The Carraighill Two Bank AnalysisTM Framework

Background to our unique approach to forecasting bank income

At its core, banking is a relatively straightforward activity: an institution collects deposits from a number of individuals or companies and uses these deposits to issue loans. As a general rule of thumb, banks generally seek to maintain parity between loan and deposit volumes, i.e, to have a loans-to-deposits ratio of 1:1 or 100%. Additionally, banks issue debt in the form of subordinated bonds to increase the variety of their funding mix (a regulatory capital requirement). The presence of these additional liabilities means banks also diversify their asset mix through buying securities.

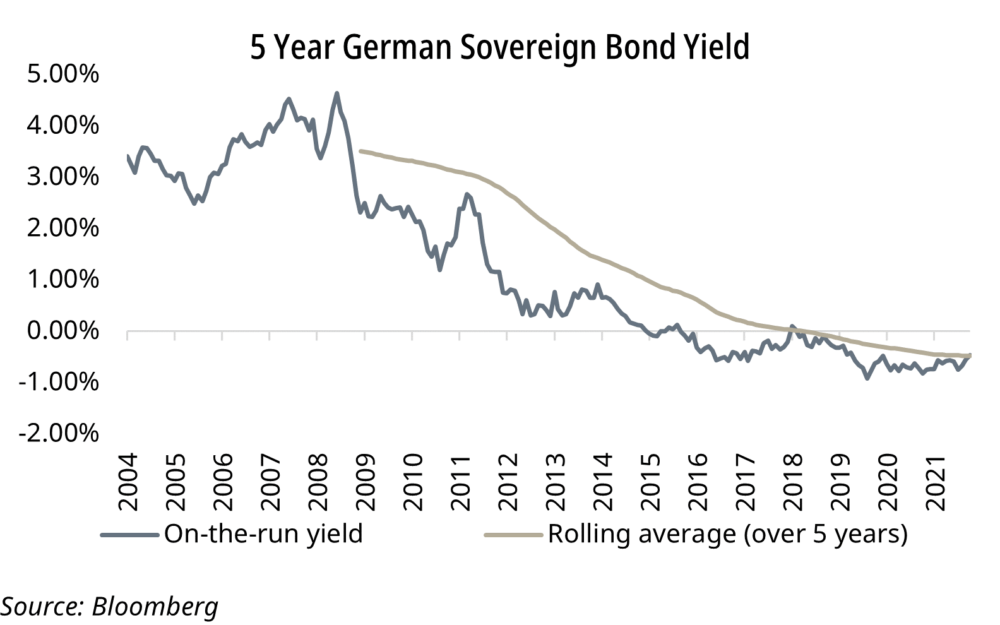

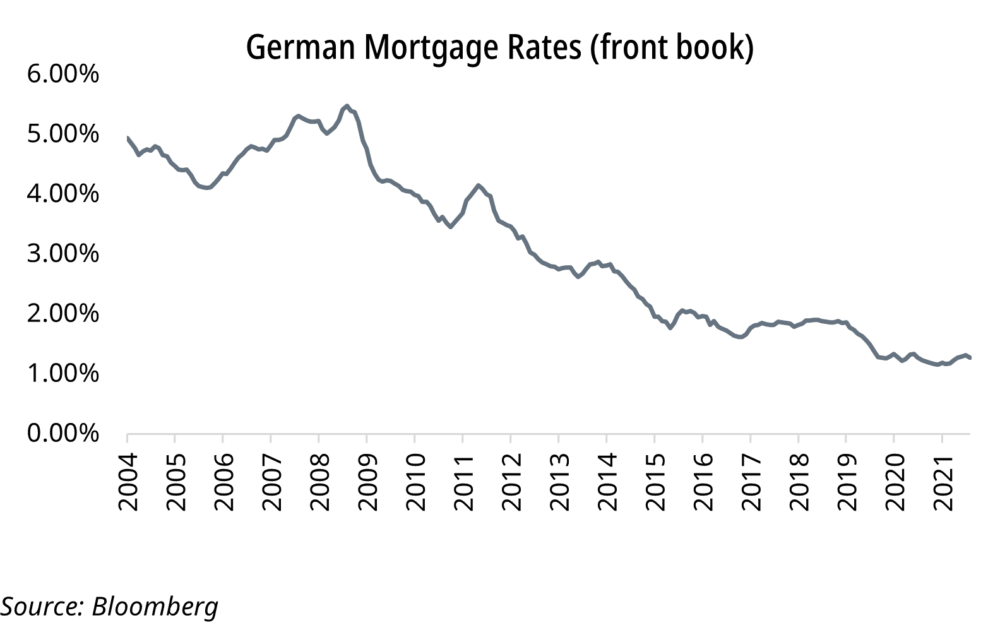

This concept of maintaining a blend of retail and wholesale funding to issue loans and purchase securities has long been standard practice. However, what is often underappreciated is how important these purchased securities are to banking income. For example, consider a German bank in the 2000’s: mortgage loans were typically issued at a rate of 4-7% throughout the decade. Alongside this, the 5 year German sovereign yielded an average of 3-4%. This meant that so long as German current account rates were kept relatively low, it was possible for the German bank to manage its margin and generate positive returns for shareholders. The joke about banking following the 3-6-3 rule held true: so long as you can borrow at 3% and lend at 6%, you can be on the golf course by 3pm.

What has changed in the subsequent decade of falling and ultimately negative interest rates is maintaining this margin has become increasingly difficult. German mortgage rates consistently fell and have been below 1.5% for two years now. Worse still is the fact that the 5 year sovereign yield turned negative in 2015. For the poor German bank in our example, maintaining a net interest margin sufficient to run a profitable business has become ever more difficult: yields on sovereign bonds are negative, yet it cannot pass this negative rate onto its current account holders – it must absorb this gut punch.

The downward trend in asset yields has been steeper for sovereign bonds than mortgages. At Carraighill, we first observed this negative reinvestment roll (i.e. 3% yielding 5 year sovereign bonds maturing and being reinvested at -50bps) for Bankia in 2014. We successfully forecasted falling NII as high-yielding Spanish sovereign bonds were maturing. The stock fell 30% over the 15 month period of our initial short recommendation. Following this, we adopted our Two Bank AnalysisTM framework.

We trademarked this framework in October 2018 to preserve IP. It allows us to approach the problem of forecasting NII by splitting the bank into “two banks”: one engaged with banking activities and one which earns income from its securities portfolio. We find this an excellent way to understand which banks in Europe have the strongest pure banking franchises and which are benefitting most from a “carry trade” within their securities books. As the lower-for-longer negative rate environment persists, it allows us to ascertain who is suffering from particularly large, negative reinvestment rolls.

Some banks try to offset these negative reinvestment rolls within their securities portfolios in different manners:

- Pan-European banks with operations in various geographies will change exposures over time. For example, Erste owns more Czech bonds than Austrian ones despite its Austria operation being more than double the size.

- Some banks purchase higher return securities, such as bank bonds, corporate bonds or collateralised loan obligations. The risk-return trade-off centres around the risk-weighting attributable to such securities (local sovereign bonds carry a very low risk weighting and hence only a small amount of capital must be set aside, unlike riskier alternatives which are more capital intensive)

- Banks in the UK tend to deploy their excess liquidity into swap contracts.

Ultimately, we believe our Two Bank AnalysisTM framework allows us, and hence our clients, to forecast a bank’s income more accurately than the market.

If you would like to access our work, Carraighill Research Access enables you to access these and other thematic and sectoral research through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.