Adyen, Nexi and Worldline – Where do they Stand in Europe’s Payments Universe?

At Carraighill, we conduct ongoing analysis of three European payments companies: Adyen, Nexi and Worldline. These are the major publicly listed players headquartered in Europe.

The European market is highly fragmented and despite extensive M&A activity in recent years, traditional banks still process most of payment volume. This short post discusses the positions of these three companies, the primary drivers of their revenue growth, and the factors that influence their ability to win market share from the traditional banks.

Very broadly speaking, payment companies make money by charging a percentage fee (take rate) on the volume of transactions they process. The payments industry is therefore generally characterised by a recurring revenue stream and a high level of operating leverage once the necessary payments infrastructure is established. Marginal capital expenditure requirements are small, allowing large players to compete on price. This presents a major barrier for new market entrants. Two trends fuel revenue growth in the industry:

1. Growth in consumer spending:

This increases the Total Payments Volume (TPV) processed by the companies, on which they earn a margin. The nature of the spending (discretionary vs non-discretionary) is important during times of macroeconomic uncertainty. Worldline and Nexi’s revenues are an even split between discretionary and non-discretionary whilst Adyen is heavily reliant on the former.

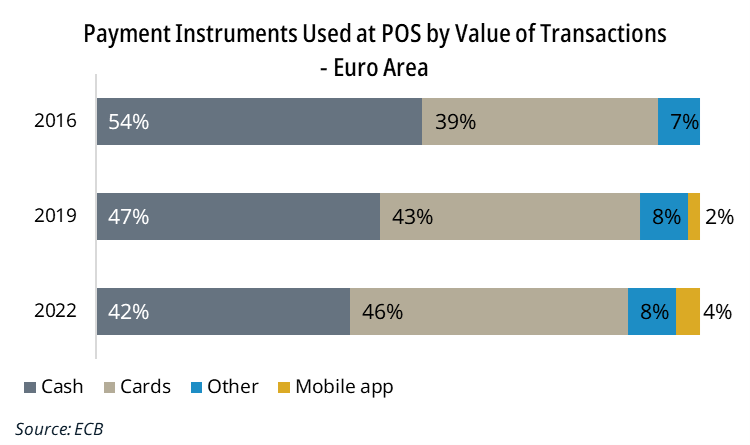

2. The shift from physical to digital forms of payment:

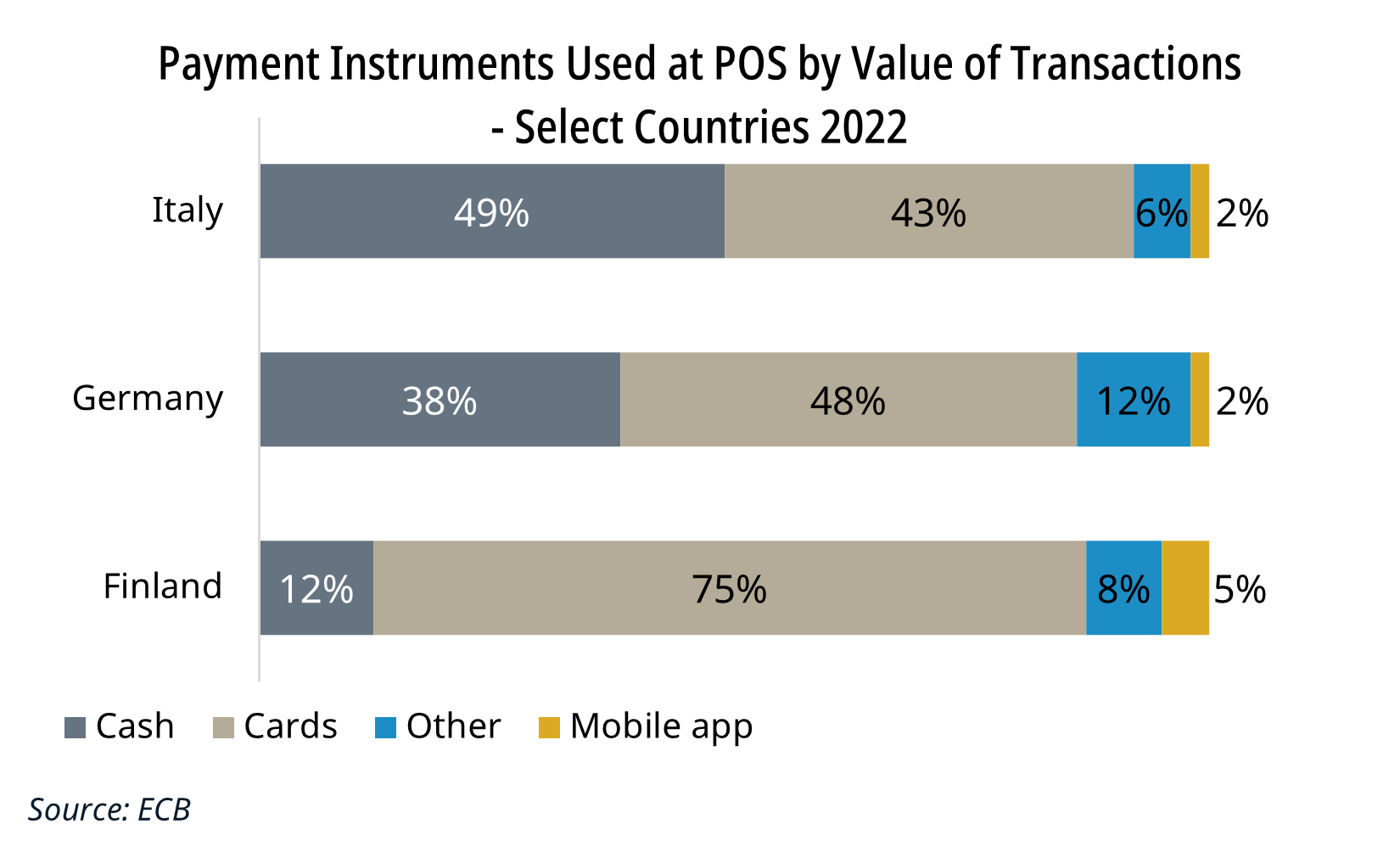

This move was accelerated by the pandemic (reflected in the companies’ share prices). Demography is an important driver of the shift, with young, growing populations helping to accelerate it. The younger generations have a much higher propensity to embrace digital forms of payment versus older generations. This is apparent in the higher online penetration seen in the Nordics versus countries such as Germany and Italy, with older populations.

In terms of revenue breakdown, Nexi and Worldline are similar. Merchant Services account for c. 60% and c.70% of revenues for Nexi and Worldline, respectively. This business segment involves providing merchants with a host of services to facilitate the acceptance of payments from customers. This can range from the provision of physical infrastructure (card machines) and online payment interfaces to data analytics and fraud management software. A percentage fee (take rate) is charged on all payments processed on behalf of the merchant. For Nexi this was 0.23% in 2022, yielding c. €1.8bn in revenue. Nexi’s Merchant Services are mostly dependent on physical retail, with only 10% attributable to e-commerce. For Worldline, this figure is 25-35%.

