Greece: A decade on: Is it still a zombie economy and banking system?

Greece is a beautiful country to visit. As well as its natural beauty, it provides an unforgettable cultural experience. It is also the home to the Olympics and the European soccer champions of 2004! However, it is equally well known as the region that nearly brought the euro currency to its knees a decade ago.

While that crisis has passed, this short piece focuses on the outstanding economic issues facing a country that is still known as “the birthplace of Western Civilisation”. It provides a brief insight into some of the key investment issues facing companies in Greece.

Population and Employment Structure

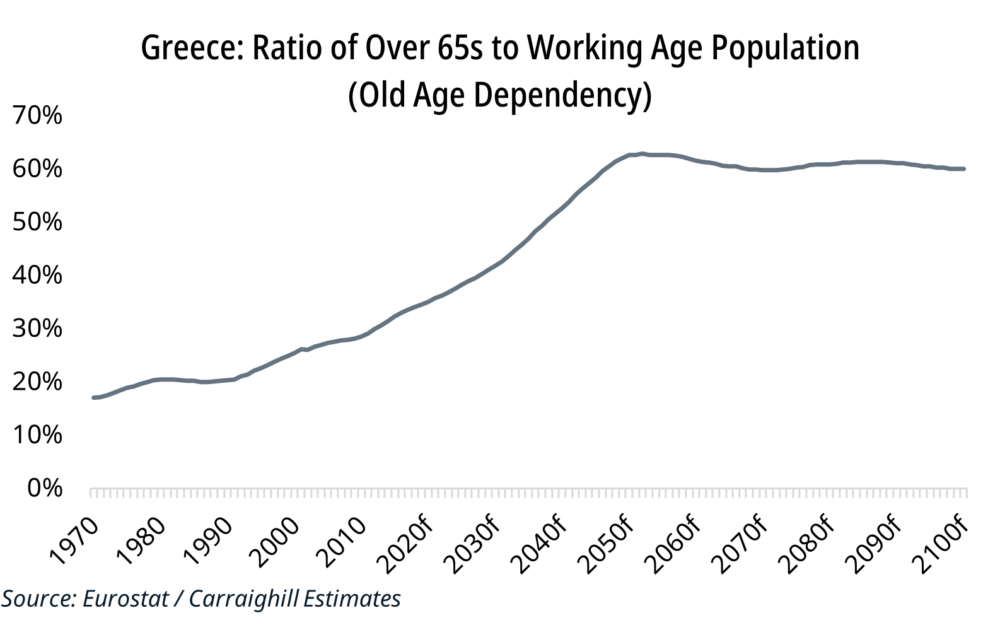

The population of Greece has moved from close to 11.1m people in 2009 to 10.8m today. By the end of this decade, it should fall to 10.3m and then decline progressively to 8m citizens by the end of this century. Although weak demographics is an issue for most countries, what is concerning about Greece is that it is starting with a median average age of 45 (the 4th highest in Europe). Its old-age dependency ratio is set to surge in the coming years.

Analogous to this is an employment structure that still focuses on small businesses and many less productive areas. For example, 55% of firms have between 0-9 employees, and only an estimated 49% of the working-age and 36% of the total population are in employment.

If we focus on one sector – manufacturing – its gross value added per employee and hours worked is 50% lower than many eastern European countries (despite a broadly similar average wage). Therefore, FDI should remain weak.

