Turkey: Will Rationalisation Follow the Underlying Mood Change?

I was recently speaking with a work colleague about risk and it reminded me of a prior conversation about the fact that “rationalisation follows mood change.”

Many factors drive this evolution of mood change (political, social, financial). People will always post-rationalise about why something happened after it has occurred, but the mood was changing long before this. The greatest example is the housing crash in many European countries in 2008. We rationalised in 2009, but the seeds were being sown from 2005 onwards.

It refocused my attention again to Turkey. It retains many advantages, including a growing young population and proximity to Europe and Asia. This had encouraged significant external investment in the economy over time, particularly by European companies. (67% of total). However, more recently, this has slowed and been replaced by a rise in the Middle East’s share of total (Qatar).

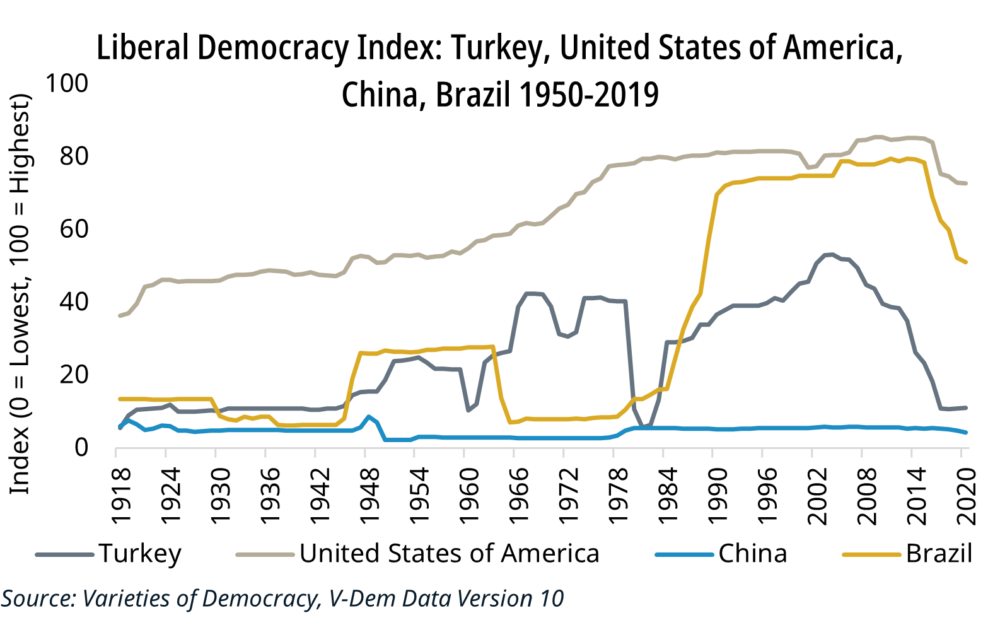

Subtly, at the crux of the issue is the potential movement of Turkey away from a secular state with European values to a more religious Islamic one. The country has undergone a change in many areas, including the media, implementation of the rule of law, foreign policy, and gender issues. This is highlighted in an index called the “liberal democracy index,” which shows the transition of Turkey over the last 10-15 years.

But does this matter?