The remaining revenue of the two companies is made up of various payment and card issuance services provided to corporations and financial institutions. Worldline also has a small (c. 5% of revenue) segment ‘Mobility and e-transactional services’ which offers digital solutions for public transport services (e.g., tap to pay on the metro), government entities and businesses.

In contrast, online payments account for c. 85% of Adyens’ total processed volumes. Instore (point of sale terminals) volumes have grown c. 4x between 2019 to 2022 (€29bn to €113bn) but its share of total volumes (c.15%) is broadly unchanged. A unique revenue driver for Adyen is its focus on ‘platforms’ (e.g., eBay, Shopify and Fresha). It currently has a total lower wallet share for platforms (less than 20%), compared to other online and in-store business segments (c. 50% for existing customers).

Efforts have been made at consolidation in recent years. Nexi merged with SIA in 2020, followed by another merger with NETS, creating the largest European Paytech company in EBITDA terms. Worldline also made acquisitions in the 2020s. Adyen does not participate in M&A activity as a point of principal, instead focusing on driving organic growth.

However, there is now a lack of M&A opportunities in the European Payments market. The next step for these companies will be to take market share from banks, which still control most payment volumes. France exemplifies this, with traditional banks having close to 100% control. As such, Worldline’s (a French company) biggest market is neighbouring Germany where it controls roughly 40% of instore payments and is one of the biggest online players. Nexi processes c. 70% of the payment volumes in Italy and the Nordics.

The lack of opportunities in the space for inorganic expansion presents a risk to these companies, particularly if discretionary spending slows into 2024.

Can they protect their revenues from potential new entrants, for example large American players?

If you would like to access our work, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. It also gives you access to investment ideas across the banks, payments, fintech, asset management, and real estate sectors for European and select emerging markets. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.