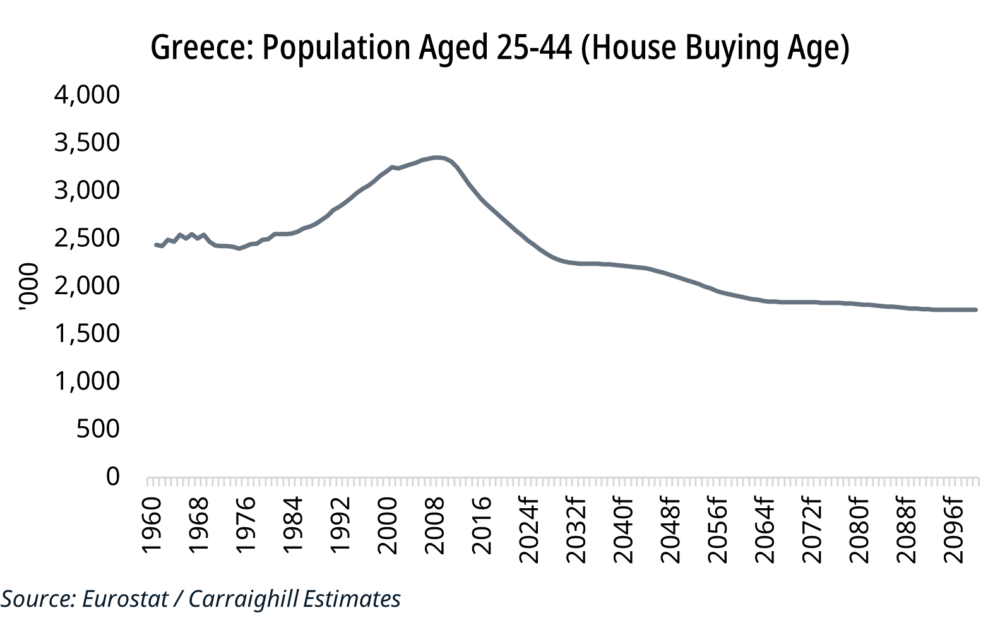

In addition, net exports is close to zero, suggesting that it will have to grow internally if it is to generate more wealth and ultimately repay its debt burden (consumption is 90% of total economic output). This will be challenging if productivity and wage growth does not resume. All this is set against a weakening population size in the key 25-44 age demographic.

Finally, a decade on, the business non-performing loans ratio is still 31% in the Greek banking system. This has still not been fully addressed.

Household cash flow and how it links to politics

From a political perspective, Greece continues to battle with high levels of poverty and a household sector that is not generating sufficient income to meet its basic consumption needs.

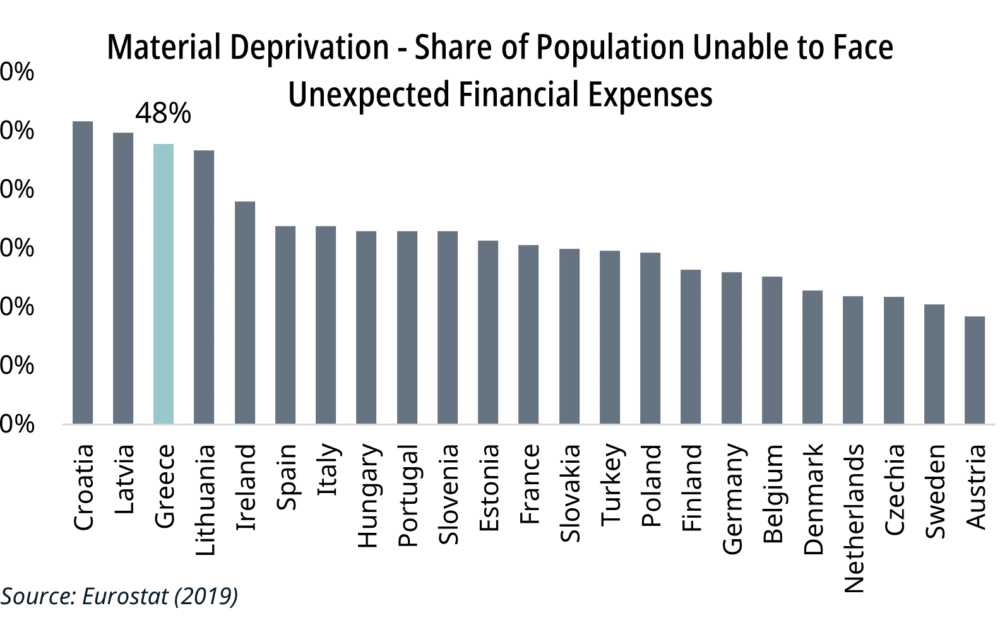

Indeed, it is astonishing that a Eurostat survey recently showed that 48% of the Greek population is still unable to face unexpected financial expenses, with 16% still suffering from material deprivation (albeit this has fallen from close to 22% in 2016). Greek government spend on the health and education of its people is amongst the lowest in Europe. Again, this will not help the long-term productive capacity of the country.

