4 2020 saw the largest flow into equity markets outside of the Euro Area since 2009.

The simple explanation for this shift away from Europe is performance. European equity markets have been flat for the past two decades, underperforming US equities and European bonds. Severe drops after the dot com and GFC crashes have been recovered but not exceeded. US equity markets have been rising strongly since 2009 (see graph). While past performance is never a guarantee of future returns, European asset managers are behaving as if this is the case.

How are individual companies showing these trends?

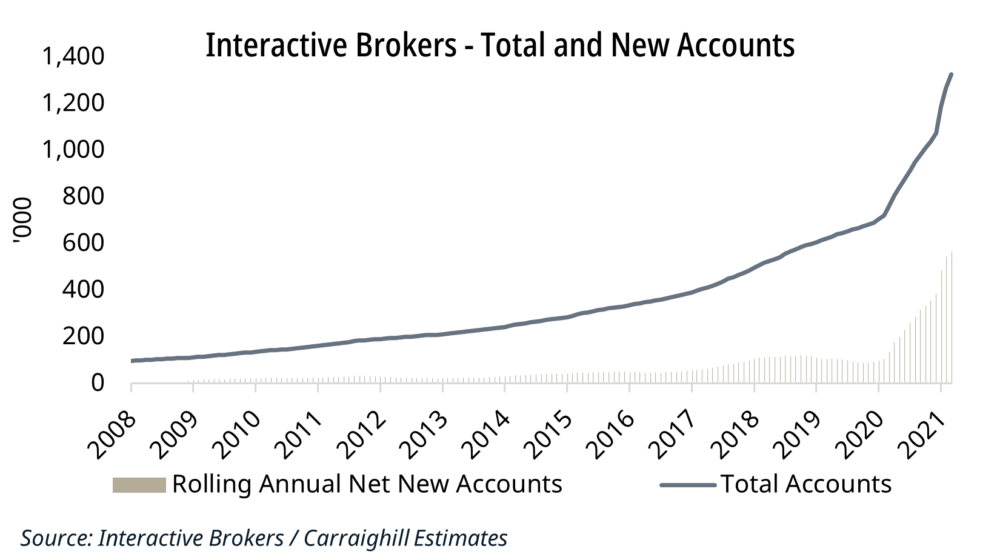

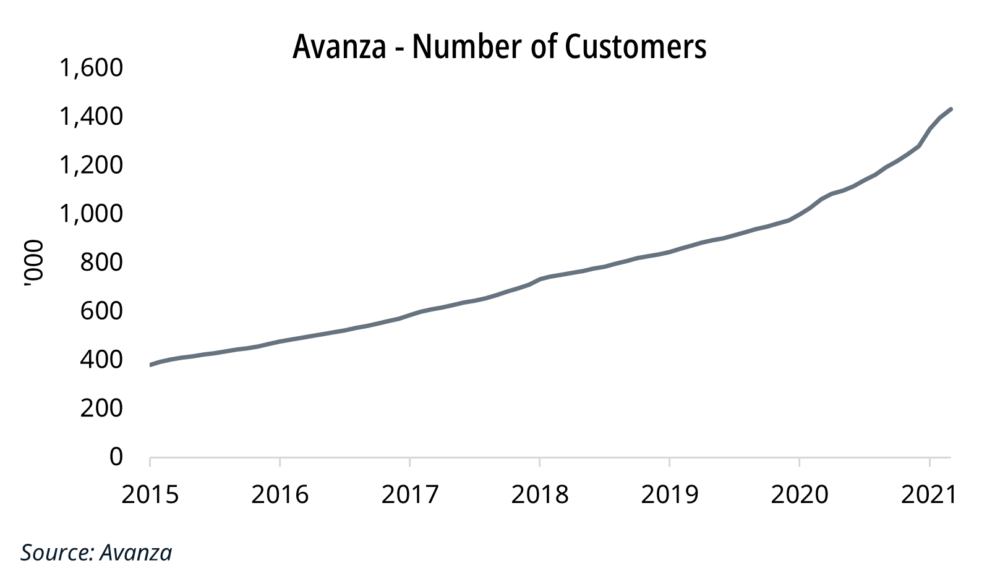

Below we show the increase in the number of customers with Interactive Brokers (a US asset manager) and Avanza (a European asset manager). Both have aggressively increased in the past year, with Interactive Brokers (IB) up 75% YoY while Avanza is up 35%. More robust growth has been seen in client equity/capital due to the mix of new accounts and rising markets (106% and 78% growth, respectively). While European equity markets have underperformed the US, European asset managers such as Avanza can still produce strong returns by allocating assets outside the Euro Area.

Will these trends continue?

Some of the tailwinds for the sector remain in place. 2020 saw the largest increase in household deposits in recent times (+6.8% in the Euro Area and the UK). This was highest in France (+9.7%) and lowest in the UK (+3.1%). Household deposit rates have also been structurally falling each year, driven by lower central bank rates.

These two factors (high deposits and low rates) are extremely favourable for European asset managers trying to attract new customer flows.

We estimate that 20% of funds in Europe are now passively managed (33% of equity funds). This also supports a continuation of a lower allocation to cash. It implies a risk on approach. We also see no significant moves yet to taper central bank QE. This has been strongly supportive of equity markets in the past year.

Investment Conclusions

These are only available to Carraighill clients. If you would like to access the reports mentioned in this article, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.