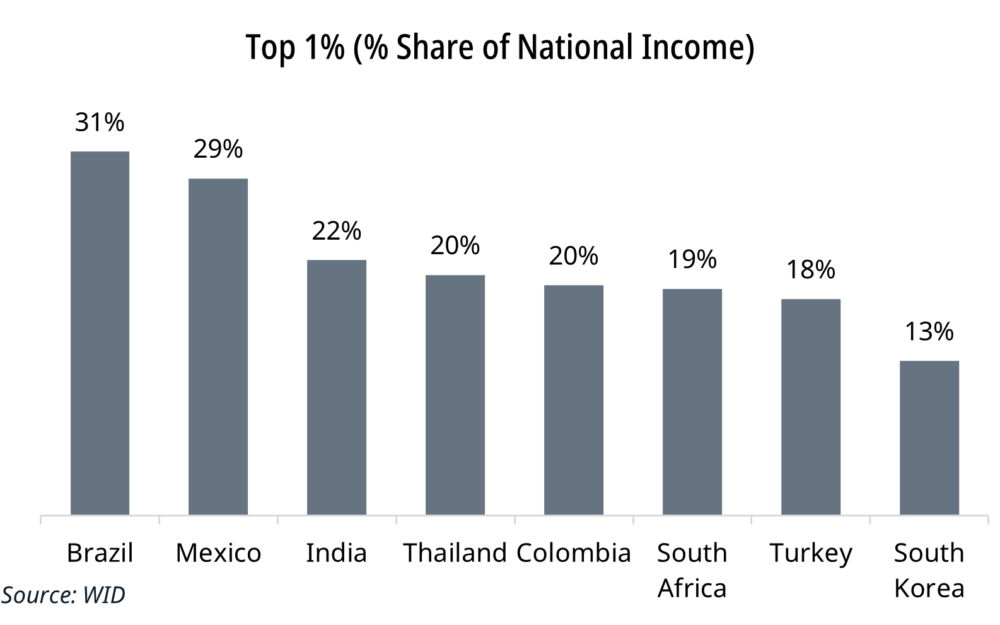

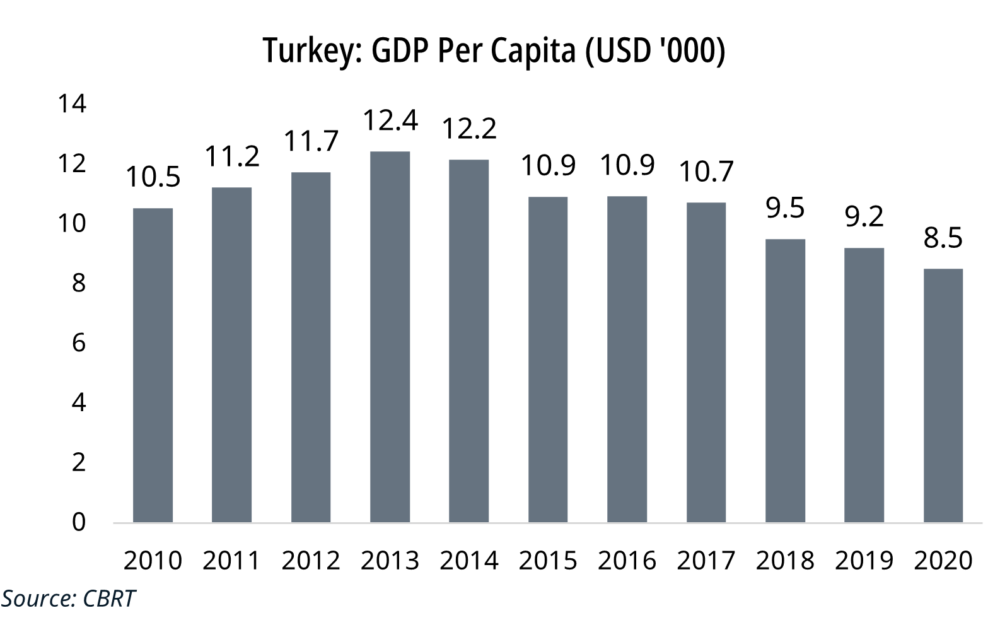

Arguably this only matters if the domestic population is not benefiting from this move. In this instance, we note that Turkish GDP per capita in US$ has been in persistent decline since 2014. In addition, the concentration of wealth is becoming more extreme (although this is not just a Turkish issue), and the material deprivation rate is high. Consequently, President Erdogan’s approval rating is falling sharply, with the next election due in June 2023. In response, he is pushing for a more liberal monetary policy. This is occurring at a time of heightened domestic financial vulnerability:

- Stated inflation is now c.20%. However, if we use relative PPP, this is now running at an estimated c.30%. The higher price of essential items will further pressure the income of the lower paid in society. This may also have political implications.

- The country has a large requirement for US$ each year as much of what it buys is denominated in FX (oil/ gas and coal in particular). It generally sends US$30bn (average over the last 18 years) abroad. To allow this to continue, it needs US$ itself. A key issue now is that Turkey is not self-sufficient in energy. The YTD current account deficit is currently US$14bn. Using current spot prices and assuming a 2019 demand pattern into Q4, this figure would deteriorate to US$39.2bn for 2021. Relative to GDP (2021 forecast), the current accounts deficit would then fall from -1.9% to -5.6%.

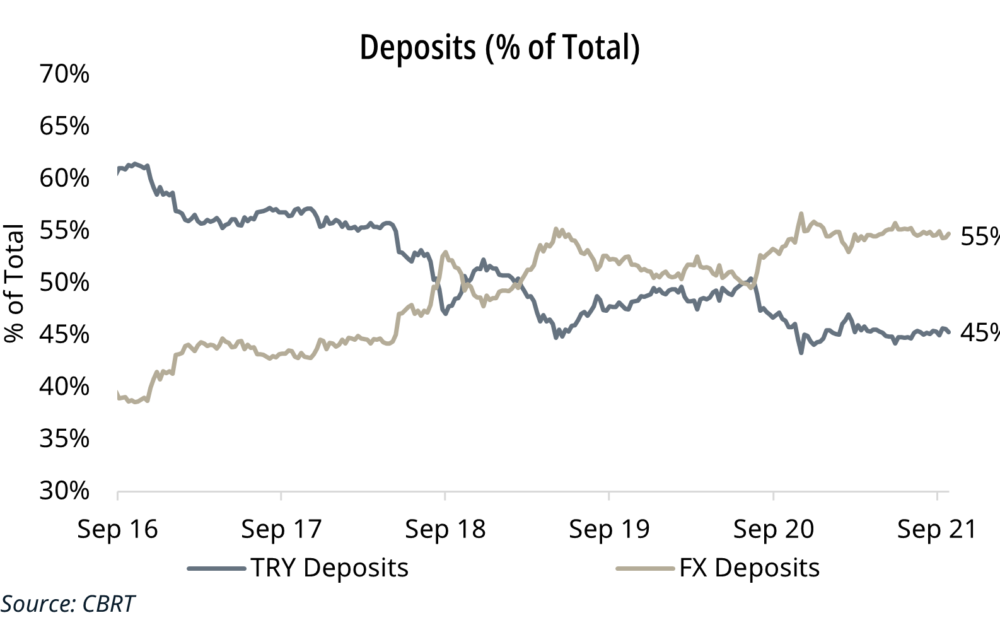

- With higher energy and food prices, real interest rates will most likely fall further into negative territory at a time when President Erdogan is pressing the CBRT to ease policy. With even lower real rates, the risks of domestic dollarisation increases further (55% of deposits are already in FX). This already means that most of the domestic population do not want to hold their money in Turkish Lira but rather prefer a foreign alternative. Will this now domestic demand for FX now also accelerate further?

- Finally, the ability of the country to meet this significant domestic and external demand for US$ is low, given its persistent weak FX reserve position. Although total reserves total US$122bn, much of this is in gold (US$43bn) or borrowed from the domestic banks using swaps (US$62bn).

- Finally, with GDP per capita in US$ falling, why would this encourage significant external investment to meet this US$ need? External debt levels in US$ are already high (c.US$430bn), with 28% of this short term in nature.

Perhaps rationalisation will ultimately follow mood change? Time will tell. The mood in Turkey has been changing for many years.

If you would like to access our work, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.