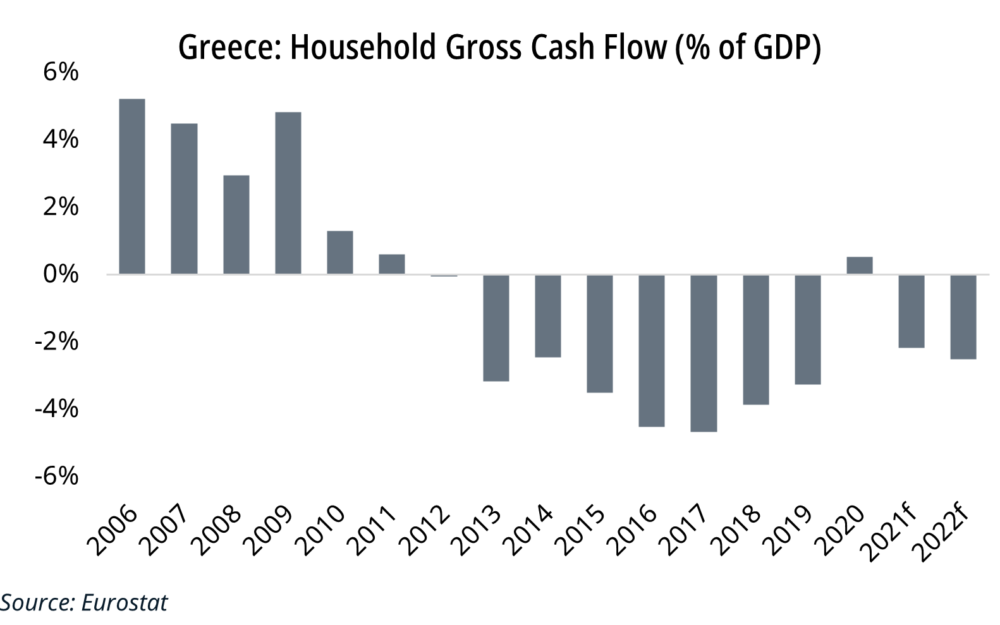

In Carraighill, we capture these challenges by monitoring the household gross cash flow. It remains negative. This is one of the key reasons we have held a thoughtful stance towards the ability of the Greek banking system to resolve its balance sheet and P&L issues since 2014. It is incredible that the number of consumer loans in arrears still represents close to 43% of total. Furthermore, c. 34% of residential mortgage customers also have repayment issues.

Because of these issues, the politics of Greece is likely to remain volatile and subject to bouts of populism (SYRIZA still retains close to 28% of the vote, according to the most recent poll data).

