Brazil: Popping the Credit Bubble and the Associated Investment Opportunities?

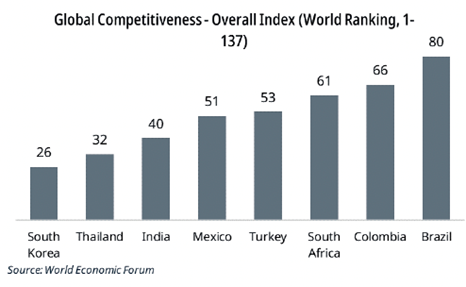

Carraighill continues to expand its investment coverage of major emerging markets. With this in mind, we would highlight that Brazil is the 6th largest country by population globally and 8th by GDP. While it is considered a regional superpower, it is fair to say that the country has failed to reach its potential on a global scale since being named in the BRICs group in the mid-2000s.

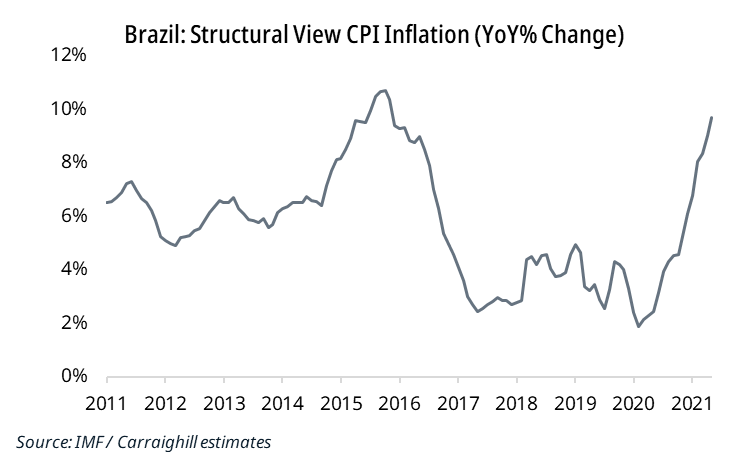

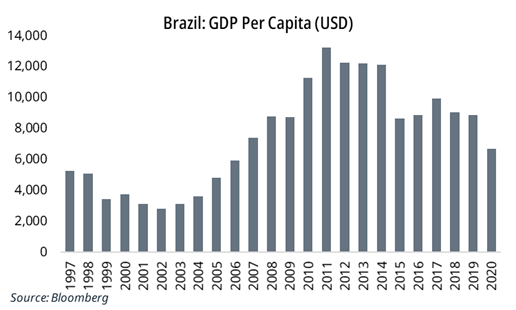

Initially, demographic tailwinds and higher commodity prices supported growth throughout this period and early 2010s. However, an unfavourable economic outlook along with political volatility led to a slowdown in growth in the subsequent years. Large government deficits and higher household consumption led to rising total economy debt. We believe this is a faltering and unsustainable policy and may result in significant defaults (through inflation or a high domestic banking NPL cycle).

We note the following key weaknesses:

- Deteriorating demographics: Population growth is now below 1% YoY and falling. Forecasts suggest the population will start to decline by 2040. This key structural tailwind which supports many other emerging markets is now fading fast.

- Weak labour market and deindustrialisation: Brazil’s labour market has failed to improve despite favourable demographics over the past decade. For example, manufacturing employment has declined since 2012 as the economy has deindustrialised. It now represents c.11% of total employment. This is worrying, as employment growth now increasingly relies on primary industries, the cyclical consumer sector, and the public sector. Moreover, sustainable productivity growth requires improvements in economic complexity, and Brazil has stagnated in this area over the past decade.

- Large debt burden in government and households: Total economy debt is close to 200% of GDP. This is remarkably high for an emerging market. Within this, public debt is now close to 100% of GDP. Household debt rose from 20% of GDP in 2010 to nearly 40% in 2020.

- Unsustainable fiscal policy: Brazil records regular primary surpluses, but the fiscal balance is negative due to high-interest payments (between -2.5% and -10% of GDP over the last decade). Successive governments have increased spending on social programmes, which has boosted consumption but with a limited lasting GDP return. This cannot continue indefinitely.

- Low investment: Overall investment peaked in 2013 at 22% of GDP. It was 15% in the most recent years. The large fiscal deficits and consumption focus have also reduced public investment, now under 2% of GDP. Foreign portfolio investment flows have also not fully recovered to 2013 levels.

As a consequence of these issues, GDP per capita in USD has fallen progressively since the middle of the last decade as governments continue to increase the debt load for zero return. This is a faltering and unsustainable policy. Are these risks culminating to make Brazilian investments (banks/ fintech/ bonds) exceptionally vulnerable to a new crisis?

The structural challenges are arising at a time when interest rates are going up. The policy rate increased by more than 7ppts from early 2021 to present. It is set to rise further. Furthermore, the liberal democracy index has declined since President Bolsonaro came to office. His sentiments may further damage democracy in Brazil. An election is due in late 2022. His opponent, former President Lula (left-leaning), is currently leading in the polls.

Brazil’s ability to escape the middle-income trap will require impressive policy and structural reform. President Bolsonaro has largely failed to implement this. The next election (October 2022) will be critical to the country’s success. Brazil’s outlook is likely to be turbulent due to rising interest rates on an excessive debt load.

This region will become a focus for Carraighill in the coming years as we seek to explore further the associated investment opportunities (of which there are many).

If you would like to access our work, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.