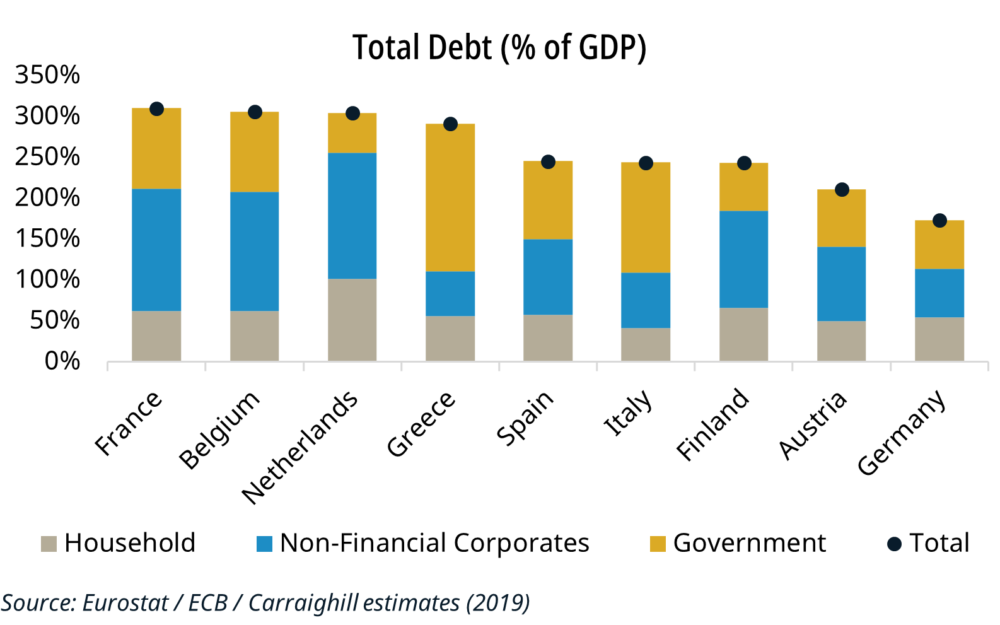

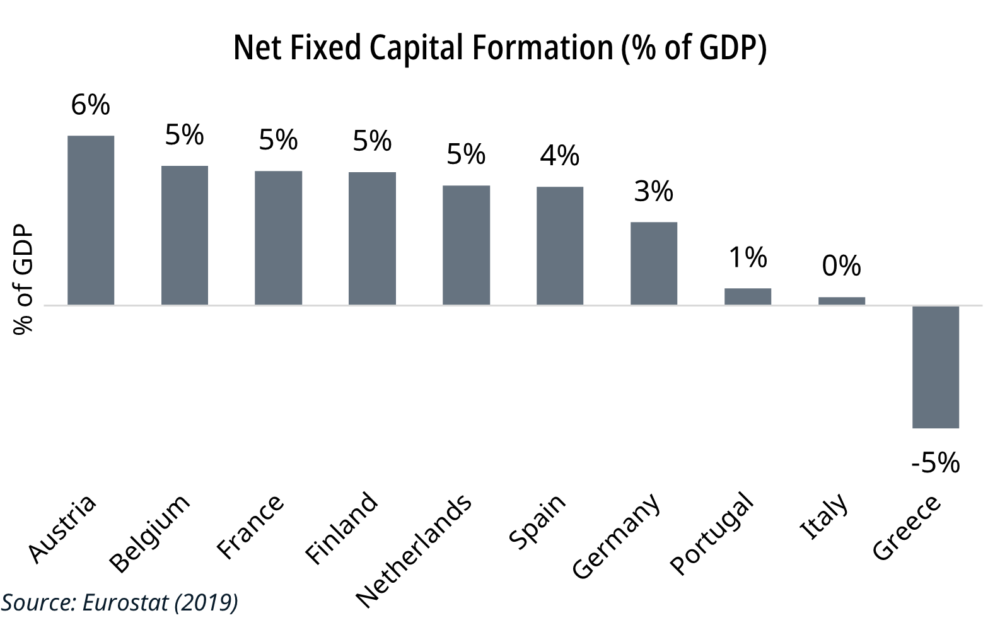

Does debt matter? Greece has a total economy debt of close to 300% of GDP. This remains amongst the highest in Europe. Economic growth is generally driven by technology and entrepreneurship interacting with land, labour, and capital (debt & equity). The overuse of any one factor limits its marginal return. In our view, we believe that leverage still plays too large a role in the economy. A first derivative of this is weak net investment trends (gross capital expenditure less depreciation). A similar issue is evident in Italy.

Given a declining marginal return on debt, there should be limited longer-term demand for new borrowing in the banking system.

The decision by the ECB to include the Greek sovereign in the PEPP programme is clearly a benefit to the banking system. Greek 5-year yields have since moved close to zero. However, any resurgence in activity from this will most likely be fleeting as the real issue of excess debt has not been resolved. It remains unlikely that Greek debt will ever be repaid in today’s money.

Reasons for optimism

There are some exciting initiatives underway in Greece. These include the potential of Piraeus Port to be the new gateway for imports into Europe. In addition, Eldorado Gold has recommenced its investment in the Skouries, Olympias, and Stratoni/Mavres Petres mines and facilities in Northern Greece. This may be the largest gold mine in Europe.

The EU recovery fund will also provide some much-needed stimulus (although this may fall into the ‘fallacy of the broken window’).

In addition, politics is now more business friendly, and the Greek banking system is gradually reducing its NPE exposures. The latter issue will take time, with the upcoming ECB stress tests of potential significance.

It’s not all the fault of Greece – The fixed exchange rate system flaw: Greece remains part of the euro currency and appears uncompetitive in this rigid monetary structure. Europe has not yet had a “Hamilton” moment. This, too, will most likely come.

We try to be optimistic, but sometimes we must also be realistic. Time will tell if 2021 is a turning point for Greece. We really do hope so.

If you would like to access the reports mentioned in this article, Carraighill Research Access enables you to access these and other thematic and sectoral research reports through our secure online portal. If you would like to speak to a partner or analyst on the topics raised in this piece, you can contact us here.